Financial Review

Overview

Group revenue at $154.2 million was 9.2%

higher than 2013, with Healthcare reporting

an 18.1% growth in revenue. Profits from both

Healthcare and Investments grew 31.0% and

17.5% respectively. Group earnings increased

10.1% to $118.8 million due to higher profitability

from Healthcare, higher investment income and

higher share of results from associated companies.

With net higher earnings registered for the year,

earnings per share increased to 54.3 cents (2013:

49.4 cents). Net assets per share increased to

$12.82 (2013: $11.18) with the increase in

earnings and higher market valuations of available-

for-sale financial assets.

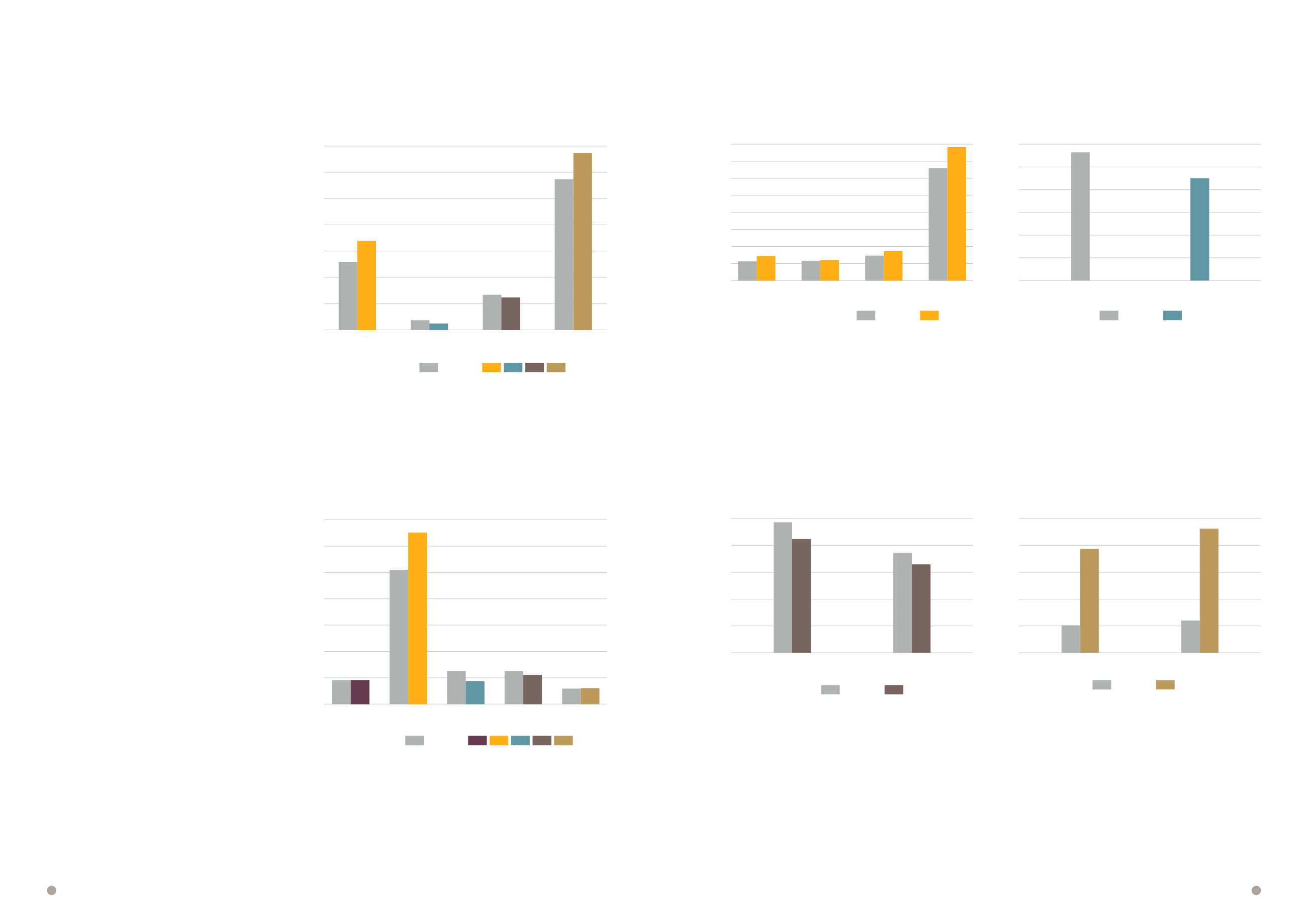

Segment Profits Before Interest Expense and Tax ($m)

2013

2014

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0

Healthcare

Leisure

Property

Investments

25.9

3.8

33.9

2.5

13.4

57.3

67.3

Return on Assets Employed

The Group applies a Return of Assets Employed

(“ROA”) measure to evaluate the performance

of its business operations. The ROA measures

profitability of assets utilised by the various

operations.

In 2014, the Group’s ROA maintained at 4.6%,

from higher profitability of Healthcare, offset by

decrease in profit from Leisure and Property. ROA

of Healthcare division improved from 25.6% to

32.7%. The decline in ROA of Leisure to 4.4%

is attributable to lower visitorship and intense

competition. ROA of Property decreased to 5.6%

from the net increase in fair value of investment

properties and decrease in profit from lower

occupancy rate. ROA of Investment increased

slightly to 3.1%, consistent with the higher

dividend income received during the year and

larger asset base due to higher market valuations.

