For the financial year ended 31 December 2015

102

HAW PAR CORPORATION LIMITED

27. FINANCIAL RISK MANAGEMENT

(CONTINUED)

(c) Credit risk

(continued)

(i) Financial assets that are neither past due nor impaired

Short-term bank deposits that are neither past due nor impaired are mainly deposits with banks with high

credit-ratings assigned by international credit rating agencies. Trade receivables that are neither past due nor

impaired are substantially companies with a good collection track record with the Group.

(ii) Financial assets that are past due and/or impaired

There is no other class of financial assets that is past due and/or impaired except for trade receivables.

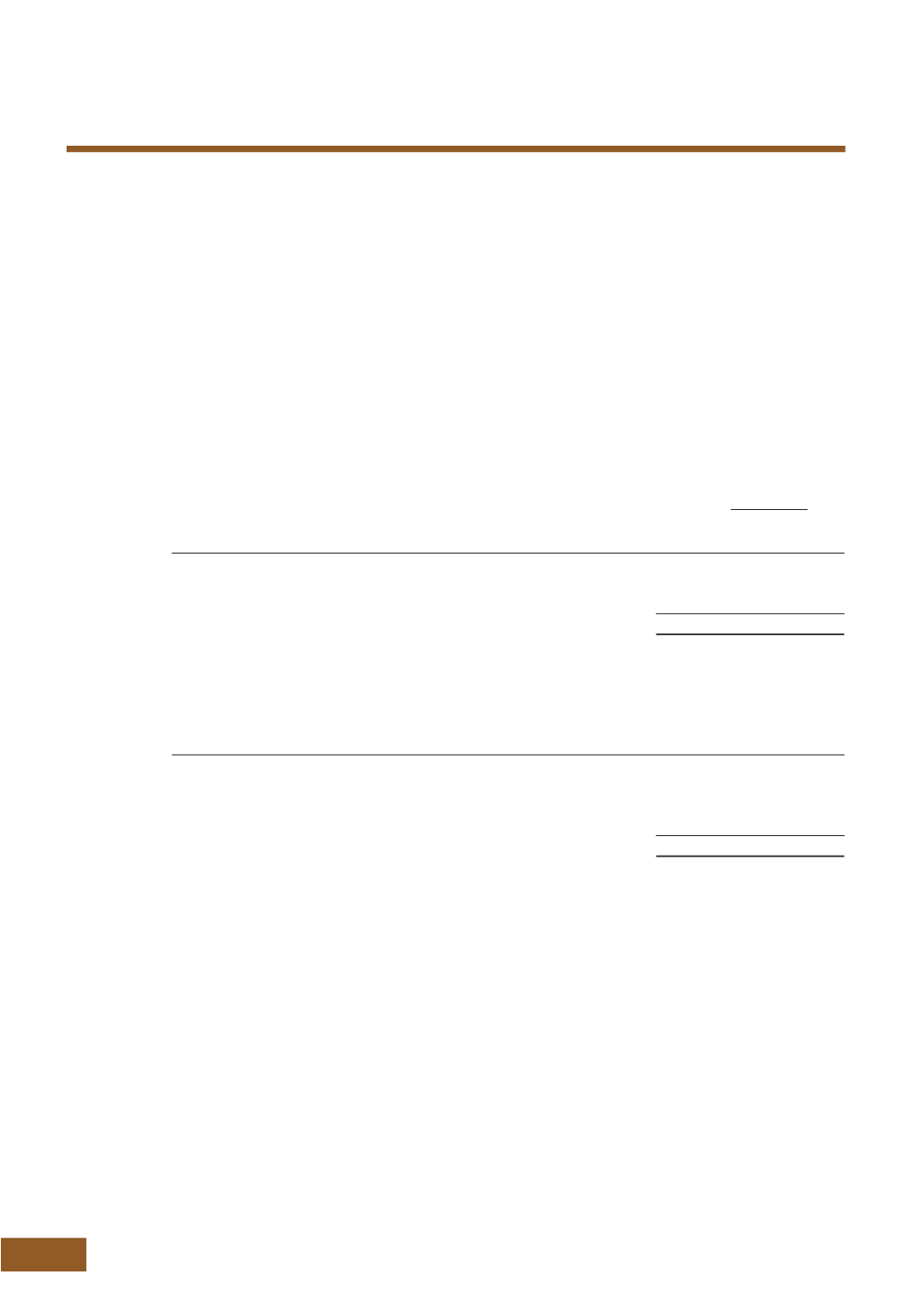

The age analysis of trade receivables past due but not impaired is as follows:

The Group

2015

2014

$’000

$’000

Past due within 1 month

191

1,688

Past due 1 to 3 months

33

6

224

1,694

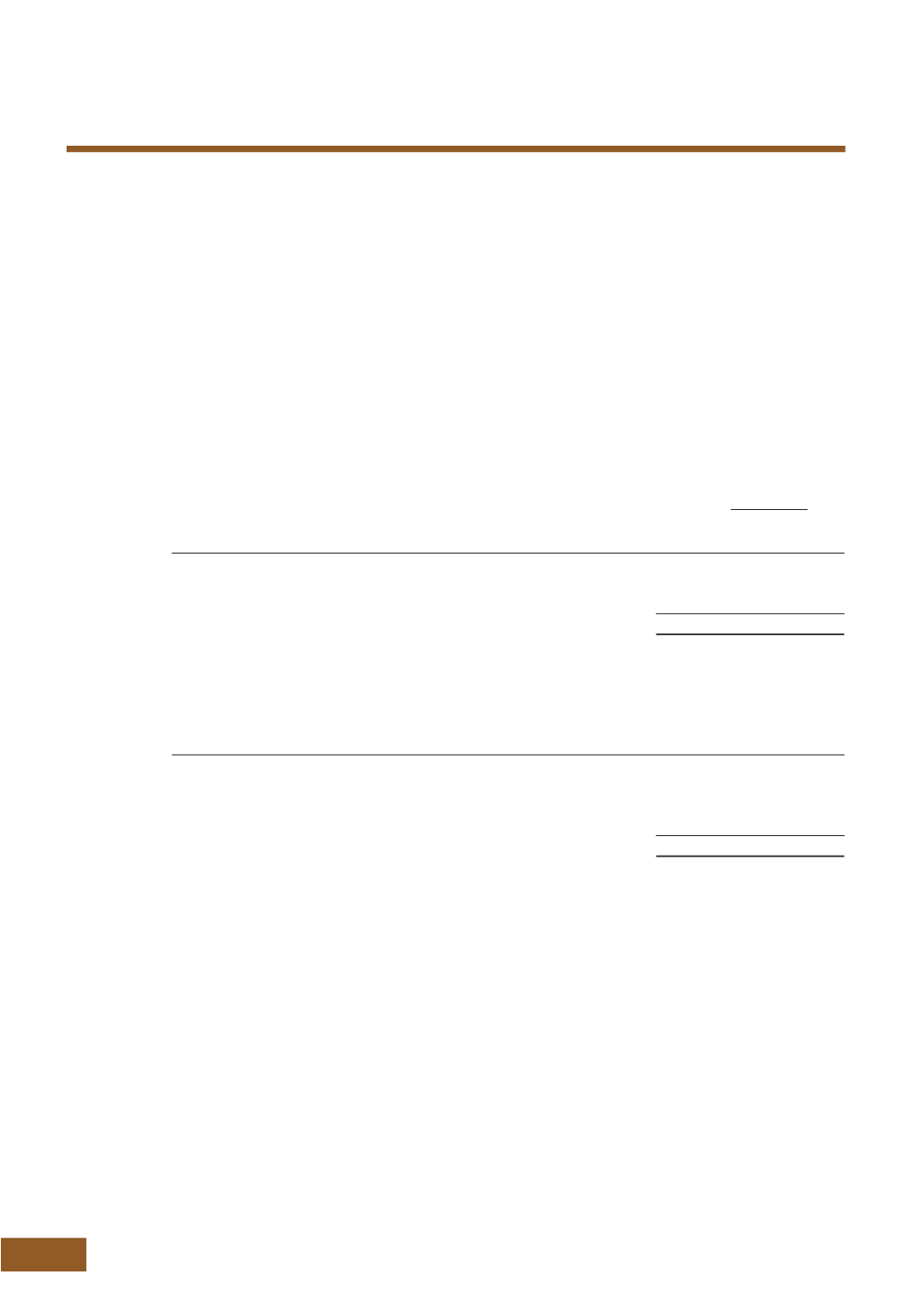

There is $16,000 (2014: $8,000) trade and other receivables that are individually determined to be impaired

and the movement of the related allowance for impairment are as follows:

2015

2014

$’000

$’000

Beginning of financial year

8

23

Allowance made during the year

8

1

Allowance utilised

–

(16)

End of financial year

16

8

(d) Capital risk

In managing capital, the Group’s objectives are to safeguard its ability to continue as a going concern and to

maintain an optimal capital structure so as to maximise shareholder value. In order to maintain or achieve an

optimal capital structure, the Group may adjust the amount of dividend payment, return capital to members, buy

back issued shares or obtain new borrowings.

Management monitors capital based on ability of the Group to generate sustainable profits and availability of

retained profits for dividend payments to members. The Group’s overall strategy remains unchanged from 2014.

The Group and the Company are in compliance with all externally imposed capital requirements for the financial

years ended 31 December 2015 and 2014.

NOT E S TO T H E F I NAN C I A L S TAT EME N T S

(CONTINUED)