For the financial year ended 31 December 2015

80

HAW PAR CORPORATION LIMITED

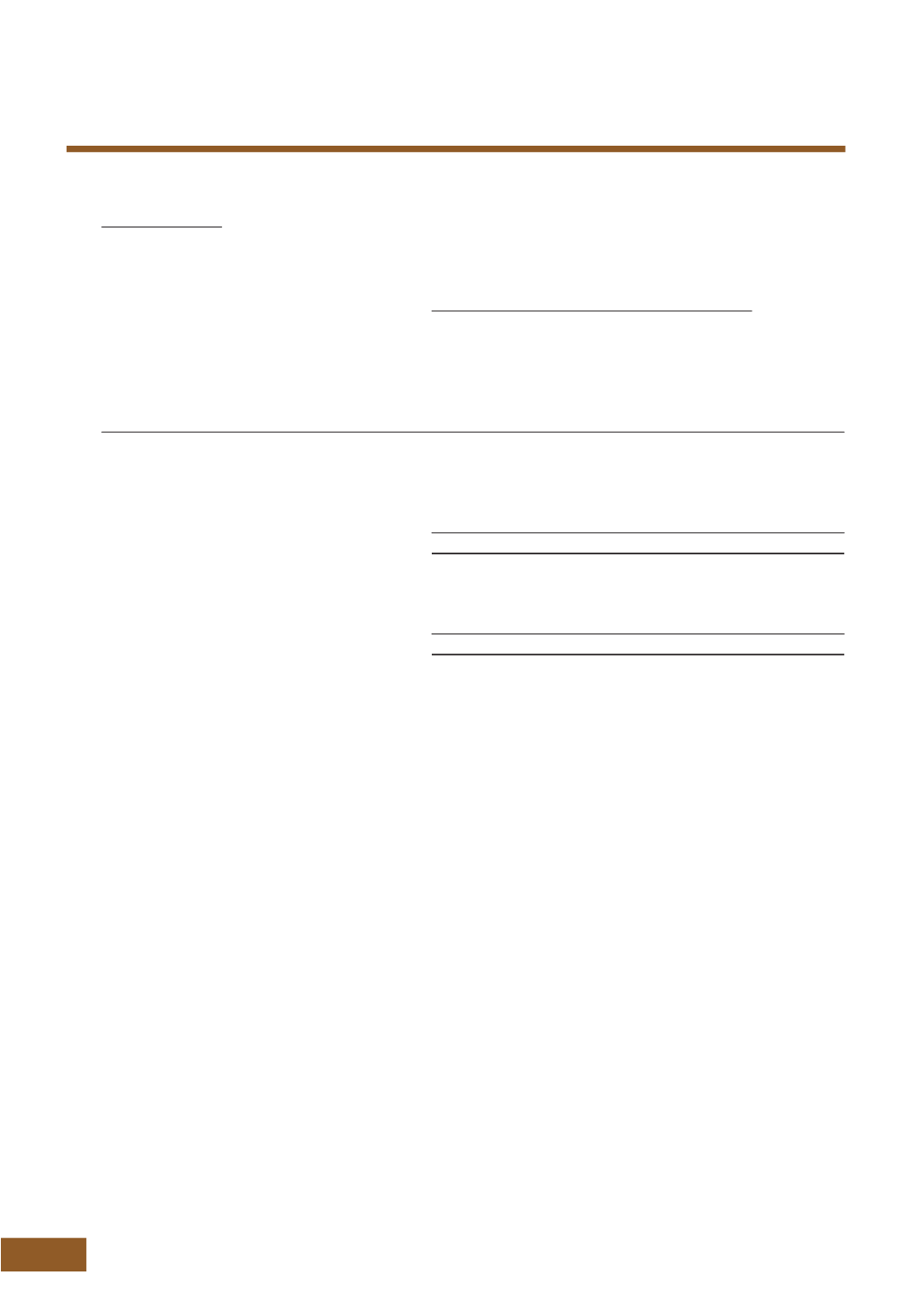

11. INVESTMENT PROPERTIES

(CONTINUED)

Fair value hierarchy

The following table illustrates the fair value measurement hierarchy of the Group’s investment properties:

Fair value measurements using

Quoted

prices in

Significant

Significant

active

observable unobservable

markets

inputs

inputs

Description

(Level 1)

(Level 2)

(Level 3)

Total

$’000

$’000

$’000

$’000

Recurring fair value measurement for:

