F I NAN C I A L R E V I EW

100

80.0

60.0

40.0

20.0

0

120

100

80

60

40

20

0

Healthcare

2014

2015

2014

2015

2014

2015

2014

2015

Leisure

Property

Investments

America

Middle East

Europe

Asia

50.0

40.0

30.0

20.0

10.0

0

Healthcare

Group

Property

Leisure

Investments

OVERVIEW

Group revenue at $178.8 million

was 16% higher than 2014, with

Healthcare reporting a 25% growth in

revenue. Profits from both Healthcare

and Investments grew 42% and 32%

respectively. Group earnings increased

54% to $183.3 million due to better

profitability from Healthcare, higher

investment income and associated

companies.

Earnings per share increased to 83.7

cents (2014: 54.3 cents). However, net

tangible assets per share decreased

to $11.57 (2014: $12.82) despite

the increase in earnings due to lower

market valuations of available-for-sale

financial assets.

SEGMENTAL PERFORMANCE

HEALTHCARE

Healthcare’s revenue of $152.6 million

increased 25% compared to prior

year. Higher sales to key markets

during the year also resulted in higher

revenue contribution especially from

Asian countries. Sales to Americas and

Asian regions grew 34% and 29%

respectively from the previous year.

Operating profits increased 42% to

$48.1 million due to higher sales, lower

cost of materials and more favourable

exchange rates which helped improve

margins.

LEISURE

The number of visitors to the aquariums

declined by 16% with weaker tourist

sentiments and competition from

newer attractions. Leisure contributed

a lower revenue of $12.7 million in

2015 compared to $15.6 million in

2014 due to lower visitorship and

yield. The segment recorded an

impairment charge of $4.6 million on

its fixed assets at Underwater World

Singapore due to the challenging

operating environment. Excluding the

impairment charge, Leisure reported a

profit of $0.3 million in 2015. The two

aquariums remain cashflow positive.

Continuous upgrading of facilities and

displays at Underwater World Pattaya

are done to maintain competitiveness.

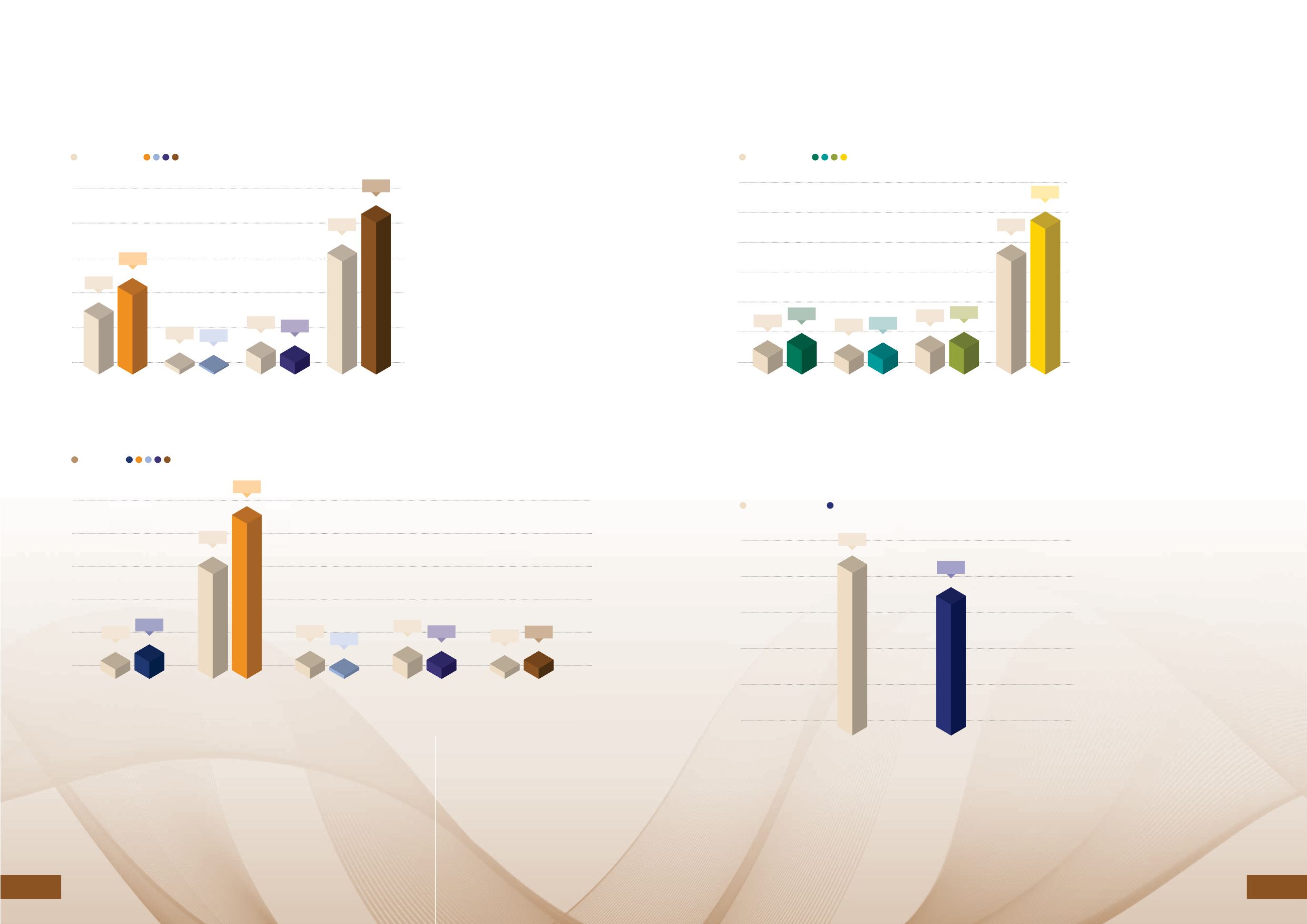

RETURN ON ASSETS EMPLOYED

The Group applies a Return of Assets Employed (“ROA”)

measure to evaluate the performance of its business

operations. The ROA measures profitability of assets

utilised by the various segments.

