For the financial year ended 31 December 2015

78

HAW PAR CORPORATION LIMITED

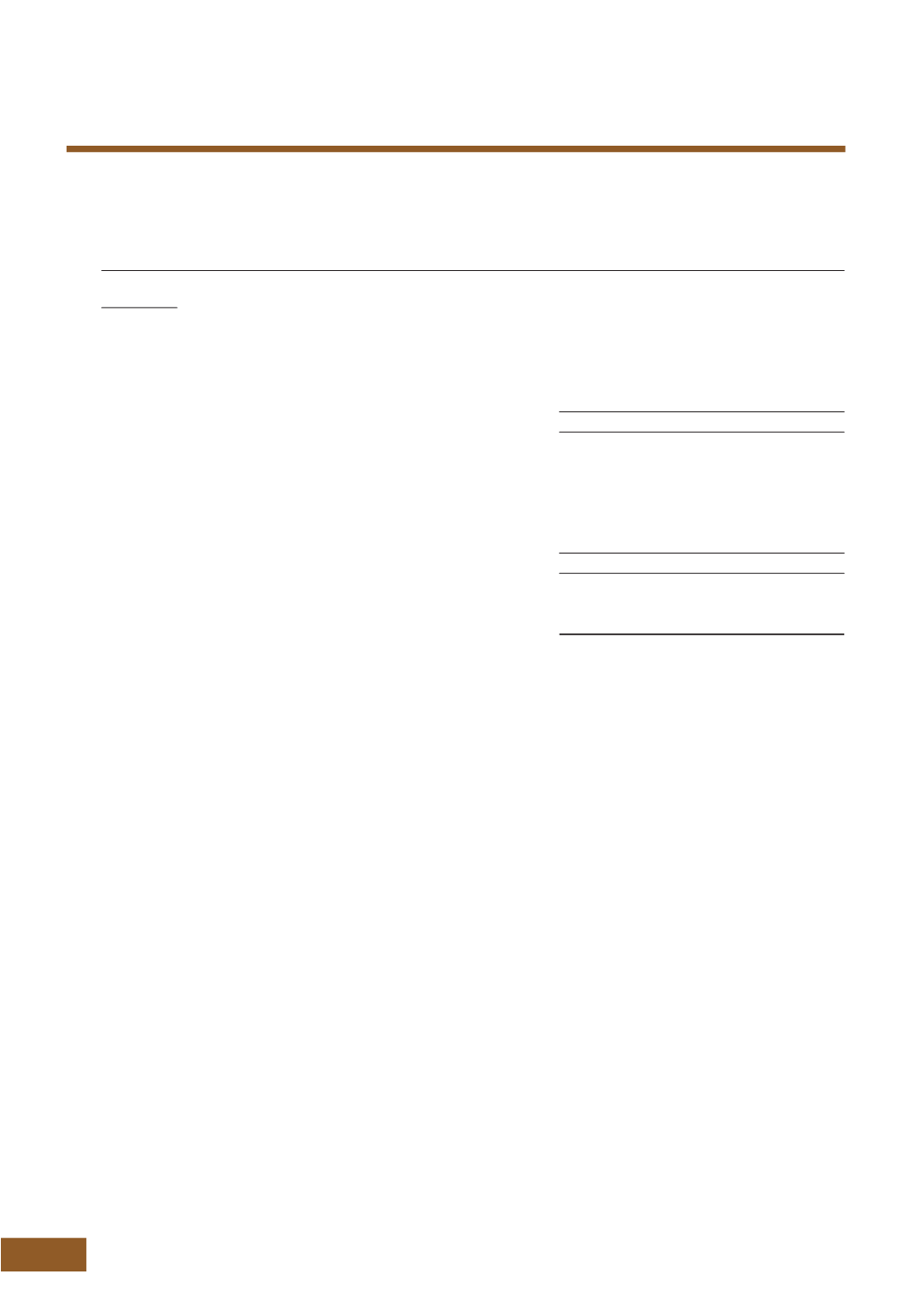

10. PROPERTY, PLANT AND EQUIPMENT

(CONTINUED)

Leasehold land

Plant and

and buildings equipment

Total

$’000

$’000

$’000

The Group

Cost

At 1 January 2014

44,556

55,469

100,025

Additions

61

2,469

2,530

Disposals/write-offs

(70)

(617)

(687)

Currency translation differences

548

202

750

At 31 December 2014

45,095

57,523

102,618

Accumulated depreciation and impairment losses

At 1 January 2014

23,471

40,796

64,267

Depreciation charge for the year

1,904

3,511

5,415

Disposals/write-offs

(50)

(522)

(572)

Currency translation differences

239

82

321

At 31 December 2014

25,564

43,867

69,431

Net book value

At 31 December 2014

19,531

13,656

33,187

Included in leasehold land and buildings is land use rights amounting to $1,116,000 (2014: $1,085,000).

As set out in Note 3(b), a subsidiary of the Group within the Leisure division carried out a review of the recoverable

amount of its property, plant and equipment due to the challenging operating environment in which the business

operates. Following the review, an impairment charge of approximately $4,601,000, representing a full write-down

of these property, plant and equipment to nil value was recognised in profit or loss for the financial year ended

31 December 2015.

NOT E S TO T H E F I NAN C I A L S TAT EME N T S

(CONTINUED)