Corporate Governance

Corporate Governance

Haw Par Corporation Limited (the "Company", and together with its subsidiaries, the "Group") is committed to upholding good corporate governance practices to enhance long-term shareholder value and safeguard the interests of its stakeholders. It has adopted a framework of corporate governance policies and practices in line with the principles and provisions of the Code of Corporate Governance 2018 (the "Code"), and taking into consideration, where applicable, the best practices of the accompanying Practice Guidance issued to the Code. The following sections describe the Group's corporate governance practices and structures that were in place during the financial year ended 31 December 2024 ("FY2024") and explain deviations from any provision of the Code.

Click here to download a copy of the details as extracted from our 2024 annual report.

BOARD MATTERS

Principle 1: Board's Conduct of its Affairs

The Company is headed by an effective Board which is collectively responsible and works with Management for the long-term success of the Company.

The principal responsibilities of the Board include:

- approving strategic plans and annual budgets;

- approving major funding, acquisition, investment and divestment proposals;

- ensuring that management establishes and maintains a sound system of internal controls, risk

management, financial reporting and statutory compliance in order to safeguard shareholders'

interests and the Group's assets;

- reviewing the performance of management in attaining agreed goals and objectives;

- approving the announcement of financial results and declaring dividends;

- guiding, reviewing and approving corporate strategy and financial planning, including major capital

expenditures, acquisitions and divestments;

- reviewing and approving material interested person transactions ("IPT") and related person

transactions;

- ensuring succession planning; and

- establishing and upholding an appropriate culture, values and ethical standards at all levels of the

Group.

All Board members bring their judgement and breadth of diversified knowledge and experience to bear on issues of strategy (including sustainability and environmental issues), performance, resources and standards of conduct. Board members understand the Company's business as well as their directorship duties (including their roles as Executive, Non-Executive and Independent Directors), and exercise due diligence and discharge their duties and responsibilities objectively at all times as fiduciaries, in the best interests of the Company. They set an appropriate tone-from-the-top on the desired organisational culture, and to ensure proper accountability within the Company, they have put in place a Code of Business Conduct and Whistle Blowing Policy, more details of which are set out under the Code of Business Conduct and Whistle Blowing Policy section of this Annual Report.

The Board meets at least four times a year to review the performance and business strategy of the Group. Meetings are scheduled in advance. Ad-hoc meetings are called when there are important and urgent matters requiring the Board's consideration. Board approval is sometimes obtained between scheduled meetings by circular resolutions in writing.

The Group has adopted internal guidelines which set out specific matters requiring Board approval, which are clearly communicated to management in writing. These written guidelines also include financial and non-financial limits of authority given to management. Under the guidelines, Board approval is required for material transactions including joint ventures, mergers and acquisitions, and for the adoption and amendment of the Group risk management policy. In respect of matters in relation to which a Board member has a conflict of interest, such Board member recuses himself from any discussion or decision involving the issue of conflict.

On sustainability issues, the Sustainability Steering Committee ("SSC"), consisting of senior management and led by the President and Chief Executive Officer (the "CEO"), evaluates sustainability efforts and priorities within the Group. The SSC, chaired by the Group General Manager (the "GGM") acting as the Group's Chief Sustainability Officer (the "CSO"), reports through the CEO to the Board. The SSC also formed the Climate Change Sub-Committee to monitor market and regulatory related developments on climate reporting requirements that are consistent with the recommendations of the Task Force on Climate-related Financial Disclosures ("TCFD").

The SSC reports to the Board, which has considered sustainability issues as part of its overall strategy formulation, and has determined the Environmental, Social and Governance ("ESG") factors identified as material to the business of the Group. The Board oversees the management and monitoring of these ESG factors. The material ESG factors that are the focus in the sustainability reporting of the Group for FY2024 include economic performance, compliance and good governance, occupational health and safety of employees, product quality and safety, labour practices and issues, supply chain, and environmental factors. All members of the Board as at 31 December 2024 have undergone training on sustainability matters as prescribed by the Singapore Exchange Securities Trading Limited ("SGX-ST").

The sustainability report of the Company can be found on the Company's website at https://www.hawpar.com/sustainability/sr.

The Board has delegated specific responsibilities to three Board Committees, which are the Audit and Risk Committee, Nominating Committee and Remuneration Committee. Changes to the Board Committees' composition and appointments to the Board Committees are approved by the Board. Each of these Committees has its own written charter or terms of reference, setting out the Committee's compositions, authorities and duties, including reporting back to the Board. These are reviewed periodically to ensure their continued relevance. The delegation of authority by the Board to the Board Committees is as set out in the table of authority grid approved by the Board.

The Investment Committee ("IC") was disbanded during FY2024 following a review by the Board. Further to the disbanding of the IC, the Board revised and approved the table of authority grid to account for this change. The responsibilities previously delegated to the IC, including reviewing the performance of the Group's investments, evaluating potential acquisitions and disposals, assessing funding requirements and managing key financial risks, have been transferred to Management. These duties are now vested in a newly established Investment Management Committee ("IMC"), which is a management committee and not a board committee. The IMC is headed by the CEO and comprises the Chief Financial Officer ("CFO"), Group General Manager and the Company Secretary. The IMC holds bimonthly meetings.

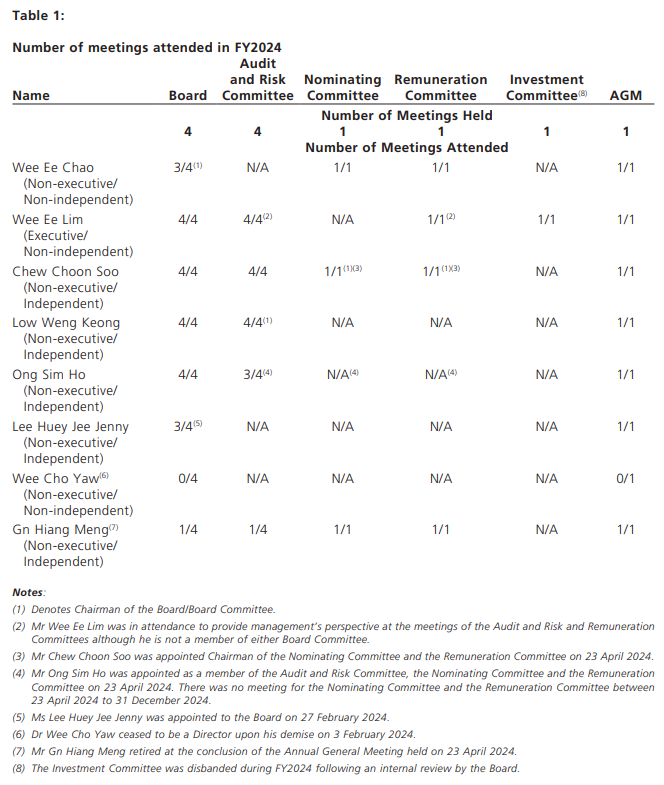

The Board held four meetings during FY2024. Directors attend and actively participate in Board and Board Committee meetings, and can attend Board and Board Committee meetings in person or virtually if they are unable to attend in person. The attendance of Directors at the Annual General Meeting ("AGM"), Board and Board Committee meetings held in FY2024 is as follows:

The Board and Board Committees also make decisions by way of circulation of resolutions in writing as needed.

