HAW PAR CORPORATION LIMITED

98

NOTES TO THE FINANCIAL STATEMENTS

(CONTINUED)

For the financial year ended 31 December 2014

26. FINANCIAL RISK MANAGEMENT

(CONTINUED)

(a)

Market risk

(continued)

(1) Foreign currency risk (continued)

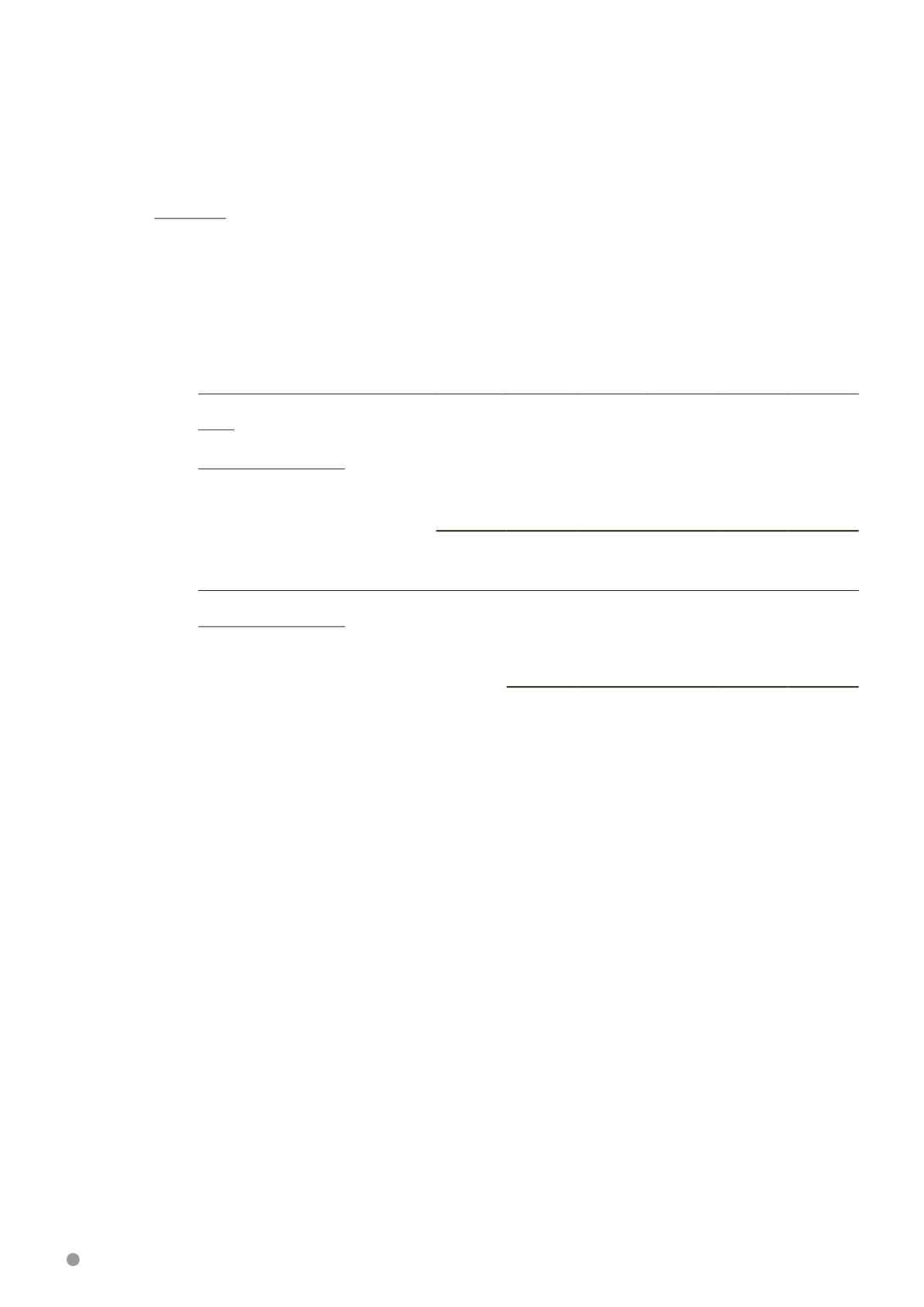

A 10% (2013: 10%) weakening of Singapore Dollar against the following currencies at reporting date

would increase/(decrease) profit or loss by the amounts shown below, with all other variables including

tax rate being held constant:

USD

HKD

Euro

JPY Others

Total

$’000 $’000 $’000 $’000 $’000 $’000

Group

At 31 December 2014

Profit or loss, after tax

Other comprehensive income

552

845

(233)

–

(34)

–

(22)

