HAW PAR CORPORATION LIMITED

92

NOTES TO THE FINANCIAL STATEMENTS

(CONTINUED)

For the financial year ended 31 December 2014

22. RELATED PARTY TRANSACTIONS

(CONTINUED)

(b)

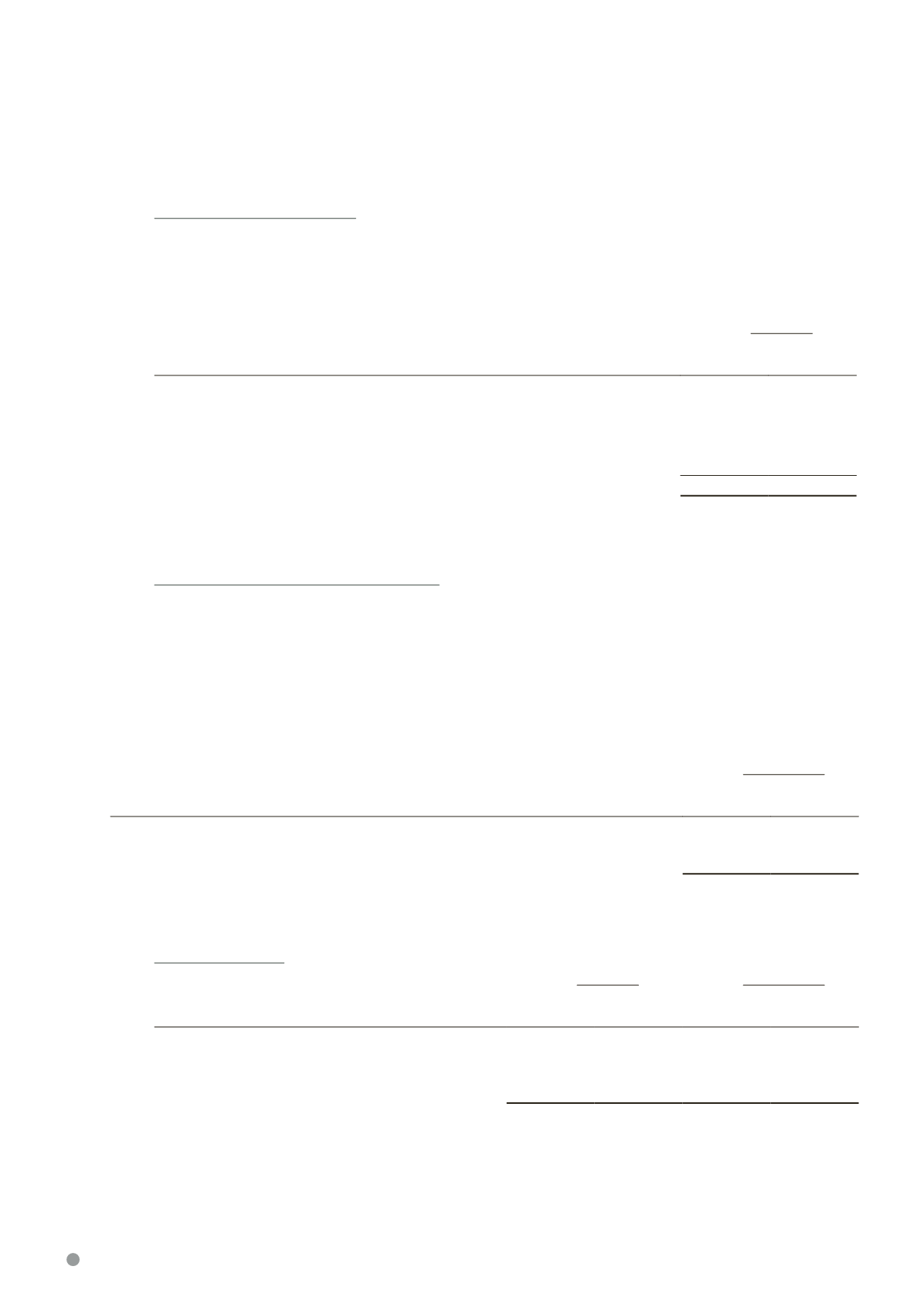

Key management’s remuneration

The key management’s remuneration includes fees, salary, bonus, commission and other emoluments (including

benefits-in-kind) computed based on the cost incurred by the Group and the Company, and where the Group or

Company do not incur any costs, the value of the benefit. The key management’s remuneration is as follows:

The Group

2014

$’000

2013

$’000

Directors’ fees, salaries and other short-term employee benefits

4,288

3,752

Employer’s contribution to Central Provident Fund and other

defined contribution plans

96

90

Share options granted

162

128

4,546

3,970

Total compensation to Directors of the Company included in the above amounted to $2,304,000 (2013:

$2,130,000).

