For the financial year ended 31 December 2015

81

ANNUAL REPORT 2015

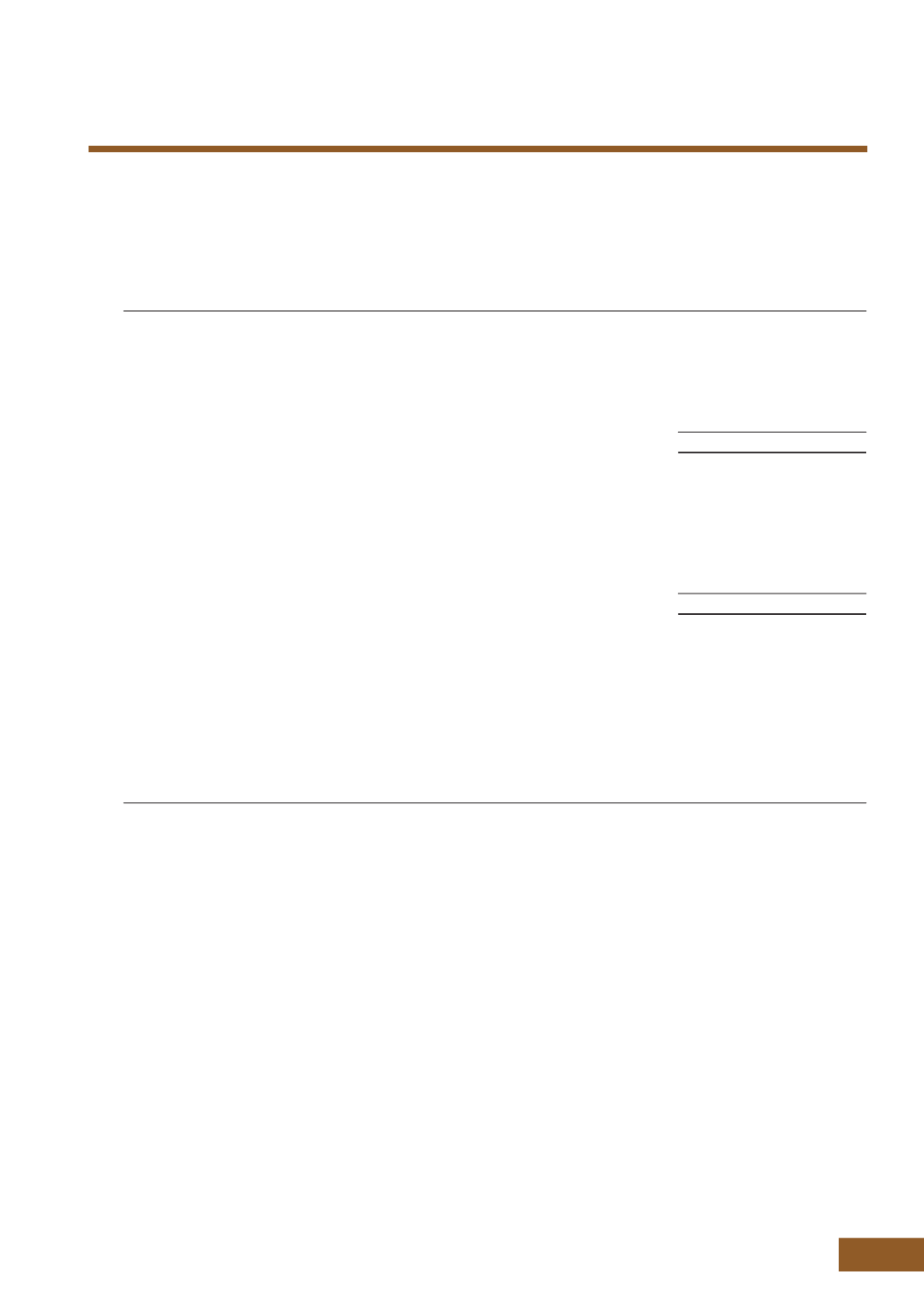

11. INVESTMENT PROPERTIES

(CONTINUED)

Reconciliation of fair value measurements categorised within Level 3:

Commercial

Industrial

properties properties

$’000

$’000

2015

Beginning of financial year

148,435

67,300

Improvements

2,282

–

Fair value changes recognised in profit or loss

(1,467)

(500)

Currency translation

(5,227)

–

End of financial year

144,023

66,800

2014

Beginning of financial year

107,800

67,300

Transfer to Level 3

37,635

–

Improvements

28

85

Fair value changes recognised in profit or loss

2,972

(85)

End of financial year

148,435

67,300

There were no changes in valuation techniques during the year.

The Group’s policy is to recognise transfers into and out of fair value hierarchy levels as of the date of the event or

change in circumstances that caused the transfer.

