For the financial year ended 31 December 2015

75

ANNUAL REPORT 2015

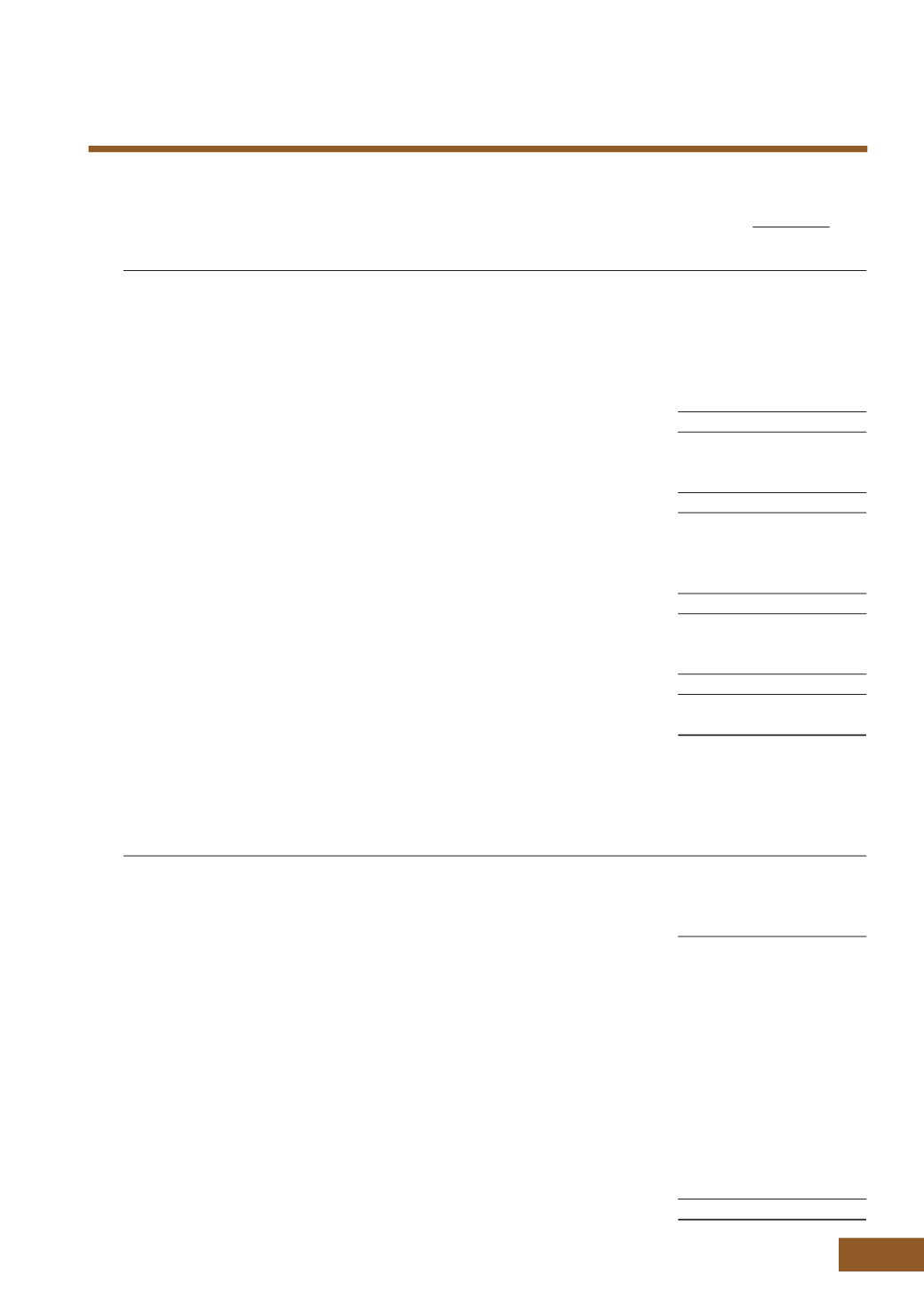

7. TAXATION

The Group

2015

2014

$’000

$’000

Tax expense attributable to profit is made up of:

Current taxation

Current year:

- Singapore

8,116

6,412

- Overseas

3,537

2,347

11,653

8,759

Over provision in respect of previous years:

- Singapore

(26)

(638)

- Overseas

(70)

(71)

(96)

(709)

Deferred taxation

Origination and reversal of temporary differences:

- Singapore

(623)

(147)

- Overseas

(1,029)

177

(1,652)

30

Under provision in respect of previous years:

