14

15

ANNUAL REPORT 2015

HAW PAR CORPORATION LIMITED

F I NAN C I A L C A L E NDA R

Date

Event

14 May 2015

Announcement of 2015 1st quarter results

11 August 2015

Announcement of 2015 2nd quarter results

4 September 2015

Payment of 2015 First & Interim dividend

4 November 2015

Announcement of 2015 3rd quarter results

25 February 2016

Announcement of 2015 full-year audited results

7 April 2016

Announcement of Notice of Annual General Meeting

29 April 2016

47th Annual General Meeting

18 May 2016

Proposed books closure date for dividend entitlement

27 May 2016

Proposed payment of 2015 Second & Final dividend and

Special dividend

FINANCIAL HIGHLIGHTS

Group turnover increased 16% from $154.2 million

to $178.8 million mainly from Healthcare. Profits from

operations grew 24% to $139.3 million due to higher

profit from Healthcare and increase in dividend income

from investments. Profit after tax increased 54% to $183.3

million with higher contribution from Healthcare, investment

income and associated companies.

Healthcare contributed a higher percentage of the Group’s

turnover from higher sales in key markets. Healthcare’s

profit increased 42% to $48.1 million from $33.9 million.

Profit contribution from the Group’s investment portfolio

increased due to one-off equity gains from associated

company and higher investment income.

FINANCIAL POSITION

Shareholders’ funds decreased 10% to $2,535 million mainly

due to lower market valuation of the Group’s available-for-

sale financial assets reflecting the volatility of the equity

market. During the year, the Group also disposed part of

its investment in associated company, Hua Han Health

Industry Holdings Limited (“Hua Han”). The retained interest

in Hua Han was subsequently reclassified from investment

in associated company to available-for-sale financial assets.

Based on cumulative cash dividends received and net

proceeds from the partial disposal, the Group has recovered

fully its cash capital cost invested in Hua Han. The Group’s

remaining investment in Hua Han represents unrealised cash

profits in this investment.

Cash generated by operating activities and cash dividends

received from investments was $124 million in 2015, with

the Group ending the financial year with net cash balances

of $314 million.

DIVIDENDS

In view of extraordinary income during the year, the Board

of Directors are recommending a final dividend of 14 cents

per share and special dividend of 15 cents per share to be

approved by shareholders at the coming Annual General

Meeting. Together with the interim dividend of 6 cents

paid in September 2015, the total dividend per share for

the financial year ended 31 December 2015 is 35 cents per

share (2014: 20 cents per share).

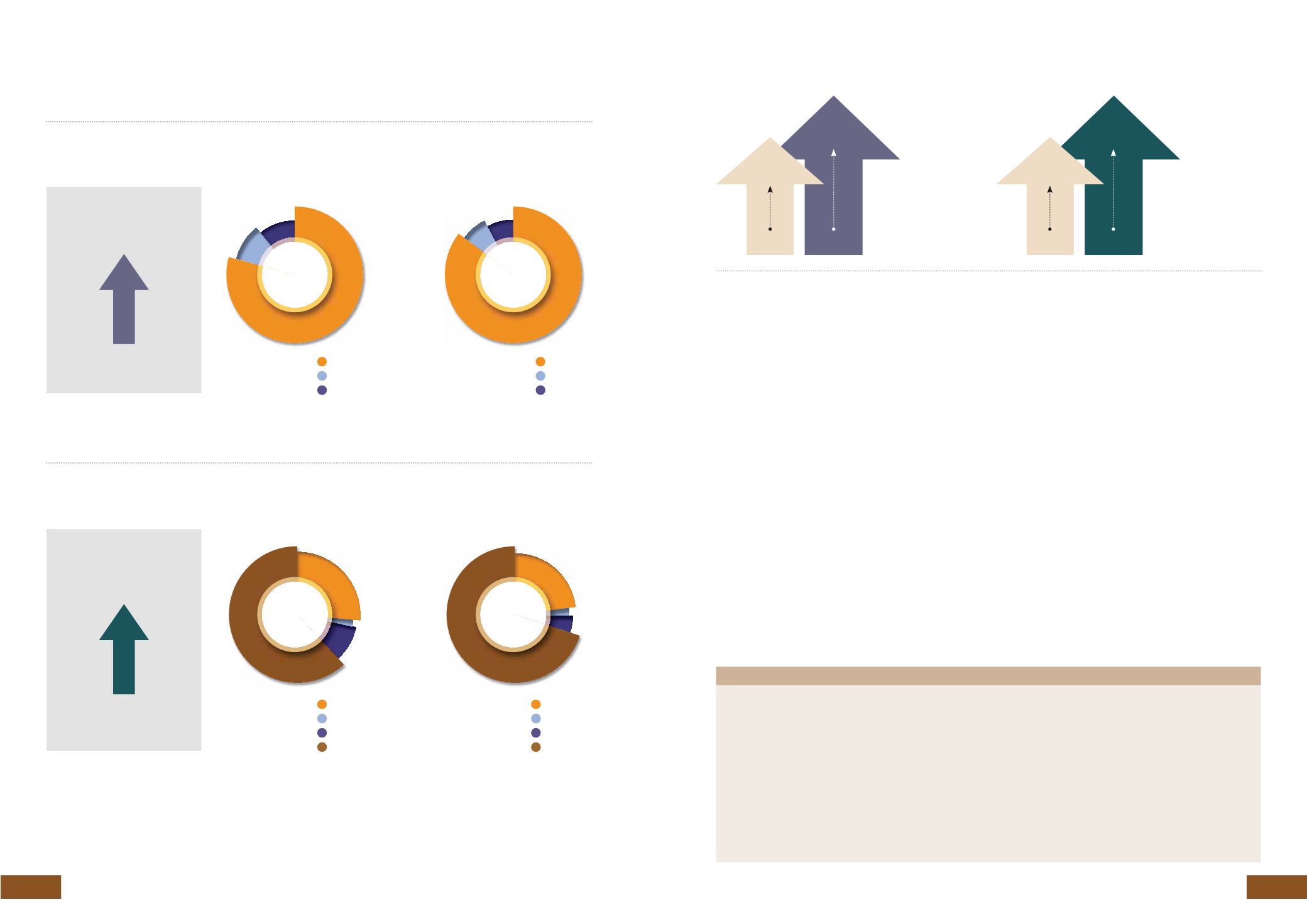

+16.0%

+54.3%

TURNOVER ($M)

2015: $178.8M

Healthcare

122.2

Leisure

15.6

Property

16.4

Healthcare

152.6

Leisure

12.7

Property

13.5

2014

2015

2014: $154.2M

TURNOVER

PROFIT CONTRIBUTION ($M)

PROFIT AFTER TAX

TURNOVER

Healthcare

33.9

Leisure

2.5

Property

15.5

Investment

75.1

Healthcare

48.1

Leisure

(4.3)

Property

7.9

Investment

142.0

2014

2015

2015: $193.7M

2014: $127.0M

PROFIT BEFORE TAX

G R OU P F I NAN C I A L H I G H L I G H T S

$178.8M

$183.3M

$154.2M

$118.8M

2015

2015

2014

2014