ANNUAL REPORT 2014

97

NOTES TO THE FINANCIAL STATEMENTS

(CONTINUED)

For the financial year ended 31 December 2014

26. FINANCIAL RISK MANAGEMENT

(CONTINUED)

(a)

Market risk

(continued)

(1) Foreign currency risk (continued)

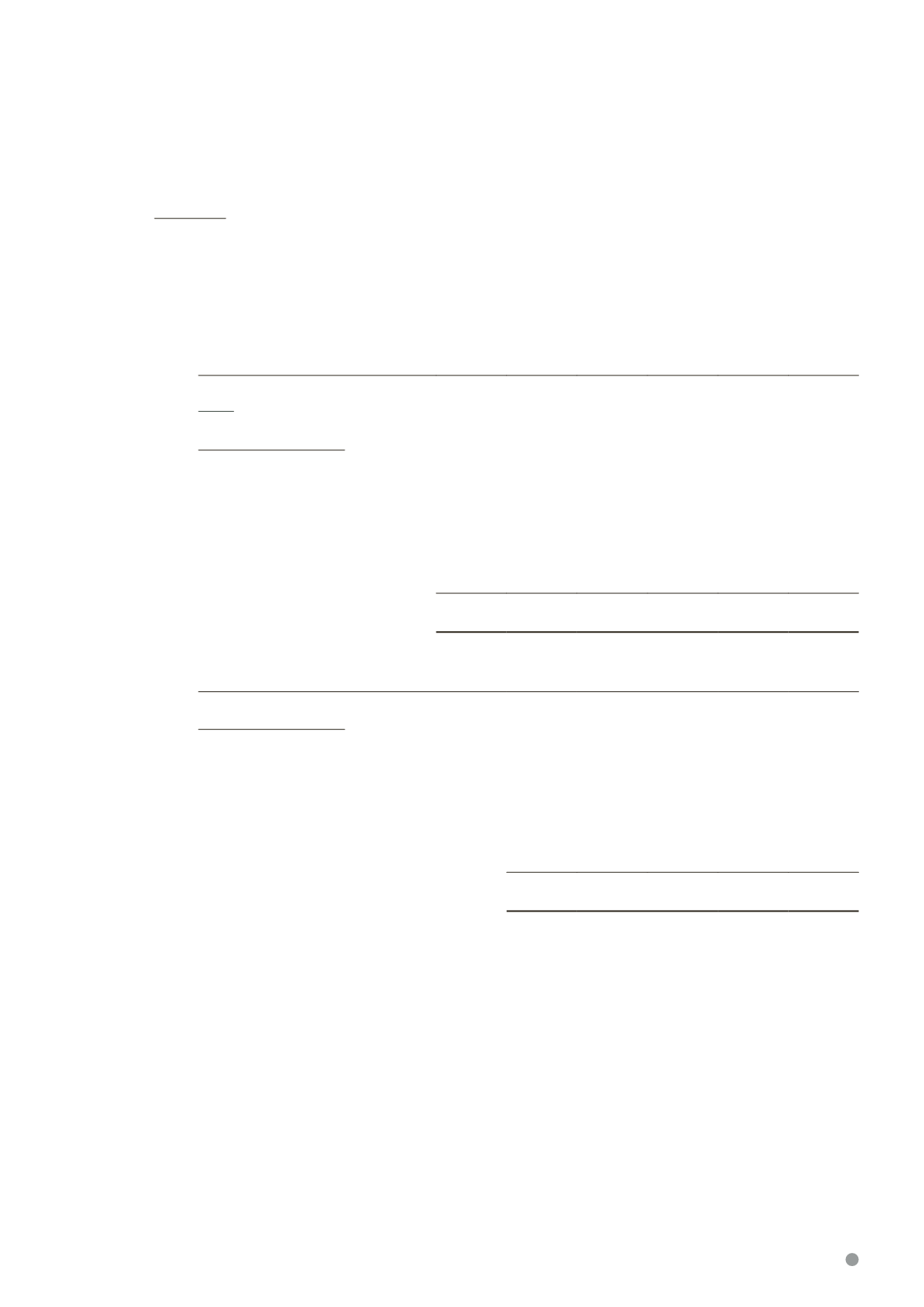

The Group’s currency exposure of financial assets/liabilities net of those denominated in the respective

entities’ functional currency based on the information provided to key management is as follows:

USD

HKD

Euro

JPY Others

Total

$’000 $’000 $’000 $’000 $’000 $’000

Group

At 31 December 2014

Cash and cash equivalents and

available-for-sale financial assets 24,049 113 1,008 48,246 16,547 89,963

Trade and other receivables

9,077

– 1,420

–

533 11,030

Trade and other payables

(3,292) (2,984) (2,846)

(272)

(800) (10,194)

Borrowings

(14,662)

–

– (41,670)

– (56,332)

Add: Firm Commitments

8,601

– 2,207 (394)

(10) 10,404

Currency exposure on financial assets

and liabilities

23,773 (2,871)