- Singapore

–

9

- Overseas

484

54

484

63

10,389

8,143

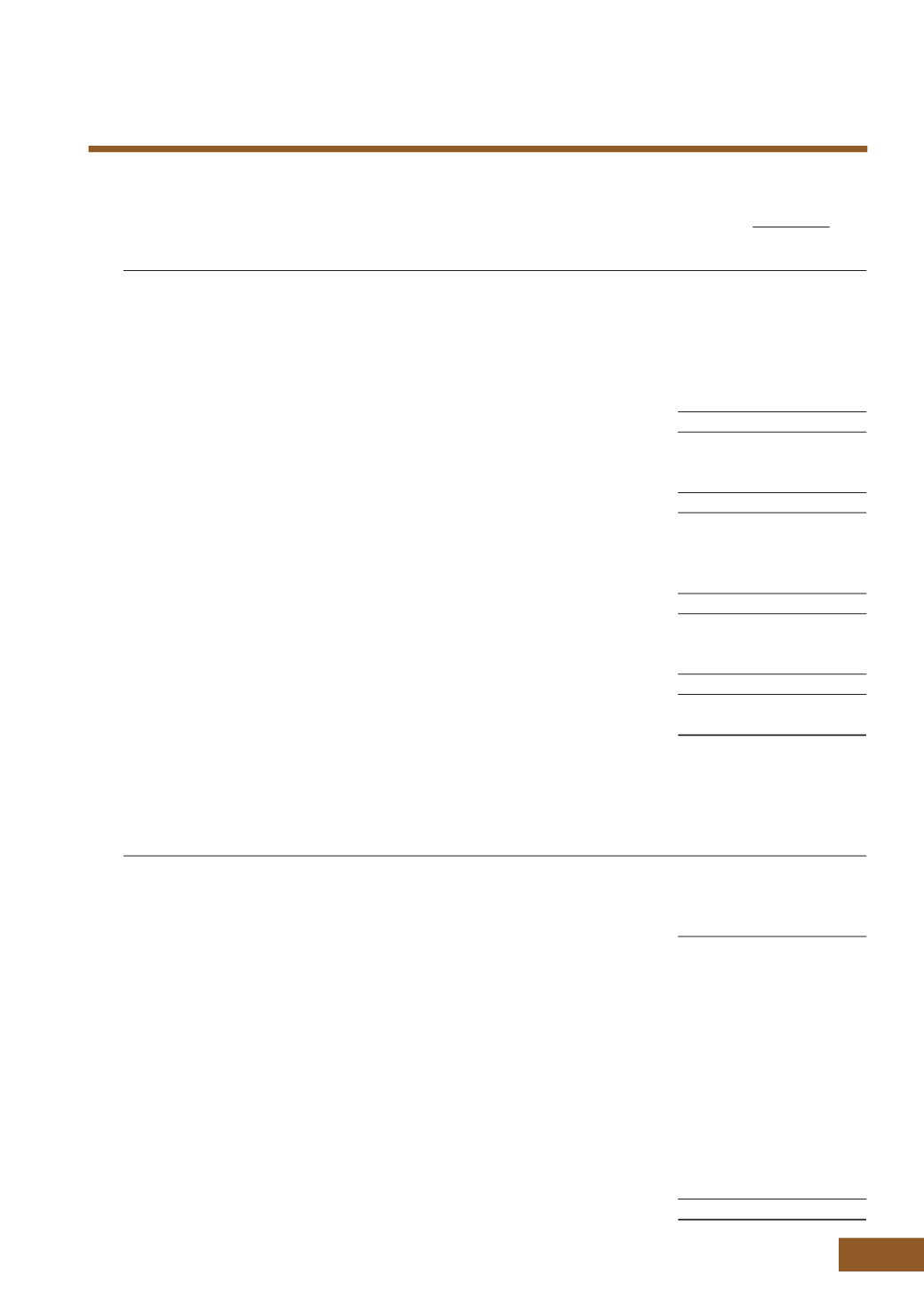

The tax expense on accounting profit differs from the amount that would arise using the Singapore standard rate of

income tax due to the following:

2015

2014

$’000

$’000

Profit before taxation

193,665

126,968

Share of results of associated companies and gain on

dilution/disposal of investment in associated company (net)

(56,376)

(11,917)

Profit before taxation and share of results of associated companies

and gain on dilution/ disposal of associated company (net)

137,289

115,051

Taxation at applicable Singapore tax rate of 17% (2014: 17%)

23,339

19,559

Adjustments:

- Tax rate difference in foreign subsidiaries

400

324

- Withholding taxes

1,006

1,081

- Tax effect of expenses not deductible for tax purposes

2,056

938

- Tax effect of income not subject to tax

(15,942)

(11,884)

- Tax rebates and exemptions

(759)

(752)

- Utilisation of previously unrecognised deferred taxes

(103)

(508)

- Deferred income tax asset not recognised

4

31

- Under/(over) provision in respect of previous years

388

(646)

Taxation expense

10,389

8,143

NOT E S TO T H E F I NAN C I A L S TAT EME N T S

(CONTINUED)