Directors are appointed by way of formal letters of appointment which set out their duties and obligations. The Company has in place a comprehensive orientation programme for newly appointed Directors. The programme is tailored according to the profile and experience of new Directors. It includes training in areas such as industry and operational knowledge or accounting updates, duties as Directors and how to discharge those duties as well as meetings with key personnel for new Directors to understand the Group's businesses, governance practices, strategic plans and objectives. Site visits are conducted as needed. The orientation programmes are conducted by the CEO, Company Secretary and various heads of business units and functions, in order to familiarise new Directors with the Group's operations, practices and Code of Business Conduct.

The Company is a corporate member of the Singapore Institute of Directors. The Company encourages Directors to keep abreast of relevant new laws, regulations, changing commercial risks and industry development from time to time, and arranges and funds the training of Directors to attend external courses and talks by professional organisations to develop and maintain their skills and knowledge, as and when relevant and needed. Directors are continuously updated by the CFO, Company Secretary and auditors on developments in the regulatory and business environment affecting the Group. In FY2024, the Directors were given updates on the changes to the Listing Rules of the SGX-ST, sustainability reporting and changes in the new accounting standards and reporting requirements. None of the Directors has appointed an alternate director.

Principle 2: Board Composition and Guidance

The Board has an appropriate level of independence and diversity of thought and background in its composition to enable it to make decisions in the best interest of the Company.

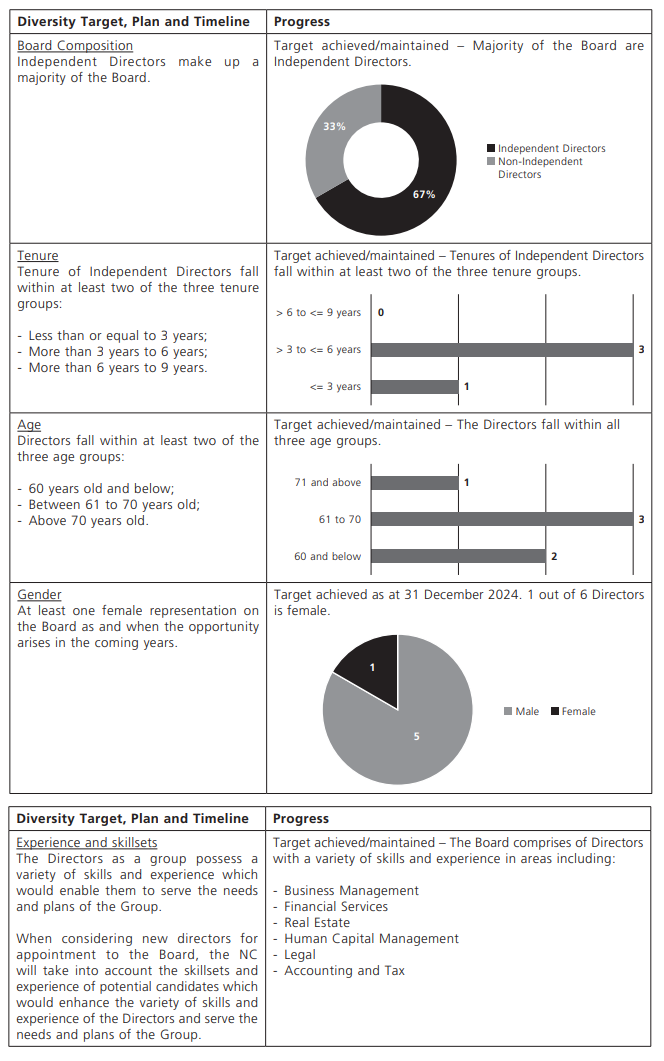

The Nominating Committee ("NC") implements the Board Diversity Policy which reflects the importance of diversity to the functioning of the Board. Our Diversity Policy seeks to include people with diversity of skills, industry and business experiences, core competencies, gender, seniority in age and experience, qualifications and other relevant attributes which the Board considers useful. The Board in FY2024 comprises a wide range of members in terms of age and background, who have been drawn from different industries, offering a diversity in skills and experience which enable them to serve the needs and plans of the Group. Such skills include core competencies in management, strategic planning and building a customer-focused experience, as well as in the areas of accounting, finance, legal and knowledge of the Group's businesses. For FY2024, the Board considers the board size of four Non-Executive and Independent Directors out of six board members to be of appropriate size and diversity mix.

The Company's board diversity targets, plans and timelines for achieving the targets and progress are as follows:

The Board has made progress and achieved its target for gender diversity in the composition of the Board in FY2024, and has met and continued to maintain its other board diversity targets for FY2024. The composition of the Board will continue to be assessed annually taking into consideration the Board Diversity Policy, targets and the needs of the Company. Nonetheless, all Board appointments will always be made based on merit.

The NC, having regard to the relevant rules of the Listing Manual of the SGX-ST, the Code's guidance for assessing independence and the relevant Practice Guidance, has determined that the Board comprised a majority of Independent Directors throughout FY2024. The Non-Executive Directors during FY2024 considered as independent by the Board are Mr Chew Choon Soo, Mr Low Weng Keong, Mr Ong Sim Ho and Ms Lee Huey Jee Jenny as indicated in Table 1 above. The Board is of the view that they maintained their independence throughout FY2024.

Independent Directors are independent in conduct, character and judgement, and have no relationships with the Company, its related corporations, its substantial shareholders or its officers which could interfere, or be reasonably perceived to interfere, with the exercise of their independent business judgement in the best interests of the Company. They are not substantial shareholders and are independent of the substantial shareholders of the Company.

