HAW PAR CORPORATION LIMITED

84

NOTES TO THE FINANCIAL STATEMENTS

(CONTINUED)

For the financial year ended 31 December 2014

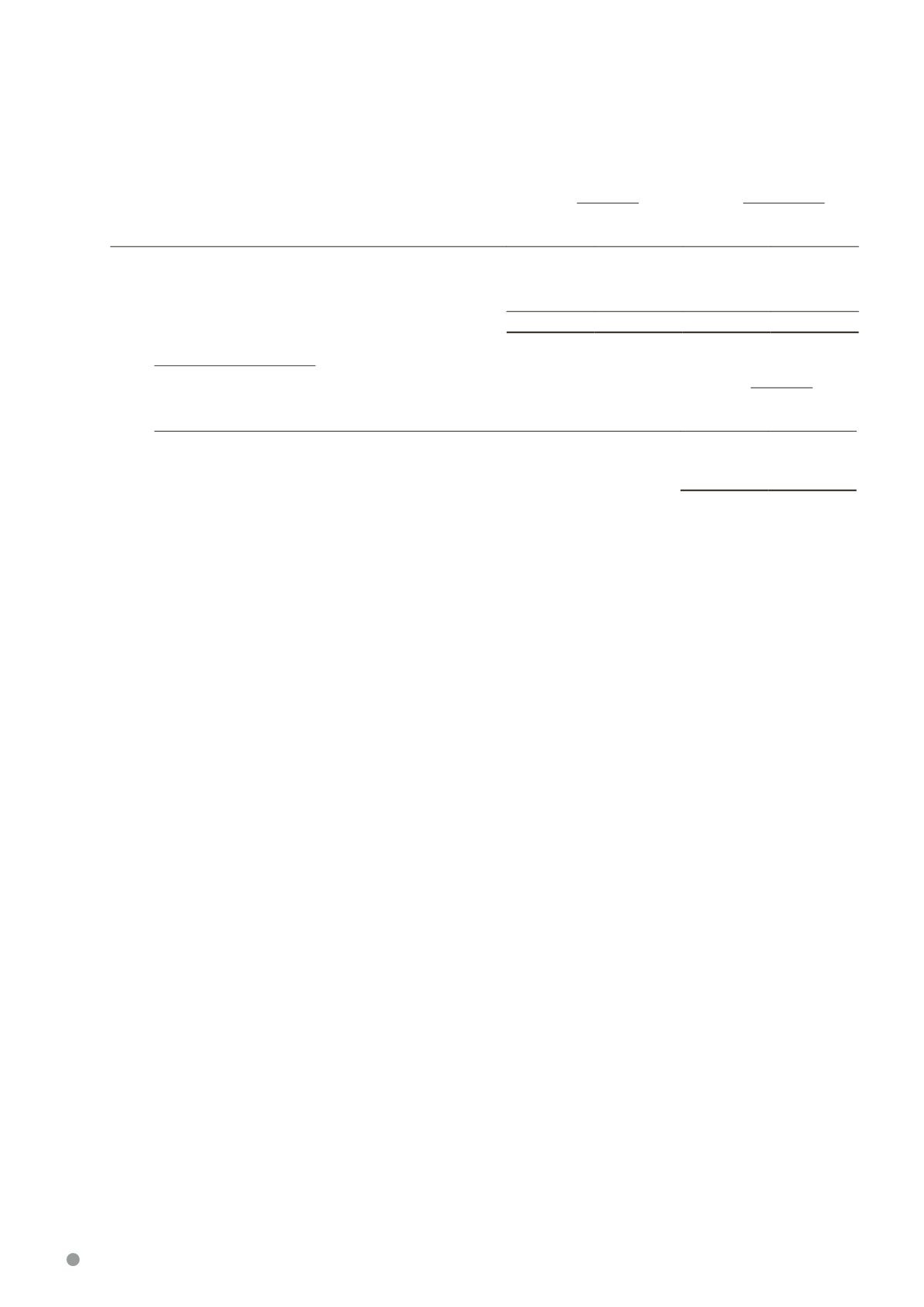

14. INTANGIBLE ASSETS

The Group

The Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Goodwill on consolidation