In 2015, the Group’s ROA increased to 7.1% from 4.6%,

from higher profitability in Healthcare and Investments,

offset by decrease in profit from Leisure and Property. ROA

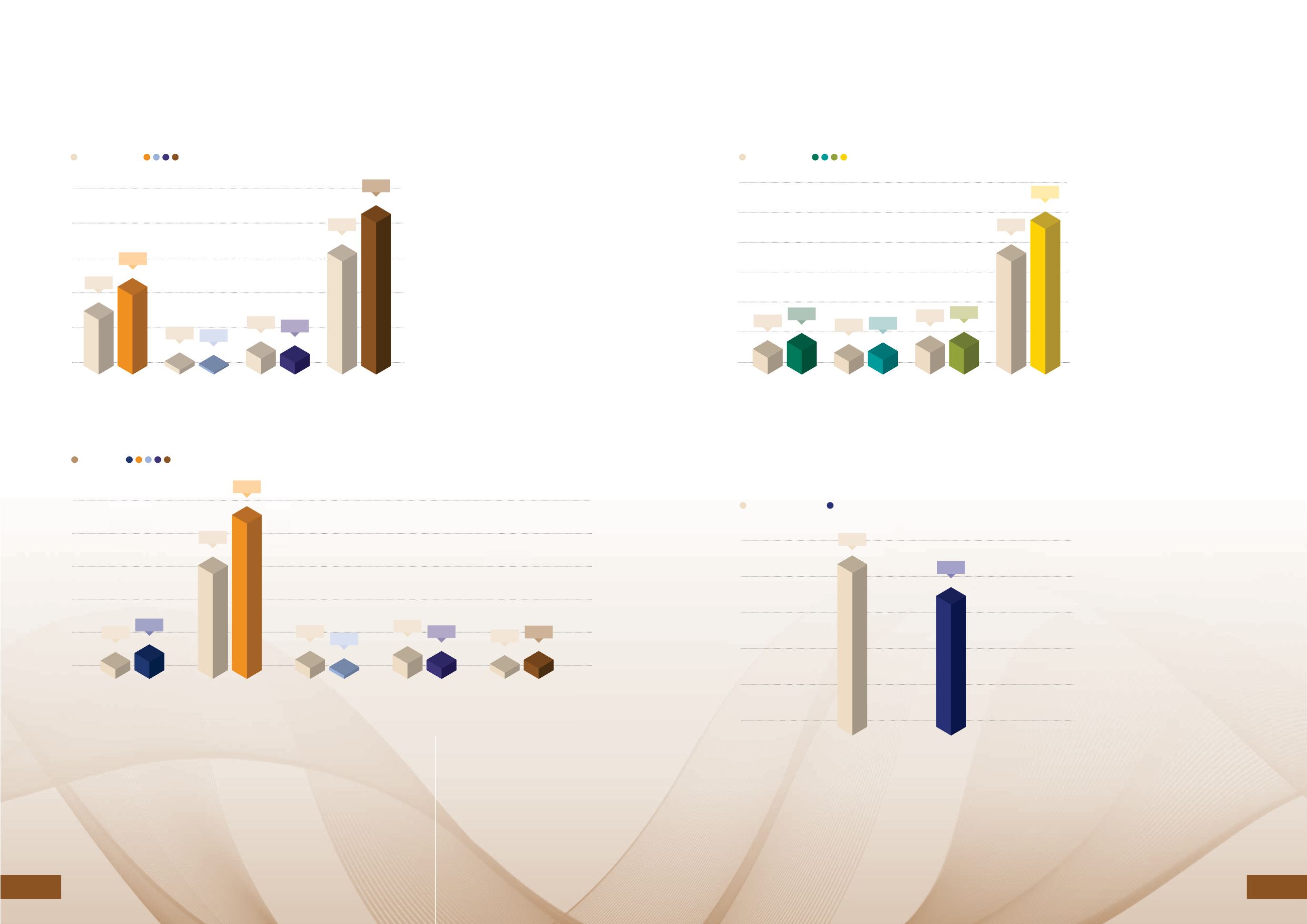

SEGMENT PROFITS BEFORE INTEREST EXPENSE AND TAX ($M)

HEALTHCARE SALES BY REGION ($M)

VISITORSHIP OF AQUARIUMS (‘000)

RETURN ON ASSETS EMPLOYED (%)

of Healthcare division improved from 32.7% to 47.4%.

The decline in ROA of Leisure to 0.5% is attributable to

lower visitorship and competition from newer attractions.

As a result of lower occupancy rate which impacted on

profitability, ROA of Property decreased to 4.7%. ROA

of Investments increased to 4.1% with higher dividend

income received during the year and smaller asset base.

48.1

2.5

12.4

0.3*

9.9

88.9

67.3

32.7

47.4

4.6

7.1

5.6 4.7

4.4

0.5*

3.1 4.1

33.9

14.5

19.4

17.3 19.7

12.1 12.8

78.3

100.7

* Excludes effects of impairment of fixed assets at Underwater World Singapore.

31

30

1000

800

600

400

200

0

905

756

ANNUAL REPORT 2015

HAW PAR CORPORATION LIMITED