(c)

Purchase of shares in an associated company

In the current financial year, an Executive Director and a key management personnel, who are nominee directors

in an associated company, were granted share options by the associated company. Upon exercising the share

options, the shares were sold by the nominee directors to the Group at cost of approximately $1,574,000.

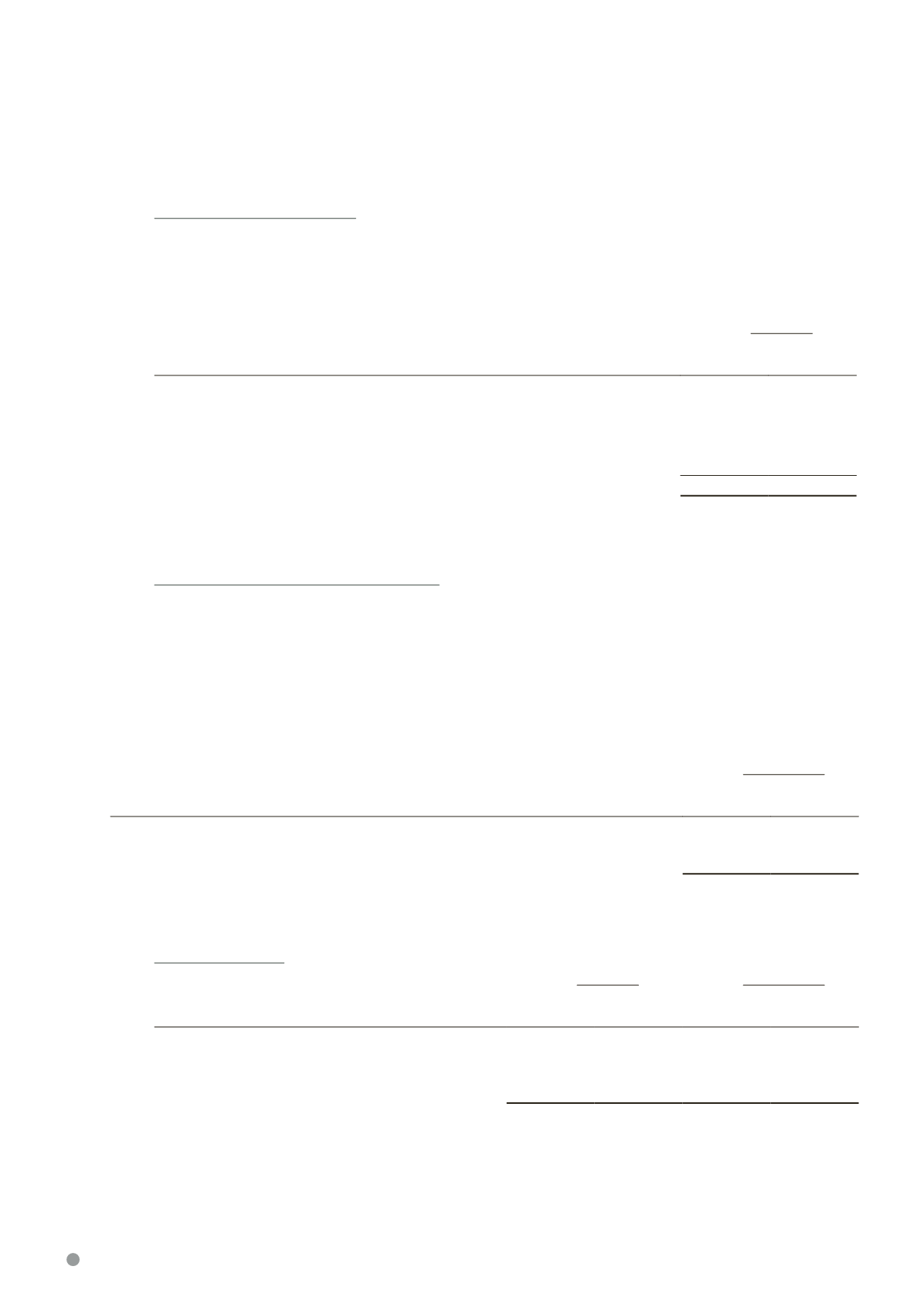

23. CONTINGENT LIABILITIES

Contingent liabilities relating to guarantees are:

The Company

2014

$’000

2013

$’000

In respect of guarantees given to banks in connection

with facilities granted to subsidiaries

68

68

24. COMMITMENTS

(a)

Capital commitments

The Group

The Company

2014

$’000

2013

$’000

2014

$’000

2013

$’000

Capital commitments authorised and contracted

but not provided for in the consolidated

financial statements

340

746

–

–

The capital commitments above relate to construction of/purchases of property, plant and equipment and

improvements to investment properties.