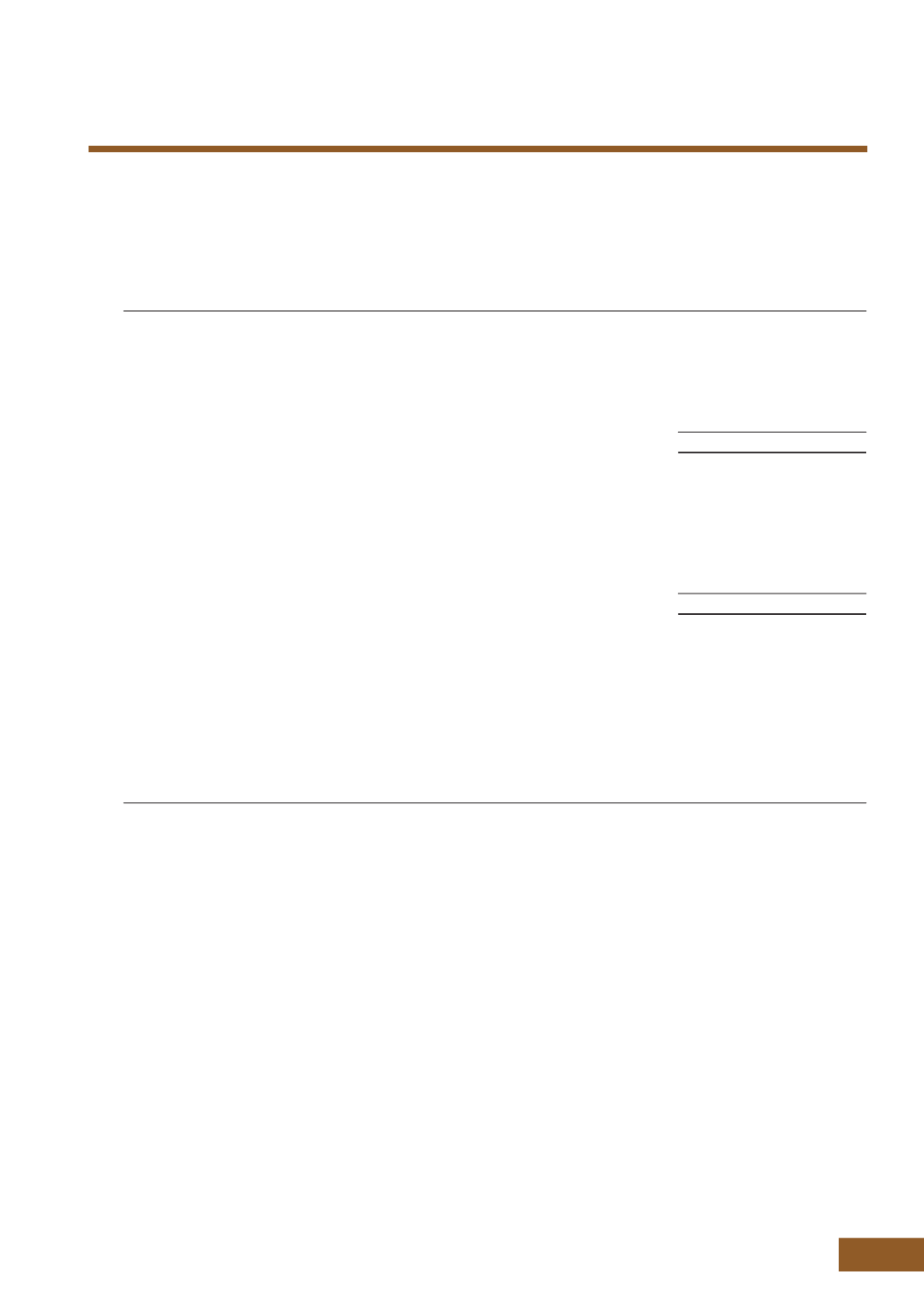

The details of the Group’s investment properties as at 31 December 2015 are as follows:

Investment properties Description

Tenure of land Independent valuer

Haw Par Glass Tower

178 Clemenceau Avenue

Singapore 239926

9-storey office building on a land

area of 899 square metres. The

lettable area is 3,316 square metres.

99-year lease from

2 June 1970

DTZ Debenham Tie

Leung (SEA) Pte Ltd

Haw Par Centre

180 Clemenceau Avenue

Singapore 239922

6-storey office building on a land

area of 2,464 square metres. The

lettable area is 10,251 square metres.

99-year lease from

1 September 1952

DTZ Debenham Tie

Leung (SEA) Pte Ltd

Haw Par Technocentre

401 Commonwealth Drive

Singapore 149598

7-storey industrial building on a land

area of 8,131 square metres. The

lettable area is 15,700 square metres.

99-year lease from

1 March 1963

DTZ Debenham Tie

Leung (SEA) Pte Ltd

Menara Haw Par

Lot 242, Jalan Sultan

Ismail, 50250

Kuala Lumpur

Malaysia

32-storey office building on a land

area of 2,636 square metres and a

parcel of commercial land of 1,294

square metres. The lettable area of

the building is 16,131 square metres.

Freehold

DTZ Nawawi Tie Leung

Property Consultants Sdn

Bhd

NOT E S TO T H E F I NAN C I A L S TAT EME N T S

(CONTINUED)