31 December 2015

Commercial properties

–

–

144,023

144,023

Industrial properties

–

–

66,800

66,800

Total

–

–

210,823

210,823

31 December 2014

Commercial properties

–

–

148,435

148,435

Industrial properties

–

9,514

67,300

76,814

Total

–

9,514

215,735

225,249

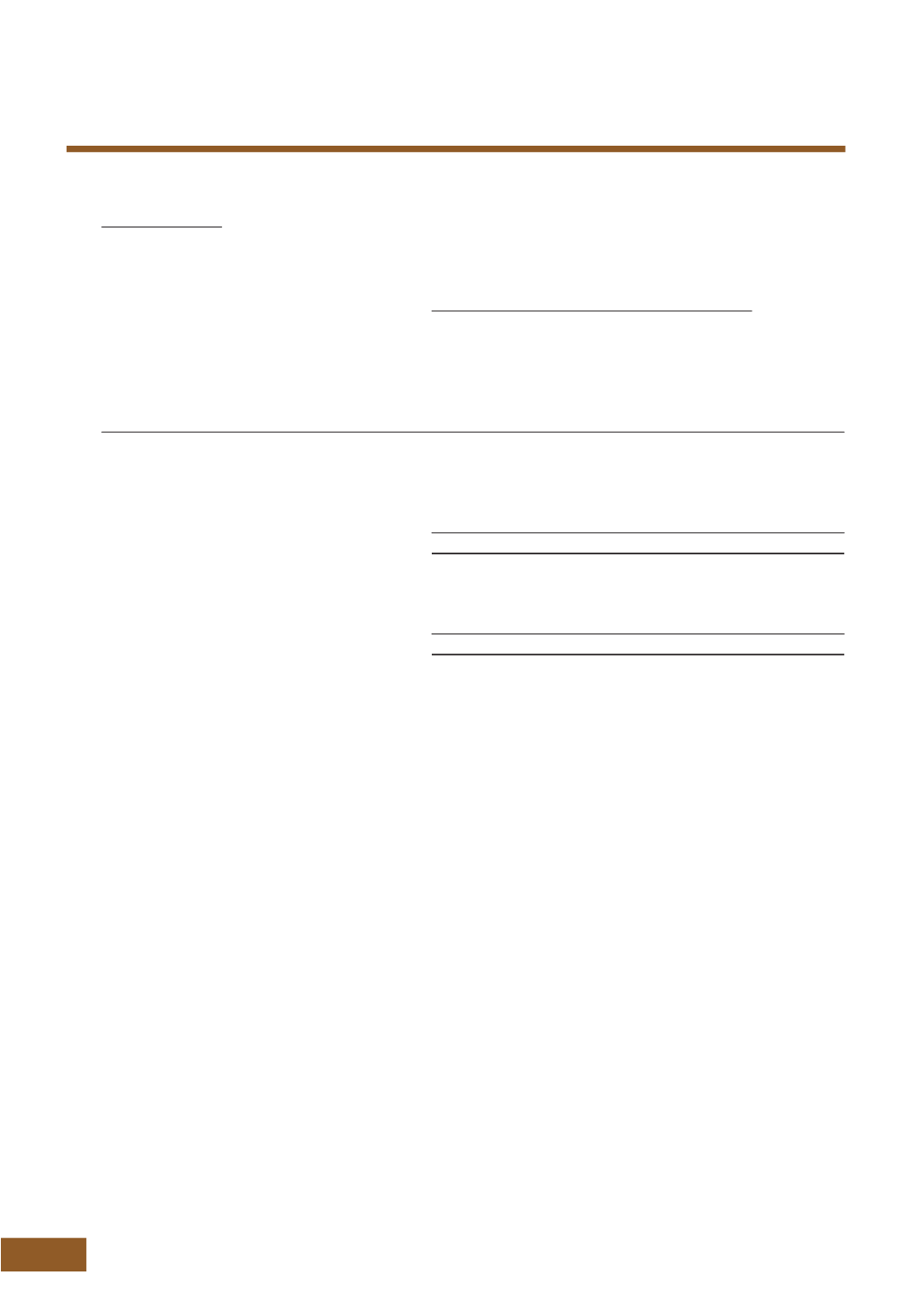

Level 2 fair values of the Group’s properties have been generally derived using the investment method cross referenced

with the direct sales comparison approach, where there have been recent transactions of similar properties in similar

locations in an active market. The cross reference revealed no significant variation in valuation. The most significant

input into the direct sales comparison approach is selling price per square metre.

Level 3 fair values of the Group’s properties have been derived using the income capitalisation approach which the

valuers have also cross referenced with that obtained under the sales comparison approach. Sales prices of comparable

properties in close proximity are adjusted for differences in key attributes such as property size, age, tenure, condition of

buildings, availability of car parking facilities, dates of transaction and prevailing market conditions. The most significant

input into the income capitalisation valuation approach is capitalisation rate.

Under Level 3 fair value measurement, the fair value of the investment properties was calculated using a capitalisation

rate ranging from 5.25% to 7% (2014: 5.25% to 7%) for commercial properties and 7% (2014: 7%) for industrial

properties. An increase in capitalisation rate will result in a decrease to the fair value of an investment property.

NOT E S TO T H E F I NAN C I A L S TAT EME N T S

(CONTINUED)