The Independent Directors are not family members of any substantial shareholder of the Company and were not directly associated with any substantial shareholder in FY2024 or the immediate past financial year. They and their immediate family members did not have any financial dealings with the Group whether in FY2024 or the immediate past financial year, nor were they or any of their immediate family members, during FY2024 or the immediate past financial year, a substantial shareholder of, or a partner in (with 5% or more stake), or an executive officer of, or a director of, any organisation to which the Group made, or from which the Group received, significant payments or material services (including auditing, banking, consulting and legal services) in FY2024 or the immediate past financial year. Also, neither they nor any of their immediate family members were employed by the Group at any time during FY2024 or during the previous three financial years. In addition, they and their immediate family members did not receive any significant compensation (of more than S$50,000) from the Company or any of its related corporations for the provision of services during FY2024 or during the immediate past financial year other than as Directors' fees for their services on the Board.

As of 31 December 2024, no Independent Director has served on the Board for an aggregate period of more than nine years.

Principle 3: Chairman and Chief Executive Officer

There is a clear division of responsibilities between the leadership of the Board and Management, and no one individual has unfettered powers of decision-making.

There is a clear division of the roles and responsibilities between the Non-Executive Chairman of the Board and the CEO, who is the brother of the Chairman. The Chairman's principal role is to lead and guide the Board. The scope of responsibilities and limits of authority of the CEO are set out in writing. The CEO executes the strategic directions set by the Board and is responsible for the Group's day-to-day operations. A table of authority grid approved by the Board sets out such division of responsibilities between the Chairman and the CEO.

Although the Chairman and CEO are related, the Board is of the opinion that it is not necessary to appoint a lead independent director for the reasons specified in this paragraph. A shareholder can approach any Independent Director for assistance through the Company Secretary, if he or she has any concerns or issues that affect shareholders generally. Where necessary, the Independent Directors also have the discretion to meet without the presence of other Directors and can provide objective feedback to the Chairman following such meetings. The chairmen of the Board Committees have sufficient standing and authority to look into any matter which management or the Executive Director fails to resolve. The Non-Executive Directors and/or the Independent Directors meet without the presence of management as and when necessary and provide feedback to the Board and/or Chairman as appropriate after such meetings.

Nominating Committee

Principle 4: Board Membership

The Board has a formal and transparent process for the appointment and re-appointment of Directors, taking into account the need for progressive renewal of the Board.

The NC comprised three members, namely Mr Gn Hiang Meng, Mr Wee Ee Chao and Mr Chew Choon Soo during the period from 1 January 2024 to 23 April 2024, with Mr Gn appointed as Chairman of the NC. Mr Gn retired as a director of the Company on 23 April 2024 and consequently stepped down as Chairman and member of the NC. On 23 April 2024, Mr Chew Choon Soo was appointed Chairman of the NC and Mr Ong Sim Ho was appointed as a member of the NC. The NC currently comprises three members, namely Mr Chew Choon Soo, Mr Wee Ee Chao and Mr Ong Sim Ho. Throughout FY2024, the NC comprised at least three Directors, the majority of whom, including the Chairman of the NC, are Independent Directors.

The principal responsibilities of the NC are to:

- review appointments / reappointments of Directors and Key Management Personnel1 ("KMPs");

- review the composition of the Board and Board Committees;

- review the succession plans for Directors, in particular for the Chairman, and KMPs and make recommendations to the Board on the same;

- assess the independence of Directors;

- evaluate the performance of the Board and Board Committees (including whether a Director is able to and has been adequately carrying out his or her duties as a Director), and review the process and criteria for such evaluation;

- set objectives for achieving board diversity and review the Company's progress towards achieving these objectives; and

- review training and professional development programmes for Directors, and make recommendations to the Board on the same.

The charter of the NC provides that the NC shall comprise not less than three members, all non-executive, of which the majority shall be independent.

Each year, the NC reviews the composition of the Board as part of its succession planning. Suitable candidates are identified through personal and professional networks. The NC reviews each candidate objectively. When assessing potential candidates, the NC takes into account the existing Board composition, and the candidate's background, qualification, experience, time commitment and his/her ability to contribute to the Board's collective skills, knowledge and experience. Where a candidate is assessed to be suitable, the NC makes a recommendation for the Board to approve the formal appointment.

The NC makes annual recommendations to the Board on the re-election of existing Directors having regard to their competencies, commitment, contributions and performance on a qualitative basis. All Directors submit themselves for re-nomination and re-appointment at regular intervals and at least once every three years. Each year, one-third of the Board retires from office by rotation. New Directors submit themselves for re-election at the AGM immediately following their appointment by the Board.

In its review of the Directors' ability to commit sufficient time to attend to the Company's affairs, the NC has considered whether it is necessary to impose a limit on the number of boards of other listed companies that Directors can sit on. The NC decided that it was not necessary to prescribe such a limit. Although some Directors sit on multiple boards of listed companies and have other principal commitments, none of them has more than four listed company directorships and the NC is satisfied that each Director is able to and has devoted sufficient time and attention to the Company's affairs to adequately and competently carry out his duties as a Director of the Company. For a full list of each Director's directorships in listed companies and principal commitments, please refer to the "Board of Directors" section of this Annual Report.

Notes:

1 The term "Key Management Personnel" shall mean the Chief Executive Officer and other persons having authority and responsibility for planning, directing and controlling the activities of the Company.

Principle 5: Board Performance

The Board undertakes a formal annual assessment of its effectiveness as a whole, and that of each of its board committees and individual directors.

The NC recommends for the Board's approval the objective performance criteria and process for the evaluation of the effectiveness of each Board Committee and of the Board as a whole, as well as the contribution by the Chairman and each individual Director to the Board.

The process of assessing the Board, the Board Committees and each Director involves each Director completing board evaluation forms to provide his/her view on the composition, practices and conduct of the Board and the Board Committees, and how the Board and each Board Committee adds value to the Company. The responses to the board evaluation forms are compiled by the Company Secretary and thereafter presented to the NC. No external facilitator has been used.

For FY2024, the NC evaluated and assessed the effectiveness of the Board's performance as a whole, taking into consideration, amongst other matters, the Board's discharge of its principal responsibilities, and the earnings of the Group, return on equity and the share price performance of the Company over a five-year period. These performance criteria also include the performance of the Company as compared to industry peers and are linked to long term shareholder value. The NC is of the opinion that the Board as a whole has performed well during FY2024 and that the Chairman and each Director has contributed to the overall effectiveness of the Board.

