For the financial year ended 31 December 2015

103

ANNUAL REPORT 2015

27. FINANCIAL RISK MANAGEMENT

(CONTINUED)

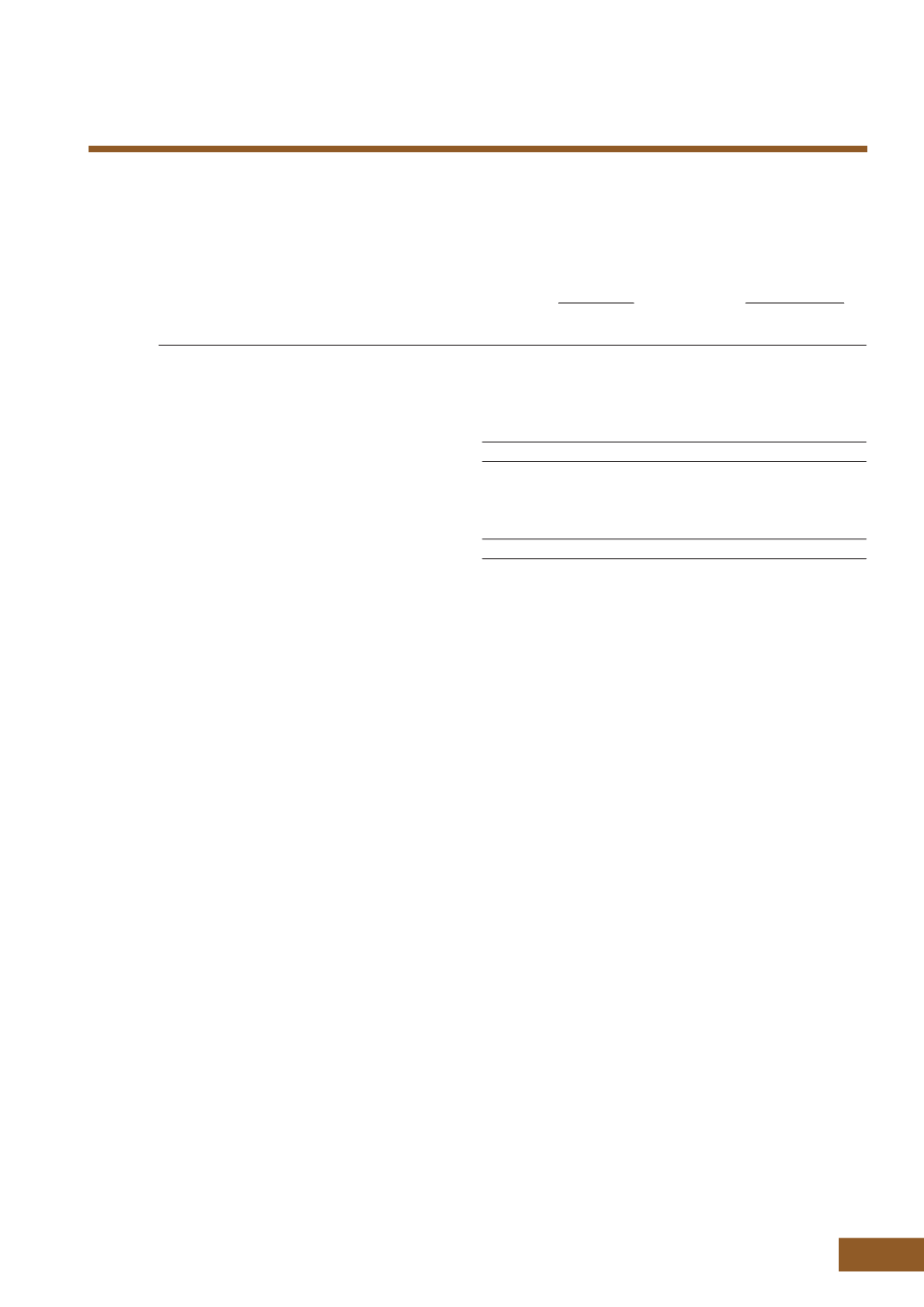

(e) Financial instruments by category

The financial instruments of the Group and of the Company include the following:

The Group

The Company

Note

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Financial Assets

Available-for-sale financial assets

14

2,080,555

2,311,492

281

330

Trade and other receivables

28,680

19,562

138,378

121,459

Cash and bank balances

18

315,731

224,666

287,257

194,270

2,424,966

2,555,720

425,916

316,059

Financial Liabilities

Trade and other payables

51,812

39,066

80,704

72,286

Borrowings

20

43,547

56,332

43,547

56,332

95,359

95,398

124,251

128,618

28. SEGMENTAL REPORTING

At 31 December 2015, the Group was organised into the following main business segments:

• Manufacturing, marketing and trading of healthcare products;

• Provision of leisure-related goods and services;

• Property rental; and

• Investments in securities.

Healthcare division principally manufactures and distributes topical analgesic products under the “Tiger Balm” and

“Kwan Loong” brand.

Leisure division provides family and tourist oriented leisure alternatives mainly in the form of oceanariums.

Property division owns and leases out several investment properties in the Asean region.

Investment division engages in investing activities, mainly in quoted and unquoted securities in the Asia region.

Inter-segment transactions are determined on an arm’s length basis. Unallocated costs represent corporate expenses.

Segment assets consist primarily of available-for-sale financial assets, investment properties, property, plant and

equipment, intangible assets, inventories, receivables, and cash and bank balances. Segment liabilities comprise

operating liabilities and exclude tax liabilities. Capital expenditure on non-current assets comprises additions to

investment properties, property, plant and equipment, intangible assets and investment in associated companies.

The Group evaluates performance on the basis of profit or loss from operations before tax expenses and management

fees charged internally and exclude non-recurring gains and losses.

The Group accounts for inter-segment sales and transfers as if the sales or transfers were to third parties, i.e. at current

market prices.

The Group’s reportable segments are strategic and distinct business units reporting to key group management. They are

managed separately because each business targets different customers and carry different business risk.

NOT E S TO T H E F I NAN C I A L S TAT EME N T S

(CONTINUED)