For the financial year ended 31 December 2015

93

ANNUAL REPORT 2015

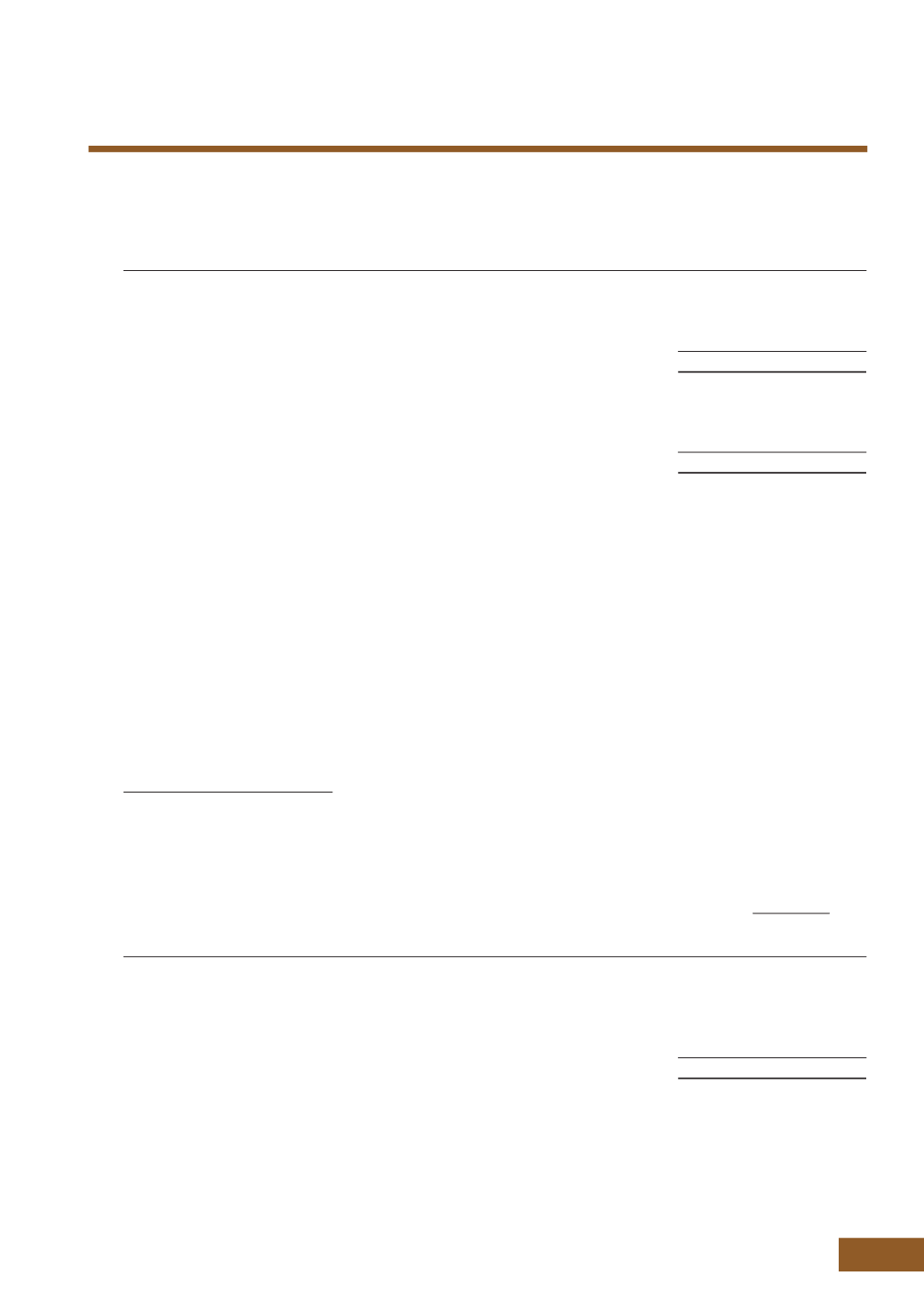

22. SHARE CAPITAL

Number

of shares

Amount

The Group and the Company

‘000

$’000

2015

Beginning of financial year

218,962

248,722

Issue of 169,000 ordinary shares by virtue of exercise of share options (Note 26(c))

169

1,173

End of financial year

219,131

249,895

2014

Beginning of financial year

218,664

246,848

Issue of 298,000 ordinary shares by virtue of exercise of share options (Note 26(c))

298

1,874

End of financial year

218,962

248,722

All issued ordinary shares are fully paid. There is no par value for these ordinary shares.

The holders of ordinary shares are entitled to receive dividends as and when declared by the Company. All ordinary

shares carry one vote per share without restriction.

Please refer to Note 26(b) for details of share options.