658

1,463

–

1,726

1,503

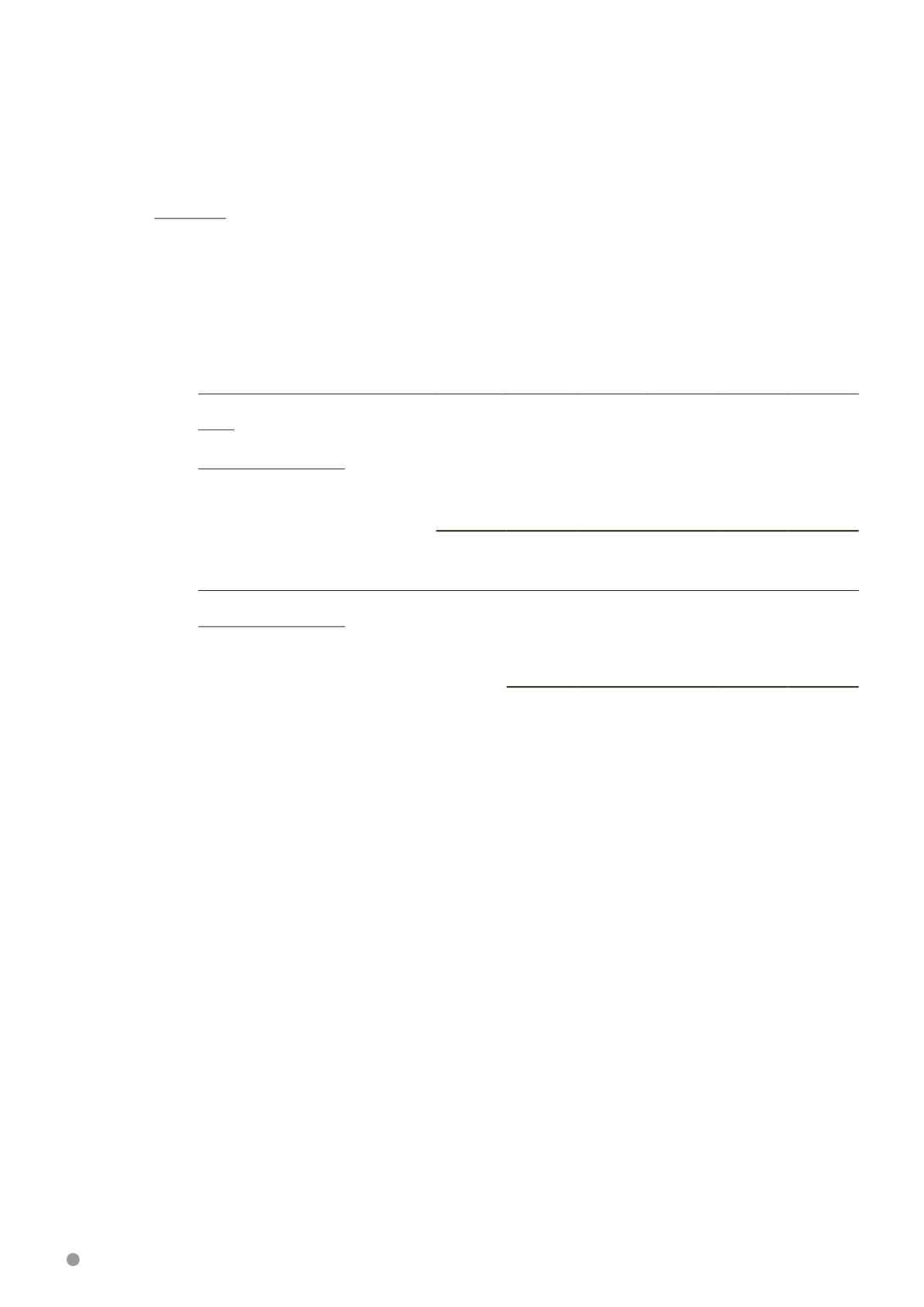

USD

HKD

Euro

Others

Total

$’000 $’000 $’000 $’000 $’000

At 31 December 2013

Profit or loss, after tax

Other comprehensive income

369

456

850

–

(114)

–

93

–

1,198

456

A 10% (2013: 10%) strengthening of Singapore Dollar against the above currencies would have had

the equal but opposite effect on the above currencies to the amounts shown above, on the basis that

all other variables remain constant.

(2)

Market price risk

The Group has substantial investments carried at fair value of $2,311.5 million (2013: $1,934.7

million) held in various forms of securities as of 31 December 2014 and have been accounted for in

accordance with the accounting policy stated in Note 2(i). These securities are mainly listed in Singapore.

The fair value of financial instruments traded in active markets (such as available-for-sale securities)

is based on quoted market prices at the end of the reporting period. The quoted market price used for

financial assets held by the Group is the current bid price. These instruments are categorised as Level

1 under the fair value hierarchy as set out in the relevant accounting standard.