1,789 5,910 16,270 44,871

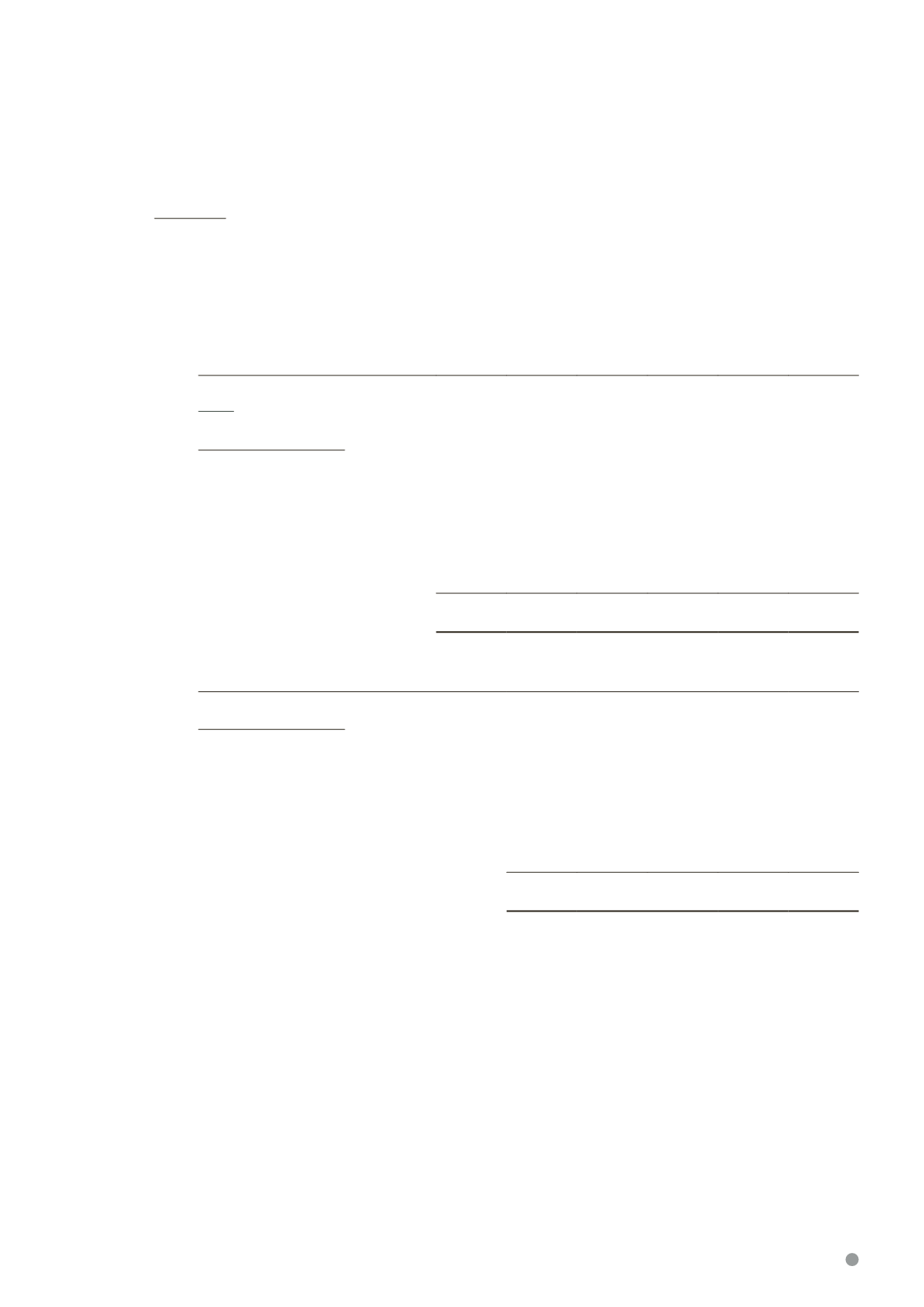

USD

HKD

Euro Others

Total

$’000 $’000 $’000 $’000 $’000

At 31 December 2013

Cash and cash equivalents and

available-for-sale financial assets

29,283 6,026 245 1,377 36,931

Trade and other receivables

5,956 4,964 1,230 170 12,320

Trade and other payables

(2,415) (3,017) (2,859)

(678) (8,969)

Borrowings

(23,784)

–

–

– (23,784)

Add: Firm Commitments

2,612

– 1,738 (109)

4,241

Currency exposure on financial

assets and liabilities

11,652 7,973

354

760 20,739

The Company does not have material foreign currency exposure as at 31 December 2014 and 2013

except for certain amounts due to a subsidiary of $8,085,000 (2013: $8,098,000) and fixed deposits

of $nil (2013: $5,994,000) denominated in Hong Kong Dollar, and borrowings of $56,332,000 (2013:

$23,784,000) denominated in United States Dollar and Japanese Yen (2013: United States Dollar only).