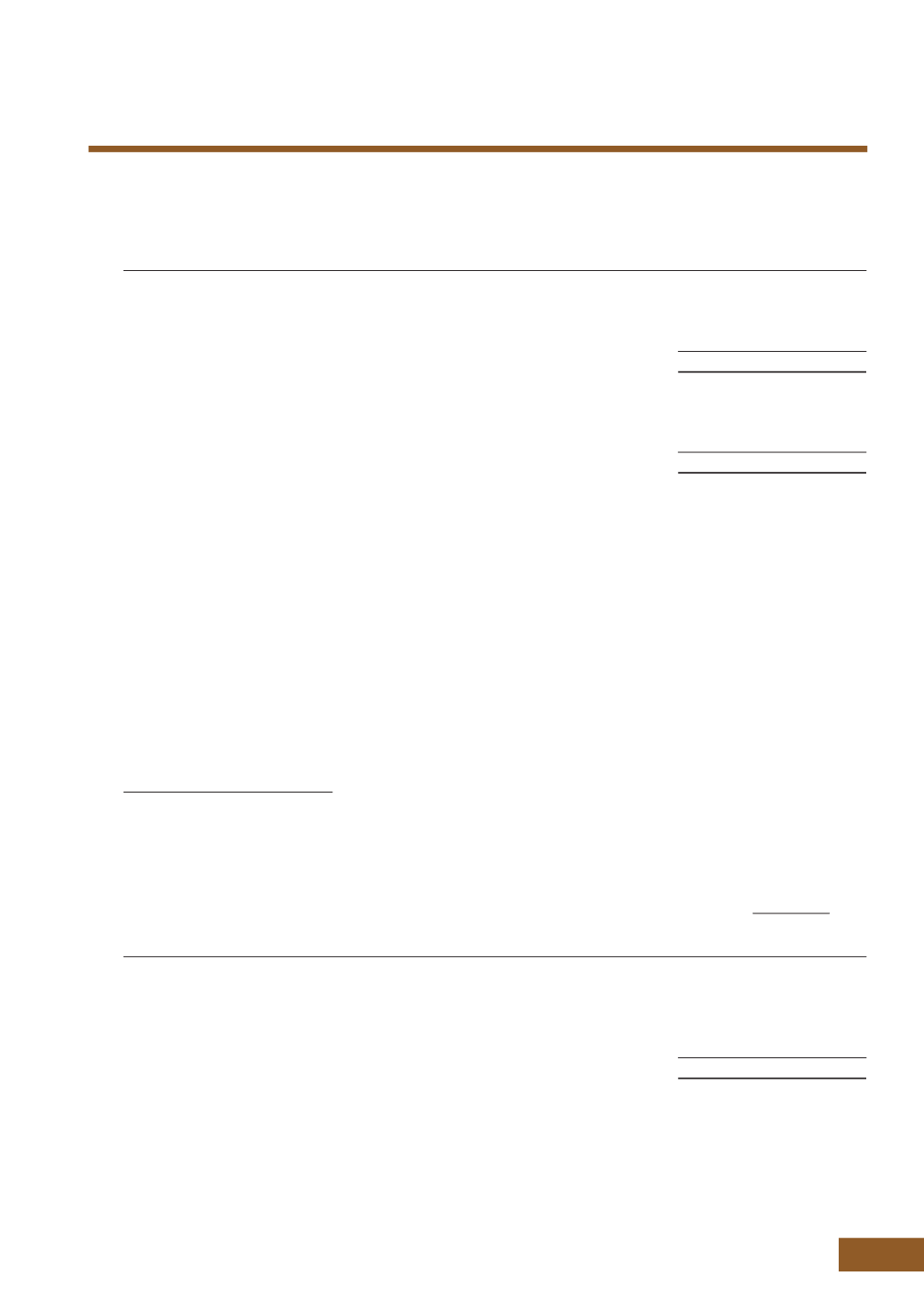

23. RELATED PARTY TRANSACTIONS

In addition to other related party information disclosed elsewhere in the financial statements, the following material

transactions have been carried out between the Group and its related parties at terms agreed between the parties

during the financial year:

Key management’s remuneration

The key management’s remuneration includes fees, salary, bonus, commission and other emoluments (including

benefits-in-kind) computed based on the cost incurred by the Group and the Company, and where the Group or

Company do not incur any costs, the value of the benefit. The key management’s remuneration is as follows:

The Group

2015

2014

$’000

$’000

Directors’ fees, salaries and other short-term employee benefits

4,649

4,288

Employer’s contribution to Central Provident Fund and

other defined contribution plans

106

96

Share options granted

136

162

4,891

4,546

Total compensation to Directors of the Company included in the above amounted to $2,435,000 (2014: $2,304,000).

NOT E S TO T H E F I NAN C I A L S TAT EME N T S

(CONTINUED)