For the financial year ended 31 December 2015

100

HAW PAR CORPORATION LIMITED

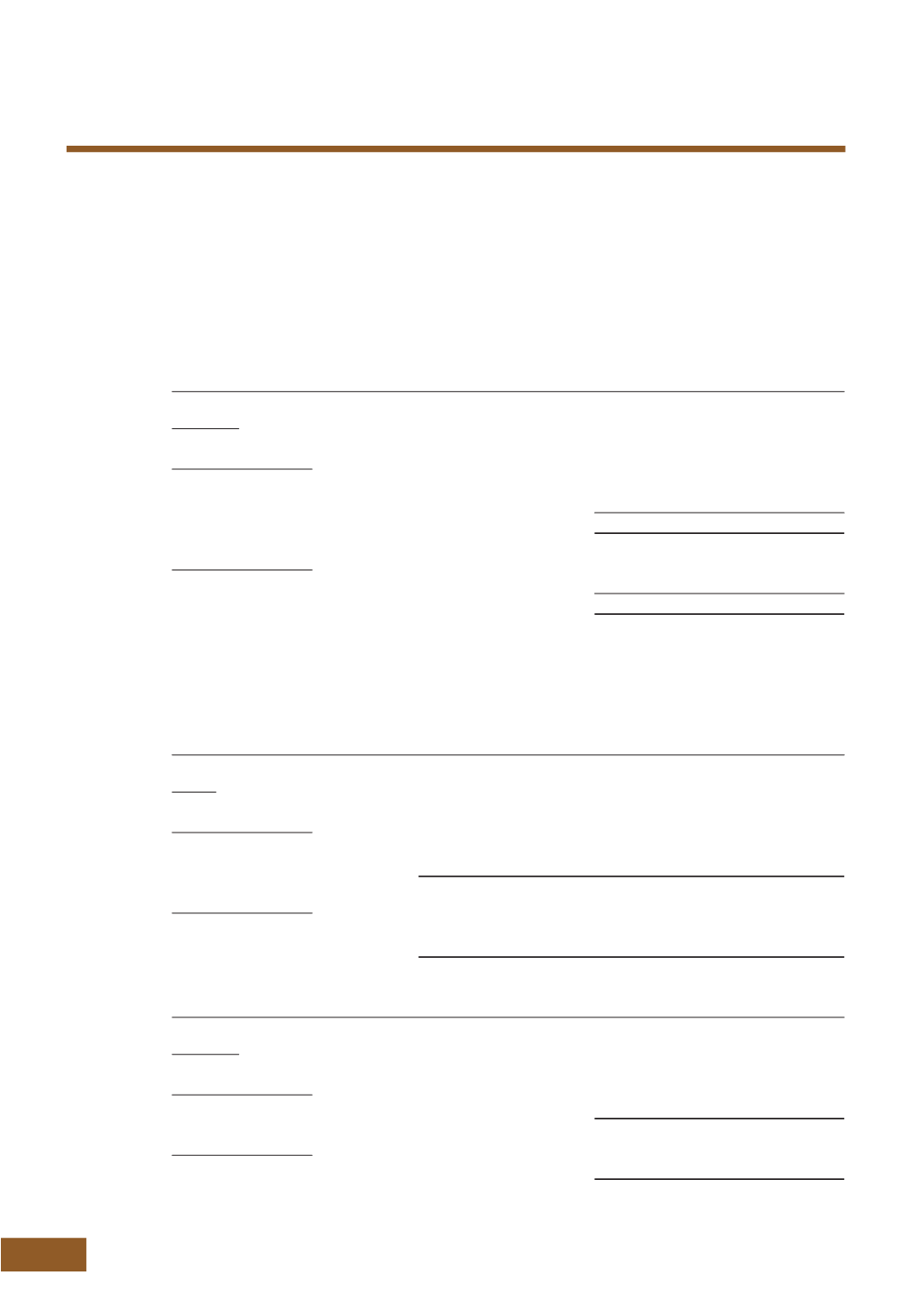

27. FINANCIAL RISK MANAGEMENT

(CONTINUED)

(a) Market risk

(continued)

(2) Foreign currency risk (continued)

The Company’s currency exposure of financial assets/liabilities net of those denominated in its functional

currency based on the information provided to key management is as follows:

USD

JPY

Total

$’000

$’000

$’000

Company

At 31 December 2015

Cash and cash equivalents

14,765

–

14,765

Borrowings

–

(43,547)

(43,547)

Currency exposure on financial assets and liabilities

14,765

(43,547)

(28,782)

At 31 December 2014

Borrowings

(14,662)

(41,670)

(56,332)

Currency exposure on financial assets and liabilities

(14,662)

(41,670)

(56,332)