For FY2024, the NC evaluated and reviewed the performance of the Board Committees (except the NC itself). It is satisfied with the matters dealt with by the Board and Board Committees and the depth and frequency of such deliberations. All Board members have access to the evaluation performed by the NC.

The Chairman of the Board and the Chairman of the NC evaluated the collective performance, commitment and contribution of all Directors based on each Director's attendance and contribution at Board meetings. They also reviewed the contribution of the Executive Director and are of the view that his performance has been satisfactory.

Access to Information

Management provides Directors with complete and adequate information on the Group's financials and operations in a timely manner, both on an on-going basis and prior to meetings. Comprehensive information including information on strategic, financial, key operational and compliance matters is provided to Directors on a monthly and quarterly basis to enable them to make informed decisions and discharge their duties and responsibilities. Matters requiring the Board's decision are generally sent to Directors at least five working days prior to Board meetings. The Company uses an electronic portal to which electronic board papers are uploaded for Board and Board Committee meetings. This has increased the Board's control over confidential and price sensitive information and has helped to create a secure environment, while contributing to the Company's sustainability efforts by reducing paper usage. The electronic portal also contains a library of resources, including constitutional documents, documents relating to past Board meetings and annual reports as well as communication tools which enable Directors to easily access relevant information and have it at their fingertips throughout the year.

Regular Board meetings are scheduled in November each year for the following year while urgent Board meetings, if needed, are normally scheduled at least five working days in advance. The Board is also provided with opportunities to meet with managers and heads of divisions on at least a half-yearly basis to understand the businesses of the Group. In the event a new business project or matter requires the Board's input, the relevant head of division and/or subject expert will be present in person at the relevant Board meeting to facilitate the Board's decision-making. Non-Executive Directors constructively challenge management's proposals on strategy and review the performance of management in meeting short and long-term business goals.

Directors have separate, independent and unrestricted access to management, the Company Secretary and external advisors (where necessary) at the Company's expense. The Company Secretary is required to attend and attends all Board meetings as well as the Audit and Risk Committee meetings. The CFO attends all Board and Board Committee meetings. They ensure that Board procedures are followed and the rules and regulations applicable to the Board are complied with. The Company Secretary and CFO are responsible for ensuring adequate information flows within the Board and Board Committees and between senior management and Non-Executive Directors, advising the Board on all governance matters, as well as facilitating orientation and assisting with professional development as required. Under the Constitution of the Company ("Constitution"), the decision to appoint or remove the Company Secretary rests with the Board as a whole. Directors may take independent professional advice, if necessary.

REMUNERATION MATTERS

Principle 6: Procedures for Developing Remuneration Policies

The Board has a formal and transparent procedure for developing policies on director and executive remuneration, and for fixing the remuneration packages of individual directors and KMPs. No director is involved in deciding his or her own remuneration.

Procedures for Developing Remuneration Policies

The Remuneration Committee ("RC") comprised three members, namely Mr Gn Hiang Meng, Mr Wee Ee Chao and Mr Chew Choon Soo during the period from 1 January 2024 to 23 April 2024, with Mr Gn appointed as Chairman of the RC. Mr Gn retired as a director of the Company on 23 April 2024 and consequently stepped down as Chairman and member of the RC. On 23 April 2024, Mr Chew Choon Soo was appointed Chairman of the RC and Mr Ong Sim Ho was appointed as a member of the RC. The RC currently comprises three members, namely Mr Chew Choon Soo, Mr Wee Ee Chao and Mr Ong Sim Ho.

Under the RC Charter, the majority of the RC, including the Chairman of the RC, shall be Independent Directors. All the members of the RC are Non-Executive Directors. The RC is supported by the Human Resource Director and/or external consultants if needed. No external consultants were engaged by the RC in FY2024.

The RC considers all aspects of remuneration, including termination terms, to ensure they are fair. The principal responsibilities of the RC include:

- in consultation with the Chairman of the Board, reviewing and recommending to the Board for its

endorsement, a framework of remuneration for the Board and the KMPs of the Company;

- reviewing and recommending to the Board for its endorsement the remuneration packages/fees of

each Director;

- reviewing the remuneration packages for KMPs; and

- administering the Company's long term incentive plan.

During FY2024, the RC reviewed the amount of Directors' fees payable to the Non-Executive Directors to be recommended for shareholders' approval. It also assessed the performance of and determined all aspects of remuneration of the Executive Director, and reviewed the remuneration packages for KMPs.

The RC has reviewed the Group's obligations arising in the event of termination of the service contracts of the Executive Director and KMPs, to ensure that such service contracts contain fair and reasonable termination clauses which are not overly generous. The RC considered whether contractual provisions are necessary to allow the Company to reclaim incentive components of remuneration from the Executive Director and KMPs. Based on the terms and conditions of the variable components of the remuneration of the Executive Director and KMPs, the RC is of the view that there is no need for express contractual provisions in the service contracts of the Executive Director and KMPs to allow the Company to reclaim incentive components of their remuneration paid in prior years in exceptional circumstances of misstatement of financial results, or of misconduct resulting in financial loss. In addition, the Executive Director owes a fiduciary duty to the Company, and the Company should be able to avail itself of appropriate remedies should there be any breach of fiduciary duties on the part of the Executive Director.

Principle 7: Level and Mix of Remuneration and Disclosure on Remuneration

The level and structure of remuneration for the Directors and KMPs are appropriate and proportionate to the sustained performance and value creation of the Company, taking into account the strategic objectives of the Company.

Principle 8: Disclosure of Remuneration

The Company is transparent on its remuneration policies, level and mix of remuneration, the procedure for setting remuneration and the relationship between remuneration, performance and value creation.

The RC takes into consideration current industry norms on compensation and adopts a remuneration policy in line with industry practices.

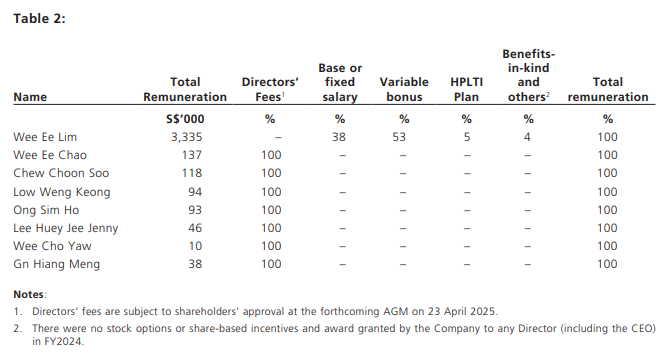

None of the Non-Executive Directors has any service contract or consultancy agreement with the Company. Non-Executive Directors, including the Chairman of the Board, are paid Directors' fees which comprise a basic fee and additional fees for serving on Board Committees. None of the Board members or RC members is involved in deliberations relating to any remuneration, fees, options and/or benefits to be granted to him individually. The RC recommends Directors' fees to the Board for endorsement prior to submission to shareholders for approval at each AGM. In the process, the RC takes into consideration the complexity of the Group, the workload of each Board Committee member, the effort, time spent and responsibilities of each Non-Executive Director, as well as market trends before recommending the fee structure to the Board, so as to ensure that the remuneration of Non-Executive Directors is appropriate to the level of contribution.