11,116

11,116

–

–

Trademarks and deferred expenditure

–

–

–

–

11,116

11,116

–

–

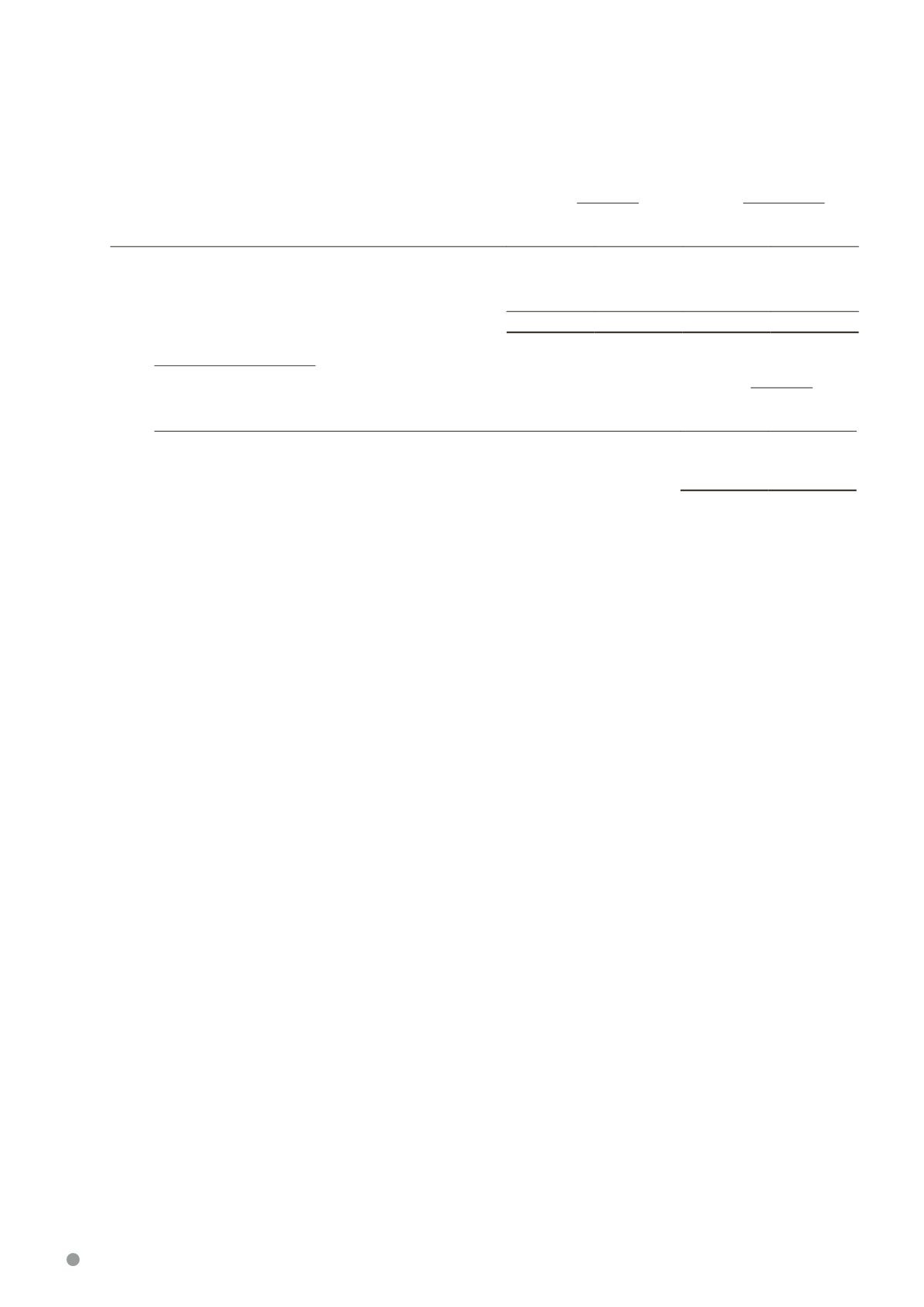

(a)

Goodwill on consolidation

The Group

2014

2013

$’000

$’000

Cost

Balance at beginning and end of financial year

11,116

11,116

Impairment test for goodwill

The goodwill is allocated to the healthcare division of the Group, which is regarded as a cash-generating

unit (“CGU”).

During the financial year, the Group has determined that there is no impairment of its CGU containing the

goodwill. The recoverable amount (i.e. higher of value-in-use and fair value less costs to sell) of the CGU is

determined on the basis of value-in-use calculations. These calculations incorporate cash flow projections

by management covering a five-year period.

Key assumptions used for value-in-use calculations:

Discount rate

7.0% (2013: 6.7%)

Growth rate

0.0% (2013: 0.0%)

These assumptions have been used for the analysis of the CGU. The discount rate used is pre-tax and reflects

specific risks relating to the healthcare division. Based on the sensitivity analysis performed, any reasonable

change in the key assumptions would not result in any impairment adjustments.