HAW PAR CORPORATION LIMITED

74

NOTES TO THE FINANCIAL STATEMENTS

(CONTINUED)

For the financial year ended 31 December 2014

6.

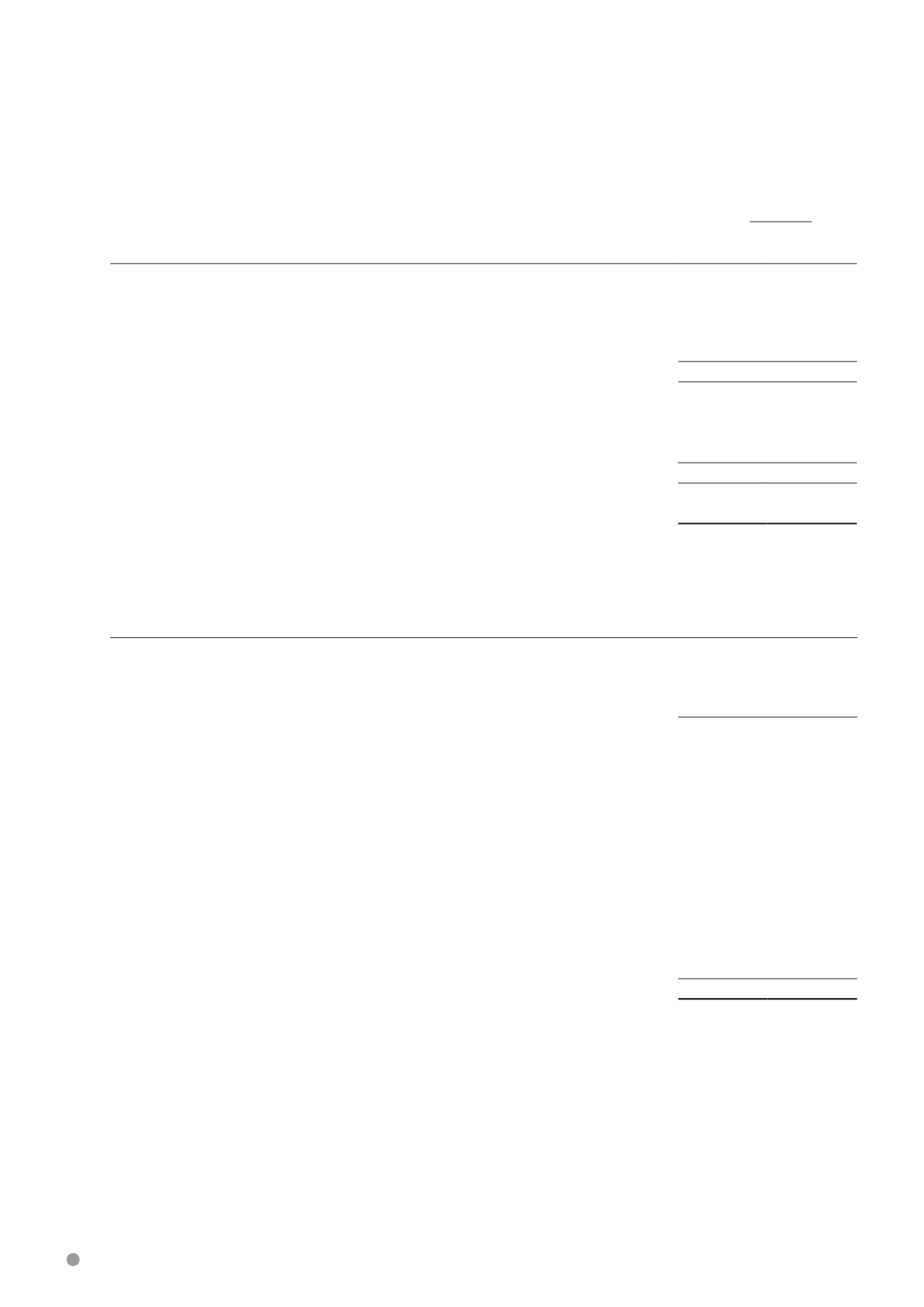

TAXATION

(CONTINUED)

The Group

2014

$’000

2013

$’000

Deferred taxation

Origination and reversal of temporary differences:

- Singapore

(147)

(163)

- Overseas

177

(95)

30

(258)

Under provision in respect of previous years:

- Singapore

9

27

- Overseas

54

178

63

205

8,143

7,358

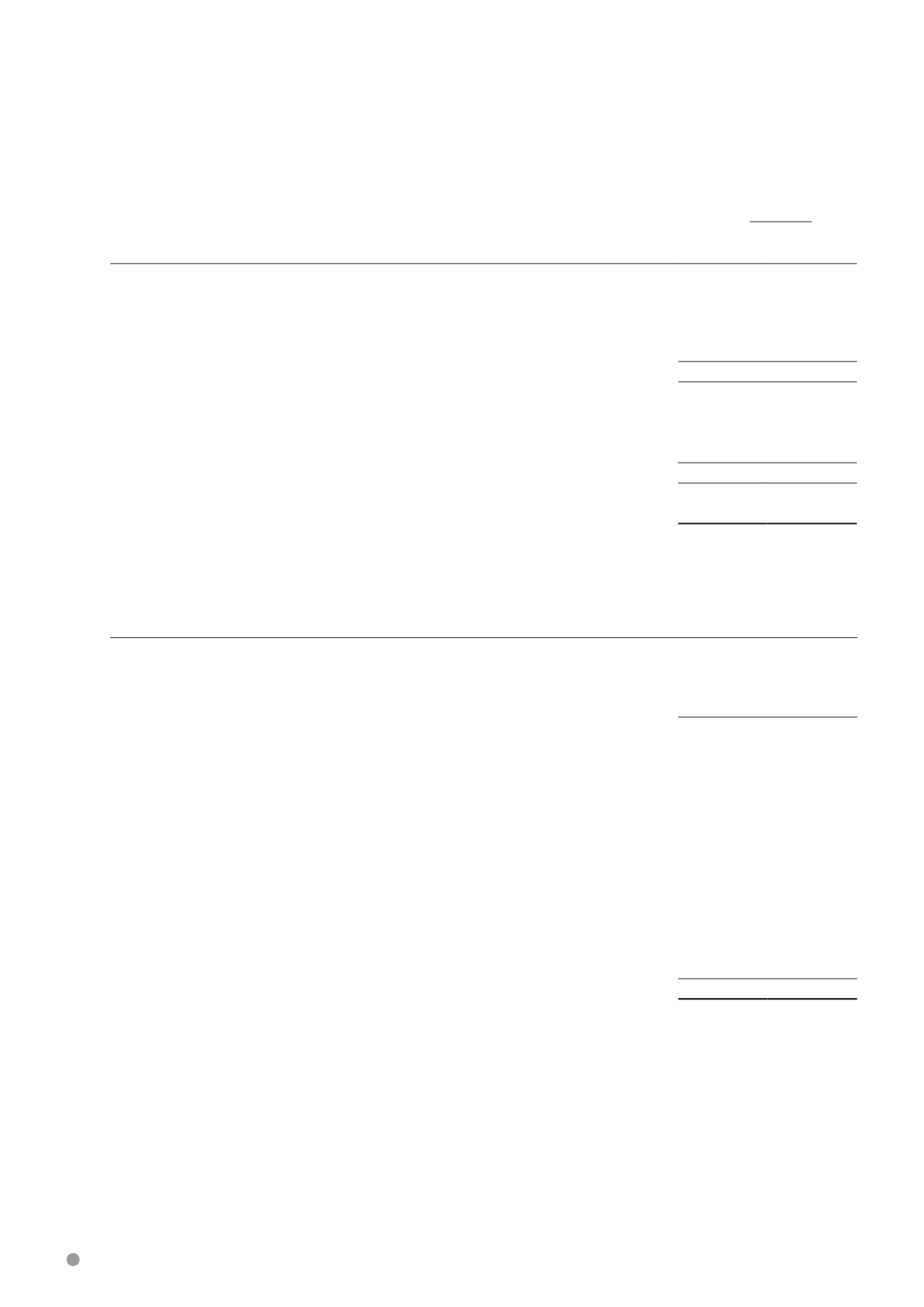

The tax expense on accounting profit differs from the amount that would arise using the Singapore standard rate

of income tax due to the following:

2014

$’000

2013

$’000

Profit before taxation

126,968

115,277

Share of results of associated companies and gain on dilution of investment in

associated company (net)

(11,917)

(8,039)

Profit before taxation and share of results of associated companies and gain

on dilution of investment in associated company (net)

115,051

107,238

Taxation at applicable Singapore tax rate of 17% (2013: 17%)

19,559

18,230

Adjustments:

- Tax rate difference in subsidiaries

324

420

- Withholding taxes

1,081

646

- Tax effect of expenses not deductible for tax purposes

938

1,002

- Tax effect of income not subject to tax

(11,884)

(11,787)

- Tax rebates and exemptions

(752)

(450)

- Utilisation of previously unrecognised deferred taxes

(508)

(806)

- Deferred income tax asset not recognised

31

32

- (Over)/under provision in respect of previous years

(646)

71

Taxation expense

8,143

7,358

There is no tax charge/credit relating to the component of other comprehensive income except for fair value gains/

(losses) on available-for-sale financial assets for which the deferred tax relating to it is disclosed in Note 20 to the

financial statements.