group financial highlights

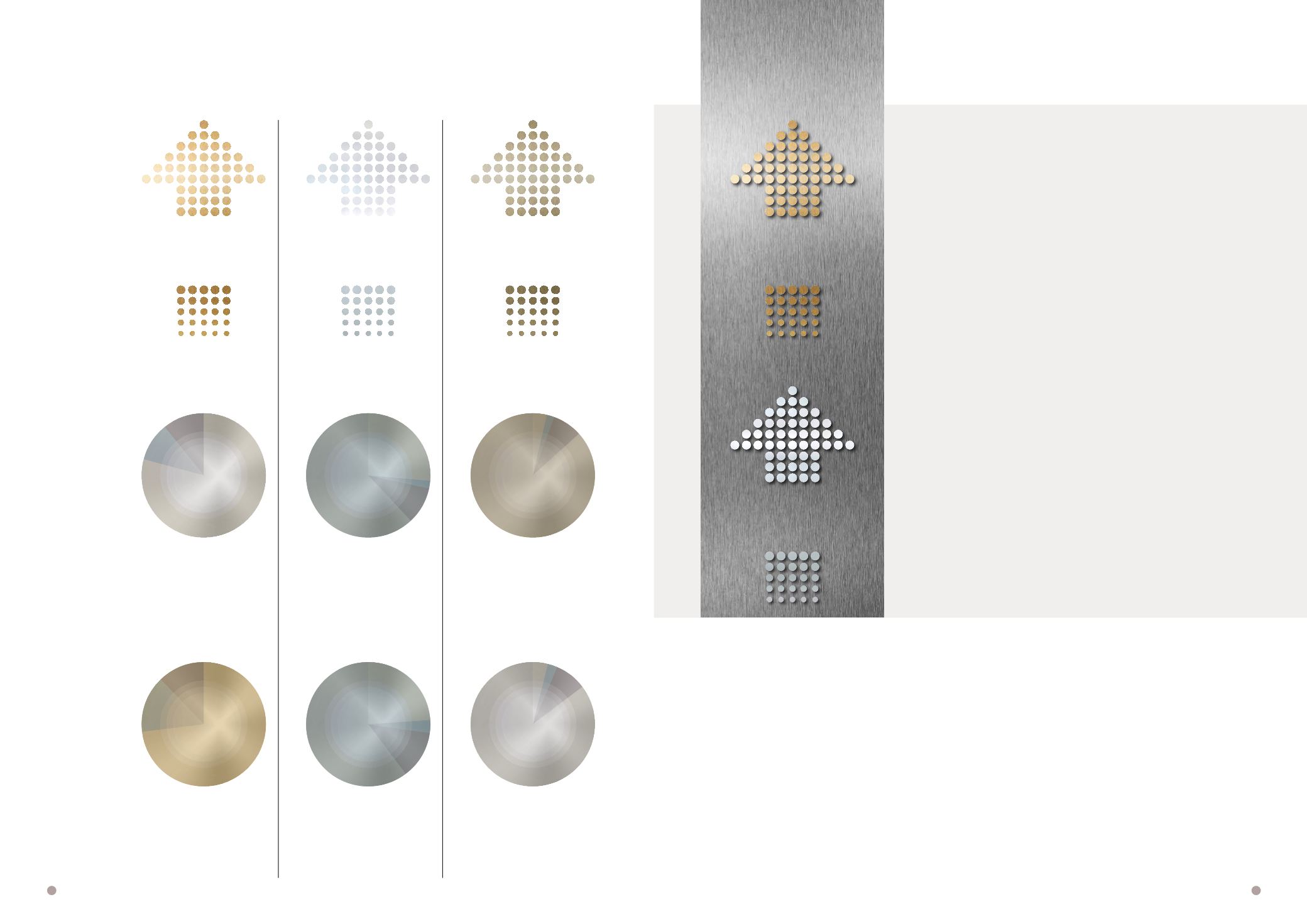

TuRNOvER (%)

2014

PROFIT CONTRIBuTION (%)

2014

ASSETS EMPLOyED (%)

2014

Healthcare

79.3

Leisure

10.1

Property

10.6

Healthcare

26.6

Leisure

2.0

Property

9.7

Investment

61.7

Healthcare

3.7

Leisure

2.0

Property

7.8

Investment

86.5

2013

2013

2013

Healthcare

73.3

Leisure

14.5

Property

12.2

Healthcare

23.9

Leisure

3.5

Property

12.4

Investment

60.2

Healthcare

4.0

Leisure

2.4

Property

8.4

Investment

85.2

Financial Highlights

Group turnover increased 9.2% from $141.2 million to $154.2 million

mainly from Healthcare. Profits from operations increased 15.9%

to $112.0 million contributed by Healthcare and higher investment

income. Profit after tax increased 10.1% to $118.8 million mainly

due to higher profitability from Healthcare, higher investment income

and higher share of results from associated companies.

Healthcare contributed a higher percentage of the Group’s turnover

from 73.3% in 2013 to 79.3% in 2014 from higher sales in key

Asian markets. Percentage of profit contribution to the Group from

Healthcare also increased from 23.9% in 2013 to 26.6% in 2014

due to higher profitability from the division and decrease in profit

from Leisure and Property.

Percentage of the Group’s total assets employed by Healthcare,

Leisure and Property decreased compared to prior year. Increase in

assets employed was mainly due to higher market valuation of the

Group’s Investment portfolio.

Financial Position

Shareholders’ funds increased by 14.8% to $2,807.5 million mainly

due to the higher market valuation of the Group’s available-for-sale

financial assets and profits from operating divisions.

The Group ended the financial year with net cash balances of $223.1

million, after dividend payments of $43.8 million. Cash generated

by operating activities was $58.1 million in 2014.

Dividends

A second & final dividend of 14 cents per share is being proposed at

the coming Annual General Meeting. Together with the interim dividend

of 6 cents paid in September 2014, the total dividend per share for

the financial year ended 31 December 2014 is 20 cents per share.

+9.2%

TURNOVER

Turnover

$154.2M

Profit Before Tax

$127.0M

Assets

$2.8B

+10.1%

PROFIT AFTER TAX

Financial calendar

Date

Event

14 May 2014

Announcement of 2014 1st quarter results

13 August 2014

Announcement of 2014 2nd quarter results

4 September 2014

Payment of 2014 first and interim dividend

13 November 2014

Announcement of 2014 3rd quarter results

27 February 2015

Announcement of 2014 full-year audited results

8 April 2015

Announcement of Notice of Annual General Meeting

28 April 2015

46th Annual General Meeting

25 May 2015

Proposed books closure date for dividend entitlement

4 June 2015

Proposed payment of 2014 second and final dividend

Haw Par Corporation Limited

14

annual report 2014

15