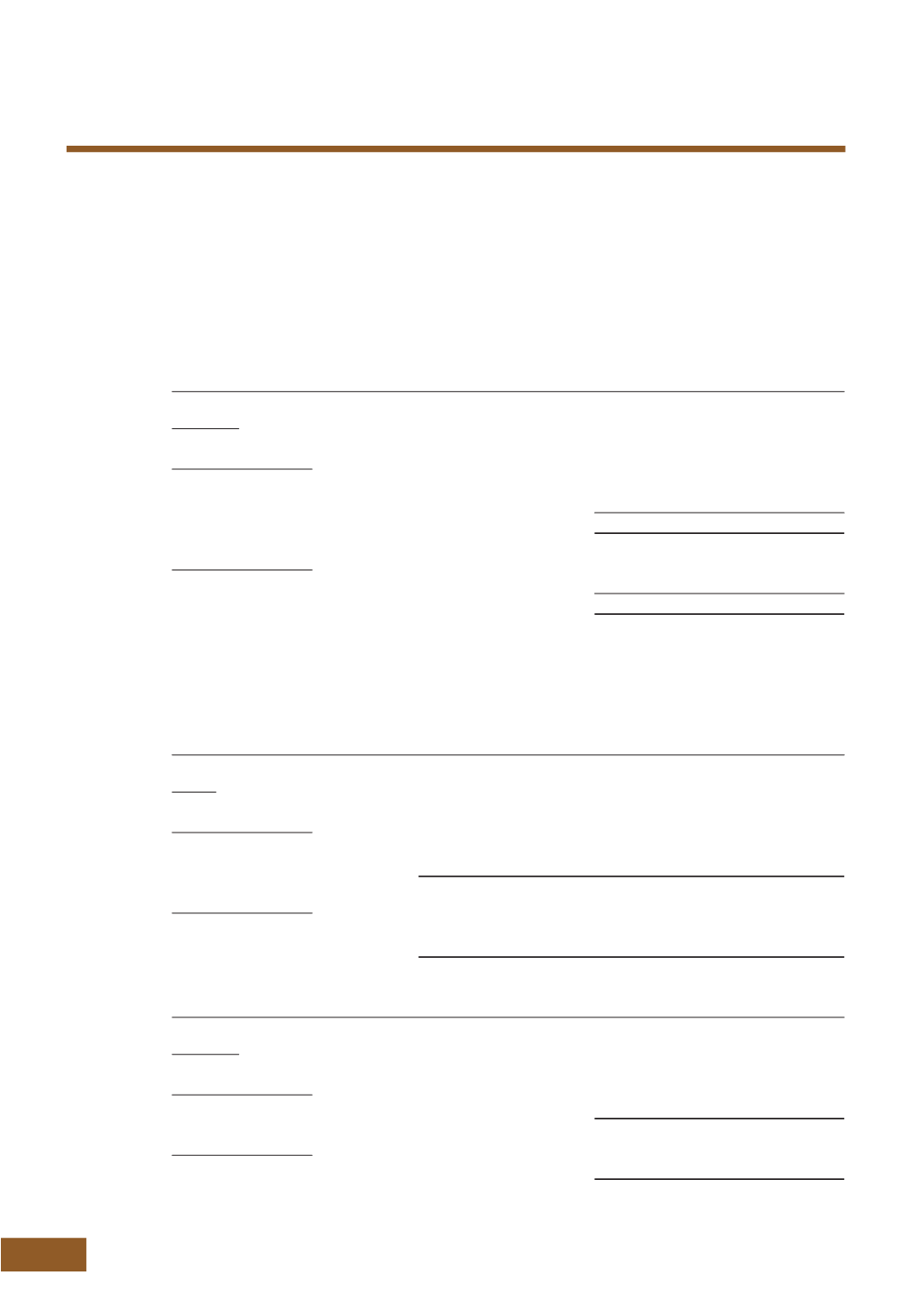

A 10% (2014: 10%) weakening of Singapore Dollar against the following currencies at reporting date would

increase/(decrease) profit or loss by the amounts shown below, with all other variables including tax rate

being held constant:

USD

HKD

JPY

Others

Total

$’000

$’000

$’000

$’000

$’000

Group

At 31 December 2015

Profit or loss, after tax

1,590

12

–

106

1,708

Other comprehensive income

2,994

14,050

1,200

–

18,244

At 31 December 2014

Profit or loss, after tax

77

11

–

1,568

1,656

Other comprehensive income

845

–

658

–

1,503

USD

JPY

Total

$’000

$’000

$’000

Company

At 31 December 2015

Profit or loss, after tax

1,226

(3,614)

(2,388)

At 31 December 2014

Profit or loss, after tax

(1,217)

(3,459)

(4,676)

NOT E S TO T H E F I NAN C I A L S TAT EME N T S

(CONTINUED)