Return on Assets Employed (%)

2013

2014

35.0

30.0

25.0

20.0

15.0

10.0

5.0

0

Group

Healthcare

Leisure

Property

Investments

4.6

32.7

6.3

5.6

3.1

3.0

4.6

25.6

4.4

6.3

12.4

Healthcare

Healthcare’s revenue of $122.2 million increased 18.1%

compared to prior year. Higher sales in key markets during

the year also resulted in higher revenue contribution

especially from Asian countries. Operating profits continued

to grow 31% above 2013 to $33.9 million as lower cost

of raw materials and favourable foreign currency rate

helped to improve margins.

Leisure

The number of visitors to the aquariums declined by 20.2%

with weaker tourist sentiments and intense competition at

the Oceanariums in the Group. Leisure contributed a lower

revenue of $15.6 million in 2014 compared to $20.5

million in 2013. Continuous upgrading of facilities and

displays at UWP are done to maintain competitiveness.

Property

Property was affected by a lower occupancy rate.

Rental revenue contributed by Property decreased

4.7% to $16.4 million and profit from its operations

decreased 7.6% to $12.4 million. Property also recorded

a lower net fair value gain of investment properties of

$3.1 million (2013: $10.7 million).

Investments

Investment income increased 10.4% from 2013 due to

higher dividends received from our investment portfolio.

The fair value of the Group’s investment portfolio increased

from $1,934.7 million as of 31 December 2013 to

$2,311.5 million as of 31 December 2014 mainly due to

the increase in share prices of main equity investments. A

net unrealized gain of $279.8 million arising from changes

in the fair value of investments has been recorded in the

fair value reserve account in 2014.