The Directors' fee structure(1) for Non-Executive Directors for FY2024 is as follows:

| Board | S$ |

| - Chairman - Deputy Chairman - Member Audit and Risk Committee - Chairman - Member Nominating and Remuneration Committees - Chairman - Member |

110,000 71,500 55,000 38,500 22,000 22,000 16,500 |

Notes:

(1) The fee structure of the Non-Executive Directors is based solely on a retainer fee basis, with additional fees for membership of

Board Committees which are commensurate with the effort and time required for the performance of their additional duties.

The Group generally remunerates its employees at market competitive levels, commensurate with their performance and contribution to the long-term interests and success of the Group. The Group's remuneration policies take into account the risk policies of the Group, including risk outcomes and the time horizon of risks. The remuneration package normally comprises fixed and variable components. The fixed component comprises basic salary, allowances and central provident fund contributions. The variable component comprises a variable bonus based on the Group's and each individual's performance and grants under the Haw Par Long Term Cash Award Plan ("HPLTI Plan"). A variable bonus scheme is in place for each business unit. This economic value-added based bonus scheme takes into consideration working capital efficiency, productivity and current year earnings in order to derive a pool for distribution in accordance with the individual's performance and his/her contributions towards meeting the respective work plans for the year. In determining the pool, investment income which comprises dividend income from the Group's strategic investments and interest income/expense from the Group's central treasury function are excluded. Eligible employees are also entitled to receive grants under the HPLTI Plan, which places emphasis on rewarding individual employees based on their performance (as explained in greater detail below).

In the annual review of the remuneration of the CEO and KMPs (who are not Directors or the CEO), the RC takes into consideration the performance of the individual as an important factor in its review and the comparative remuneration of similarly placed persons in the market. The performance criteria for the CEO includes achievement of financial objectives using financial indicators such as overall profitability and return on assets over a period of time, which criteria were chosen in order to incentivise the CEO and align his interests with that of the Group. These criteria were satisfactorily met during FY2024. The remuneration of the CEO and KMPs (who are not Directors or the CEO) is reviewed annually by the RC and includes a variable bonus component which is performance-based as described above. The level and structure of remuneration for the CEO is aligned with the long term interests of the Group.

The HPLTI Plan was put in place and was approved by the Board in FY2017 to take effect from 1 January 2018. The objective of the HPLTI Plan is to incentivise KMPs to drive long term business priorities and shareholder value creation. Under the HPLTI Plan, targets are set in advance over a two-year performance period. Participants will receive cash awards based on the level of achievement of the targets at the end of the performance period and with the RC's approval. Appropriate weightage is given to revenue and operating profit growth, and total shareholder returns, with defined superior, target and threshold performance metrics based on two-year rolling budgets approved by the Board. The RC reviews the definition of superior, target and threshold performance metrics before annual grants are awarded and will continue to review annually the relevance of the above key performance metrics.

As a whole, a significant and appropriate portion of the CEO's and KMPs' (who are not Directors or the CEO) remuneration is structured so as to link rewards to corporate and individual performance. Performance-related remuneration is aligned with the interests of shareholders and other stakeholders and promotes the long-term success of the Company. Further, remuneration is appropriate to attract, retain and motivate the Director(s) to provide effective stewardship of the Company, the CEO and KMPs (who are not Directors or the CEO) to successfully manage the Company for the long term.

The details of the remuneration of each Director for FY2024 are as follows:

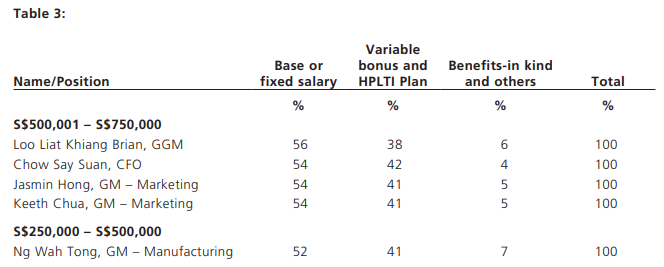

The remuneration of, each of, the top five KMPs (who are not Directors or the CEO) for FY2024, in no order of quantum sum, is as follows:

The total remuneration paid/accrued to the top five KMPs (who are not Directors or CEO) is S$2,729,122.

The aggregate amount of termination, retirement and post-employment benefits that may be granted to the CEO, and the KMPs (who are not Directors or the CEO) is about S$670,000.

Save as disclosed below, there is no employee (other than the CEO) who is a substantial shareholder of the Company, or an immediate family member of a Director, the CEO or a substantial shareholder and whose remuneration exceeds S$100,000 in FY2024. A relative of the CEO, Mr Kelvin Whang, who is the General Manager of Underwater World Pattaya, received annual remuneration (including benefits-in-kind) of between S$200,000 and S$300,000. As at 7 March 2025, there is one employee who is a substantial shareholder of the Company, namely the CEO and Executive Director, Mr Wee Ee Lim.

ACCOUNTABILITY AND AUDIT

The Board provides shareholders with a balanced and clear assessment of the Group's performance, position and prospects through announcements of its periodic and full-year results as well as timely announcements of any price-sensitive information through disclosure via SGXNET and various other forms of media, including press releases posted on the Company's website. Internal guidelines are in place to comply with legislative and regulatory requirements. Management provides the Board with management reports of the Group on a monthly basis and additional details as the Board may require from time to time. The management reports, containing sufficient details and comparisons to planned budgets, provide the Directors with a means to monitor and make balanced and informed assessment of the Group's performance, position and prospects.

Audit and Risk Committee ("ARC")

Principle 10: Audit Committee

The Board has an Audit Committee ("AC") which discharges its duties objectively.

