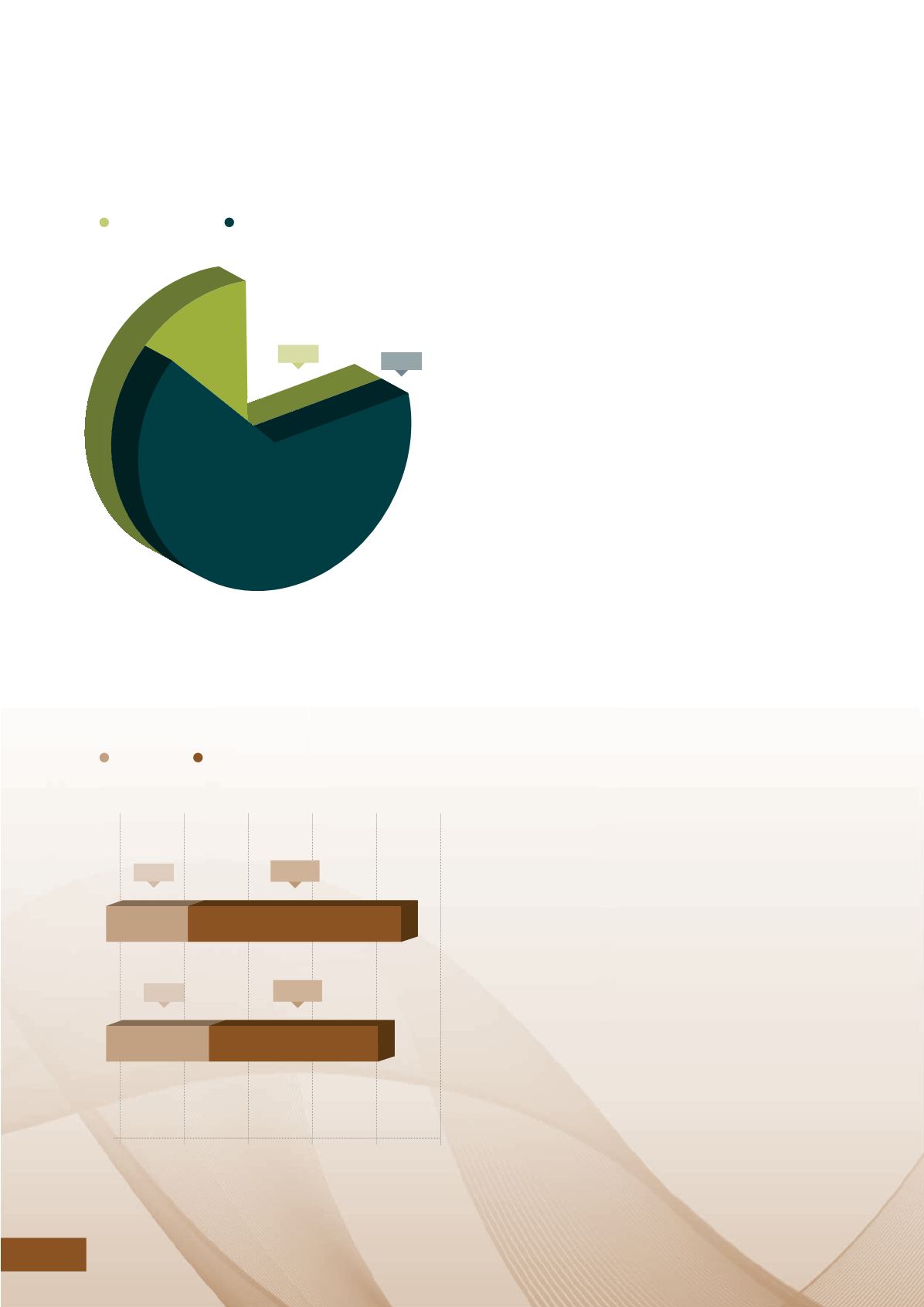

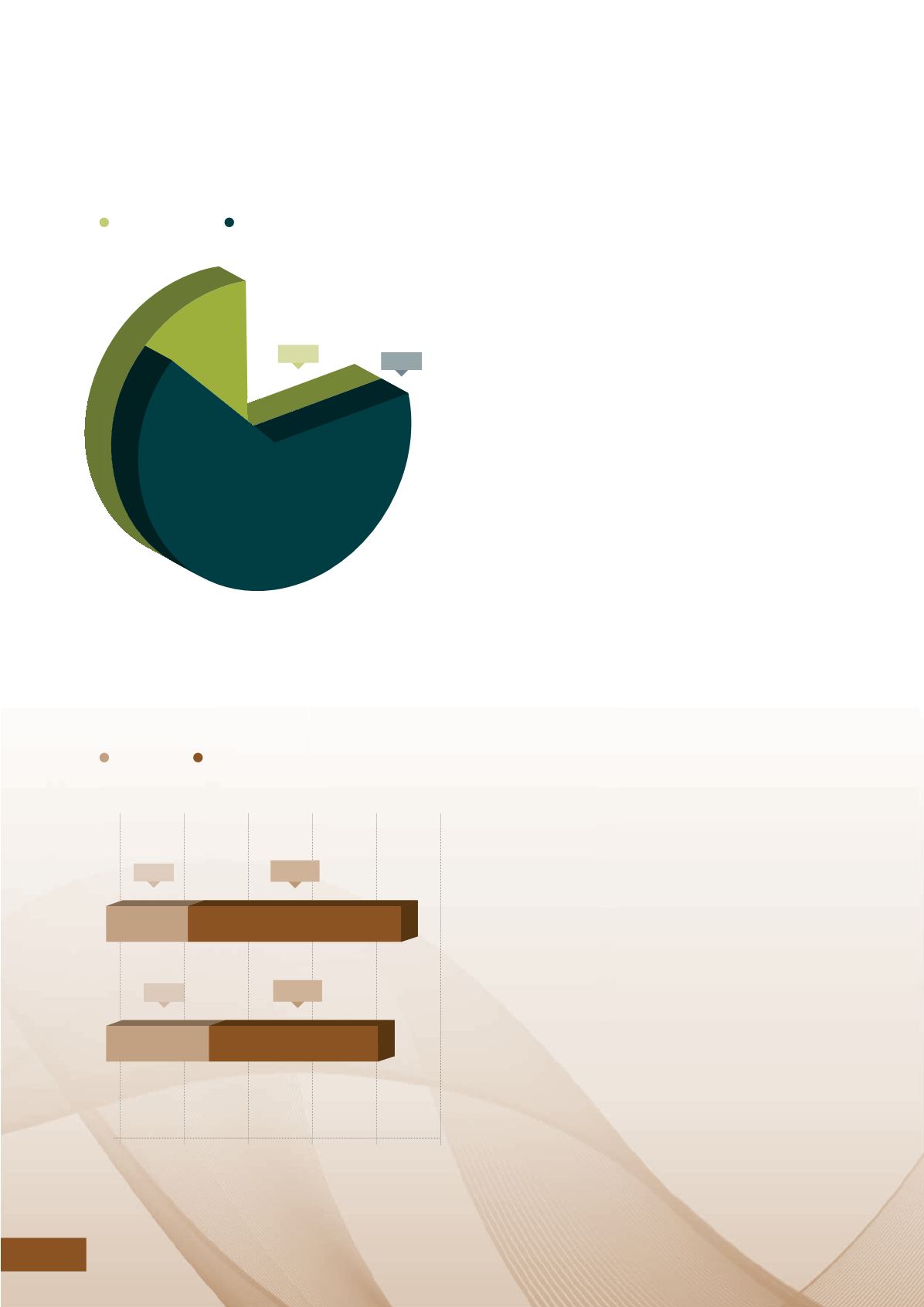

2014

2015

Cost

Fair Value

PROPERTY

Property revenue of $13.5 million decreased 17% and

profit of $9.9 million decreased 20% as a result of lower

occupancy. As a result of lower occupancy and subdued

property market outlook, Property recorded a fair value

loss of $2.0 million compared to $3.1 million gain in the

previous year.

A commercial investment property in Hong Kong was

disposed of during the year. The Group recorded a gain

of $0.3 million, being the difference between the carrying

amount of the property at fair value and net proceeds

received. Compared to original cost, the Group realised a

profit of $8.9 million from the sale of the property.

INVESTMENTS

Dividend income from quoted equity investments increased

43% to $89.5 million (2014: $62.6 million) due mainly to

higher dividends received from the Group’s investment in its

key strategic investments.

The increase in cost of investments portfolio was due mainly

to the reclassification of the Group’s retained interest in

associated company, Hua Han, to available-for-sale financial

assets measured at fair value of $154.5 million. Based on

cumulative cash dividends received and net proceeds from

the partial disposal, the Group has recovered fully its cash

capital cost invested in Hua Han. The remaining investment in

Hua Han represents unrealised cash gains in this investment.

The fair value of the Group’s investment portfolio decreased

from $2,311.5 million as of 31 December 2014 to $2,080.6

million as of 31 December 2015 mainly due to the decrease

in share prices of equity investments. As a result of depressed

equity market, net unrealised loss of $402.9 million from the

changes in fair value of investments was recorded in the fair

value reserve account in 2015.

PROPERTY (BUILDING OCCUPANCY RATES)

INVESTMENTS (COST VS FAIR VALUE) ($M)

F I NAN C I A L R E V I EW

78.2%

64.6%

2014

2015

0

500

1000

1500

2000

2500

602.8

788.6

2,311.5

2,080.6

32

HAW PAR CORPORATION LIMITED