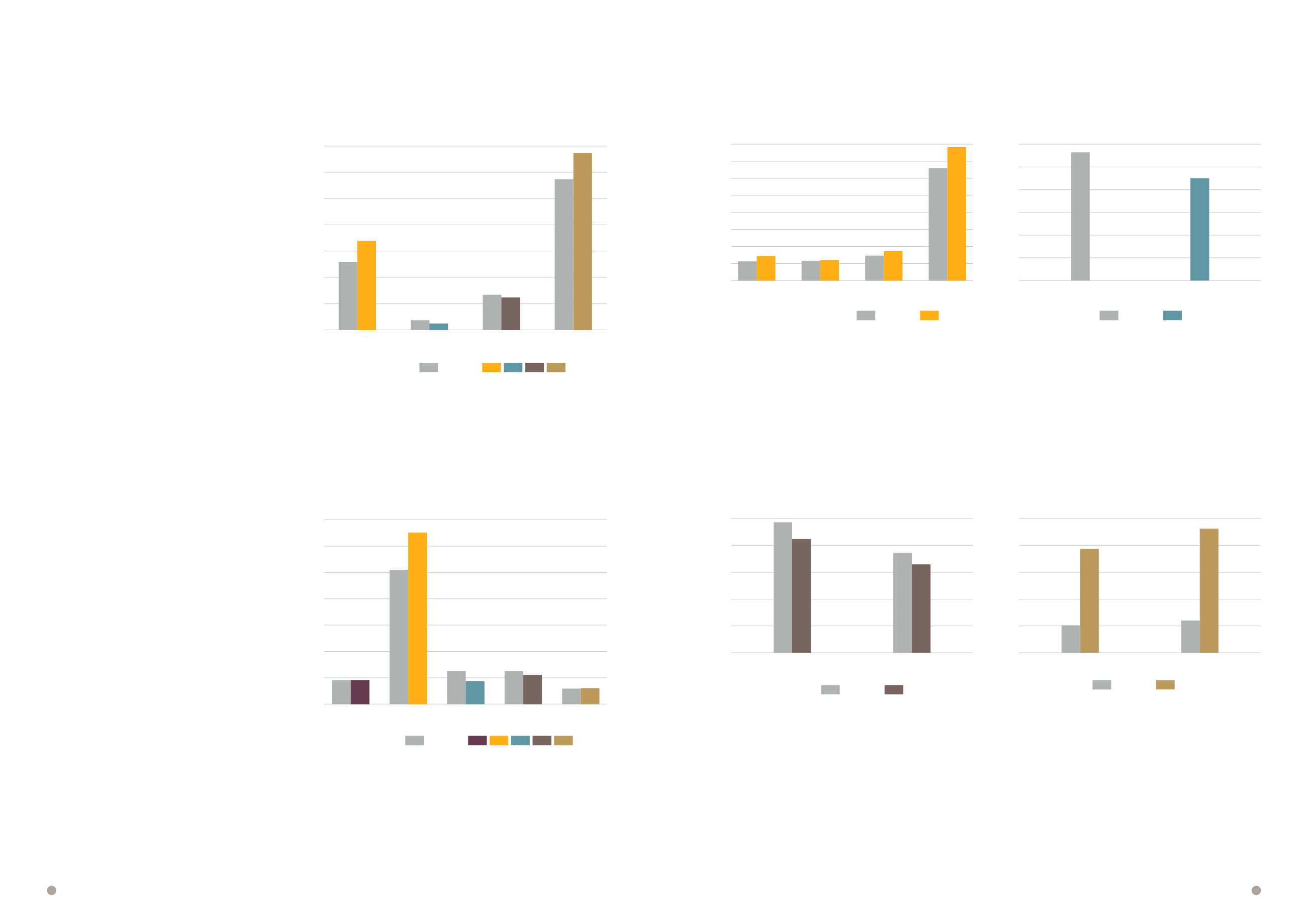

Healthcare Sales by Region ($m)

80.0

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0

America

Europe

Middle East

Asia

11.3

11.5

14.5

12.1

14.7

17.3

66.0

78.3

2013

2014

2013

2014

Visitorship of Aquariums (’000)

1,200

1,000

800

600

400

200

0

2013

2014

1,134

905

2013

2014

Property (Building Occupancy Rates)

100%

80%

60%

40%

20%

0%

Singapore Properties

Others

97.5

85.0

74.5

66.1

Cost

Fair Value

Investments (Cost vs Fair Value) ($m)

2,500

2,000

1,500

1,000

500

0

2013

2014

1,934.7

513.3

602.8

2,311.5

Haw Par Corporation Limited

30

annual report 2014

31