The ARC comprised three members, namely, Mr Low Weng Keong, Mr Gn Hiang Meng and Mr Chew Choon Soo during the period from 1 January 2024 to 23 April 2024. Mr Gn Hiang Meng retired as a director of the Company on 23 April 2024 and consequently stepped down as a member of the ARC. On 23 April 2024, Mr Ong Sim Ho was appointed as a member of the ARC. The ARC currently comprises three members, namely Mr Low Weng Keong, Mr Chew Choon Soo and Mr Ong Sim Ho. Throughout FY2024, the ARC comprised at least three Directors, all of whom are Non-Executive Independent Directors. The Chairman of the ARC, Mr Low Weng Keong, was formerly the country managing partner of a Big Four accounting firm in Singapore, and a past global chairman and president of CPA Australia. Mr Chew Choon Soo has more than 23 years of senior executive search and assessment experience and served in various regional and global management and committee roles. Mr Ong Sim Ho is the Managing Director and Head of Corporate and Finance department of Drew & Napier LLC and he is dual-qualified as a lawyer and Chartered Accountant.

The charter of the ARC provides that the ARC shall comprise not less than three members, all non-executive, and the majority of whom shall be independent. At least two members of the ARC, including the Chairman, shall have recent and relevant accounting or financial management expertise or experience. None of the current and former ARC members were partners or directors of the Company's existing auditors in the last 24 months, or had or has had any financial interest in the Company's existing auditors, PricewaterhouseCoopers LLP.

The principal responsibilities of the ARC include:

- reviewing the audit plans with the internal and external auditors;

- reviewing the audit report of the external auditors and the results of the internal audit procedures;

- making recommendations to the Board on the proposals to the shareholders on the appointment, reappointment and removal of external auditors, and the compensation and terms of engagement of the external auditors;

- reviewing annually the adequacy, effectiveness, independence, scope, results and objectivity of the external auditors, the cost effectiveness of the audit, and the nature and extent of non-audit services;

- approving the hiring, removal and compensation of the Group Internal Audit Manager and evaluating the performance of the Group Internal Audit Manager;

- ensuring that the internal audit function is adequately resourced and has appropriate standing within the Group;

- reviewing the adequacy, effectiveness, independence, scope and results of the internal audit function annually;

- reviewing the Group's periodic and full year results and annual financial statements prior to approval by the Board, and the appropriateness and consistency of accounting principles and policies adopted across the Group, including significant financial reporting issues and judgements;

- reviewing any announcements relating to the Company's performance;

- reviewing annually the adequacy and effectiveness of the Company's system of internal controls, including accounting controls, and addressing financial, operational, compliance and information technology ("IT") risks and risk management processes;

- reviewing the assurance from the CEO and the CFO as to the proper maintenance of financial records and that the financial statements give a true and fair view of the Group's operations;

- reviewing IPTs and related party transactions;

- oversight and reviewing whistle-blowing reports; and

- reviewing the policy and arrangements for concerns about possible improprieties in financial reporting or other matters to be safely raised, independently investigated and appropriately followed up on.

The ARC has full authority to investigate any matter, including, but not restricted to, issues of internal controls, suspected fraud or irregularity. It has access to and full co-operation of the management and may invite any Director or executive officer to attend its meetings.

During FY2024, the ARC held four meetings during which it performed its responsibilities as set out above. The Group's internal and external auditors were also present at the regular quarterly meetings. The ARC met the external and internal auditors separately without the presence of management to discuss the competency and adequacy of the Company's finance function and the level of co-operation provided by management and inquired into material weaknesses or control deficiencies noted during the course of their work. There was no adverse feedback from these meetings.

In its review of the financial statements, the ARC discussed with management the key accounting policies applied and areas where judgement and critical estimates were involved. After extensive discussions, the ARC was satisfied with the measurement and disclosure of the related financial instruments in the Group's financial statements in all material aspects. The ARC also discussed with the external auditors all significant matters noted during their audit which were contained in their report to the ARC. The valuation of financial assets was a key audit matter highlighted by the auditors in their audit report and the ARC was satisfied with the extent of work performed by the auditors. Following the review and discussions, the ARC recommended to the Board to approve the full year financial statements.

In reviewing non-audit services, the ARC was satisfied that the amount of non-audit services provided by the external auditors was not material and would not impair the independence of the external auditors. The ARC has confirmed that the Company has complied with Rule 712 and Rule 715/716 of the Listing Manual of SGX-ST which set out the requirements on the appointment of the auditors. The ARC has recommended to the Board the re-appointment of PricewaterhouseCoopers LLP as the Group's auditors for the ensuing year. The aggregate amount of fees paid/payable to PricewaterhouseCoopers LLP for FY2024 is approximately S$347,000. The breakdown of fees paid/payable for audit and non-audit services is approximately S$343,000 and S$4,000 respectively. The ARC has reviewed and is satisfied with the independence and objectivity of the external auditors.

The ARC and the Board has reviewed the suitability of the external auditors, PricewaterhouseCoopers LLP for their role by assessing a wide range of factors including the quality of their work, their expertise and resources for a job involving the size and complexity of the Company's operations, and whether their own quality control procedures are dedicated to upholding the Code. The ARC has reviewed and is satisfied with the independence and objectivity of the external auditors.

The ARC members are regularly updated by management and the auditors (both internal and external) on changes to accounting standards and issues which have a direct impact on financial statements, compliance with legislation and accounting-related matters.

Principle 9: Risk Management and Internal Controls

The Board is responsible for the governance of risk and ensures that Management maintains a sound system of risk management and internal controls, to safeguard the interests of the Company and its shareholders.

The Group has established a formal risk management framework across the entire organisation to provide a structured approach for managing risks. The framework enables management to have a formal structure for risk management and assessment. The framework is designed to ensure that risks are identified, assessed, monitored and effectively managed. It is in line with the best practices as contained in the Risk Governance Guidance for Listed Boards, issued by the Corporate Governance Council in May 2012.

The Board has overall responsibility for the governance of risk and determination of risk policies. The Board, assisted by the ARC, is responsible for determining the Company's level of risk tolerance (including the nature and extent of significant risks which the Company is willing to take in achieving its strategic objectives and value creation) and oversees the management in implementing the risk management and internal controls system.

The Risk Management Committee is chaired by the CEO and comprises the CEO, the CFO and the GGM. The Group Internal Audit Manager is also in attendance at the Risk Management Committee meetings.

It performs the following roles:

- oversees the development of risk management policies;

- provides overall leadership, vision, framework and direction for risk management;

- promotes a risk management culture through human resources, use of technology and organisation structure;

- monitors the effectiveness of risk management and makes refinements as and when necessary;

- ensures that risks are properly addressed; and

- reports to the ARC and the Board twice a year on risk management activities and attestation undertaken.

Risks are analysed and assessed in terms of risk impact and risk likelihood. Risk impact includes financial, operational (business interruption), regulatory/legal and reputational impact. Risk likelihood includes both quantitative and qualitative appraisals and classified as 'Low', 'Moderate', 'High' and 'Critical'. Management evaluates the options and controls needed to deal with identified risks, depending on the risk impact, likelihood and related costs and benefits. These risks are reviewed both against the entity level parameters and from the Group's perspective. The ARC monitors the Risk Management Committee's activities on behalf of the Board to ensure that identified risks are effectively managed.

Risks are broadly categorised as follows:

Strategic risks

These include most of the inherent risks of each operating unit and the relevant macro-environment such as brand protection, competition and epidemic outbreak risks. All such risks are reported to the ARC and the Board. Measures taken to manage risks include diversifying either geographically or in product offerings, putting in place business continuity plans and ensuring sufficient insurance coverage for various types of risks.

Operational risks

These relate to day-to-day operations and include security threats, product quality, employee attrition, capacity management, and supply disruption and concentration risk of key suppliers. The general manager of each operating unit implements policies and procedures to monitor such risks.

Compliance risks

Each operating unit is subject to various degrees of regulatory controls, particularly the Healthcare division. Compliance with local laws and regulations in various geographical locations is monitored by the operating unit and the functional departments in Singapore.

Financial risks

Financial risks are mitigated by using appropriate hedging instruments when necessary and actively managing foreign exchange and credit exposures. Financial risks are monitored by the Investment Management Committee. Generally, the Group is conservative in its financial dealings and does not engage in speculative instruments that would expose the Group to unnecessary financial risks.

Information Technology risks

In pursuit of an IT environment that is robust, resilient and secure, improving the Group's IT infrastructure continues to be the focus of IT operations. Adequate measures including proper authorisation access, back-up systems and equipment are in place to safeguard against prolonged disruptions to businesses due to IT failures and loss of confidential data. The Group, in consultation with cyber security vendors, progressively enhances its IT infrastructure to deal with the evolving cyber risks that are presenting themselves in various forms to enhance the Group's cyber resilience. While management is cognisant of these risks, the way forward is to deal with these risks while harnessing the benefits of IT.

Emerging risk trends

While the Group's current risk management process already takes into account overall business risks, the Risk Management Committee also keeps abreast of specific emerging risk trends such as climate-related risks. The Climate Change Sub-Committee monitors market and regulatory related developments on climate reporting requirements that are consistent with the recommendations of the TCFD. The Risk Management Committee continues to assess the materiality of ESG and related risks to the Group as the ESG landscape continues to evolve.

The Board (assisted by the ARC) reviews the adequacy and effectiveness of the Group's risk management and internal control systems, including financial, operational, compliance and IT controls twice a year.

For FY2024, the Board has received assurances from:

- the CEO and the CFO that the financial records have been properly maintained and the financial

statements give a true and fair view of the Group's operations and finances; and

- the CEO and the Risk Management Committee that the Group's risk management and internal control systems are adequate and effective in all material respects as at 31 December 2024.

Based on work performed by the internal and external auditors and reviews undertaken by the Risk Management Committee and the ARC, the Board, with the concurrence of the ARC, is of the opinion that the internal controls addressing financial, operational, compliance and IT risks and risk management systems and processes were adequate and effective for the Group as at 31 December 2024.

The Group's internal controls and risk management systems are designed to manage rather than eliminate the risk of failure to achieve business objectives, and can only provide reasonable, but not absolute, assurance that the Group will not be adversely affected by any reasonably foreseeable event. The Board recognises that no system of internal controls and risk management can provide absolute assurance.

Code of Business Conduct and Whistle Blowing Policy

The Group has in place a Code of Business Conduct that sets out the business practices, procedures and ethical conduct expected of all employees in their course of employment and in dealings with customers, suppliers and consultants. The Code of Business Conduct is sent to all employees and a separate briefing is conducted for newly hired employees.

In line with the Code of Business Conduct, the Group has in place a Whistle Blowing Policy and process under which employees and external parties may report to the ARC any improprieties or suspected wrong-doing by management or other staff without fear of reprisal. The ARC is responsible for oversight and monitoring of whistleblowing. Whistleblowing reports marked "Private and Confidential" may be sent to the Group Internal Audit Manager at Haw Par Corporation Limited, 401 Commonwealth Drive, #03-03 Haw Par Technocentre, Singapore 149598, or by email to whistleblowing@hawpar.com. The Group is committed to ensure protection of whistleblowers who have acted in good faith against detrimental or unfair treatment. All reports received are accorded confidentiality and independently investigated by the whistleblowing unit, comprising the Human Resource Director and Group Internal Audit Manager. Details of the Whistle Blowing Policy are posted on the Company's intranet. New employees are briefed on the policy during their orientation. Existing employees are reminded of the policy from time to time in order to raise awareness of the availability of the channel of reporting. The Code of Business Conduct is effectively communicated and integrated into the Company's strategy and operations, including risk management systems and remuneration structures.

Internal Audit

The Company has an internal audit ("IA") department, which is staffed with professionally qualified personnel. The Group Internal Audit Manager reports directly to the Chairman of the ARC. The majority of the staff in the IA department are members of the Institute of Internal Auditors. The appointment, removal, evaluation of performance and compensation of the Group Internal Audit Manager rests with the ARC.

The IA function follows the Standards for the Professional Practice of Internal Auditing set by the Institute of Internal Auditors. The IA function adopts an Internal Audit Charter that is reviewed annually and has strict procedures in reporting its audit findings to the management and the ARC.

The role of the IA function is to render support to the ARC in ensuring that the Group maintains a sound system of internal controls by performing regular monitoring and testing of key controls and procedures, reviewing operational and financial activities and undertaking investigations as requested by the ARC.

The IA department submits its internal audit plan to the ARC for approval at the beginning of each year. Audit reviews are carried out on all significant business units in the Group and a summary of findings and recommendations is discussed during each ARC meeting. The IA function has unfettered access to the ARC and to all documents, records, properties and personnel for the purposes of its audit. The ARC is of the view that the IA function is adequately resourced, independent, effective and staffed with persons with the relevant qualifications and experience and has appropriate standing within the Group.

Shareholders' Rights and Engagement with Shareholders

Principle 11: Shareholder Rights and Conduct of General Meetings

The Company treats all shareholders fairly and equitably in order to enable them to exercise shareholders' rights and have the opportunity to communicate their views on matters affecting the Company. The Company gives shareholders a balanced and understandable assessment of its performance, position and prospects.

Principle 12: Engagement with Shareholders

The Company communicates regularly with its shareholders and facilitates the participation of shareholders during general meetings and other dialogues to allow shareholders to communicate their views on various matters affecting the Company.

The Group is guided by an investor relations policy which allows for an ongoing exchange of views and that aims to promote regular, effective and fair communication with shareholders. Communication of relevant announcements of the Group is generally made through annual reports, SGXNET announcements, press releases and the Group's corporate website at www.hawpar.com. In line with its sustainability efforts, the Company's Annual Report and the Notice of AGM are available through the Group's website and SGXNET and may be accessed by entering the URL set out in the Company's letter to shareholders. The URL at which the Annual Report may be accessed is also set out in the Notice of AGM. By filling in a copy of the Request Form, shareholders may request for a physical copy of the Annual Report. Physical copies of the Company's letter to shareholders, containing information on how shareholders may access electronic copies of the Annual Report, the Request Form and the Notice of AGM are circulated to all shareholders.

To allow the Company's shareholders to communicate their views on various matters affecting the Company and contact the Company with questions, and in order to solicit and understand the views of shareholders, the Company has a dedicated communications channel with the Investor Relations Department which is available to shareholders and can be reached via email at investorrelations@hawpar.com. The Investor Relations Department is required to respond to shareholders' queries in a timely and effective manner. When matters requiring shareholders' meetings are to be held, notices and reports/circulars are communicated in a timely manner to all shareholders. Shareholders are informed of the rules, including voting procedures, which govern the shareholders' meetings. The Constitution does not allow for absentia voting at general meetings, except through the appointment of a proxy or in the case of a corporation, a corporate representative, to cast the registered shareholder's vote in their stead. The results of the votes for all resolutions tabled at AGMs and other general meetings of shareholders are validated by independent scrutineers and are broadcast at the said meetings. The results are also announced on SGXNET after the meetings. The minutes of general meetings of shareholders are published on the Company's website and on SGXNET as soon as practicable after such meetings. The minutes record, among others, substantial and relevant comments or queries from shareholders relating to the agenda of the general meeting, and responses from the Board and Management.

The Company's dividend policy seeks to provide shareholders with a stable and efficient form of capital distribution relative to earnings. For more than 30 years, the Company has maintained sustainable dividend payments.

The Company holds regular meetings (outside of black-out periods) with research analysts, fund managers and institutional investors to understand the views of shareholders, review the Company's performance and provide investors with a better understanding of the Group's businesses, as needed.

Conduct of Shareholder Meetings

The Company gives shareholders the opportunity to participate effectively in and vote at general meetings and encourages the attendance of shareholders at general meetings. The notices of general meetings setting out the agenda, and if necessary, letters to shareholders on the items of special business, are communicated to shareholders at least 14 clear days before general meetings called to pass ordinary resolutions or 21 clear days before general meetings called to pass special resolutions. Each item of special business included in the notice of the meeting will be accompanied by a full explanation regarding the effect of the proposed resolution in respect of such business. Separate resolutions are proposed for each substantially separate issue unless the issues are interdependent and linked so as to form one significant proposal. Absent extenuating circumstances, all Directors (in particular, the chairmen of the ARC, NC and RC) as well as the external auditors and KMPs are present at general meetings, at which matters affecting the Group, the conduct of external audit and the preparation and content of the auditors' report, are addressed. The Company Secretary ensures that the applicable procedures such as those under the Constitution and the Listing Manual of the SGX-ST are followed.

A registered shareholder who is unable to attend a general meeting can appoint up to two proxies to attend, participate and vote at the general meeting on his/her behalf. In addition, a member which is a relevant intermediary, which generally includes Singapore banks and nominee or custodial service providers, as well as the Central Provident Fund Board, may appoint more than two proxies so that shareholders who hold shares through such members can attend, participate and vote at general meetings as proxies, in accordance with the provisions of the Constitution. Investors whose shares are held through relevant intermediaries can submit their requests to attend, participate and vote at each general meeting within the stipulated time period as required by such relevant intermediaries, who will then communicate such requests to the Company not less than 72 hours before the general meeting is held.

Forthcoming 2025 AGM to be convened and held by physical means

The forthcoming 2025 AGM will be held in a wholly physical format and there will be no option for shareholders to participate virtually. Arrangements relating to attendance at the 2025 AGM are set out in the notes to the Notice of AGM.

Engagement with Stakeholders

Principle 13: Managing Stakeholders Relationships

The Board adopts an inclusive approach by considering and balancing the needs and interests of material stakeholders, as part of its overall responsibility to ensure that the best interests of the Company are served.

Haw Par's management approach hinges on the commitments to our key stakeholders who are identified based on the significance of their respective impacts on the Company. We believe communication with relevant stakeholders is vital to the long term success of our businesses.

The basis for determining who is considered a key stakeholder begins with understanding our value chain and thereafter determining which stakeholders Haw Par has an impact on, and conversely which stakeholders have an impact on our businesses.

For more information on our approach, please refer to our sustainability website at: https://www.hawpar.com/sustainability/our-approach

The sustainability report of the Company can be found on the Company's website at https://www.hawpar.com/sustainability/sr

We welcome feedback from our stakeholders on our sustainability reports at sustainability@hawpar.com.

OTHER GOVERNANCE PRACTICES

Interested Person Transactions

The Group does not have any general mandate from shareholders pursuant to Rule 920 of the Listing Manual of the SGX-ST with regard to IPTs. There were no IPTs entered into by the Group and any interested persons that require disclosure under the SGX-ST Listing Rules in FY2024.

Material Contracts

Except as disclosed in the financial statements, there were no other material contracts entered into by the Company or its subsidiaries involving the interests of the CEO, any Director or controlling shareholder of the Company.

Dealings in Securities

The Group adopts best practices with respect to dealings in securities set out in Rule 1207(19) of the Listing Manual of the SGX-ST. It has a policy which prohibits its officers from dealing in the securities of the Company during the period commencing one month before the announcement of the half-year and full year results. The Company Secretary issues guidelines periodically to Directors and employees to remind them of the prohibitions in dealing with the Company's securities on short-term considerations or while in possession of material unpublished price-sensitive information, and to comply with insider trading laws at all times. There are also internal policies and guidelines on confidentiality and safeguards for the handling of confidential information.