five-year financial summary

2014

2013

2012

2011

2010

Results ($’000)

Group turnover

154,222

141,176

139,349 132,675

129,761

Profit from operations

111,976

96,574

84,526

77,816

84,806

- Healthcare

33,885

25,871

17,155

15,643

16,157

- Leisure

2,513

3,776

11,881

(1,893)

12,585

- Property

12,377

13,395

12,925

13,138

12,336

- Investment

66,850

57,002

48,587

55,691

48,993

- Unallocated expenses

(3,649)

(3,470)

(6,022)

(4,763)

(5,265)

Associates’ contribution

11,917

8,039

19,308

8,656

23,521

Fair values gains/(losses) on

investment properties

3,075

10,664

23,492

(97)

15,436

Profit before taxation

126,968

115,277

127,326

86,375

123,763

Profit attributable to equity holders

of the Company

118,825

107,919

119,965

79,808

115,099

Per share

Earnings (cents)

54.3

49.4

55.1

36.6

52.9

Dividend net (cents)

20.0

20.0

18.0

18.0

18.0

Dividend cover (times)

2.7

2.5

3.1

2.0

2.9

Statement of Financial Position

($’000)

Shareholders’ funds

2,807,465

2,444,721 2,253,217 1,788,970 1,951,892

Non-controlling interests

-

-

-

-

7,756

2,807,465

2,444,721 2,253,217 1,788,970 1,959,648

Property, plant and equipment

33,187

35,758

37,947

37,865

43,848

Investment properties

225,249

222,139

211,545

187,039

181,642

Associated companies

137,690

119,097

114,484

100,468

91,702

Available-for-sale financial assets

(“AFS”)

2,311,492

1,934,728 1,815,844 1,421,681 1,574,861

Intangible assets & other long term

assets

11,379

11,605

11,718

11,717

11,944

Other net current assets

(excluding AFS)

152,312

174,968

110,968

65,429

100,016

Long term liabilities

(63,844)

(53,574)

(49,289)

(35,229)

(44,365)

Net assets

2,807,465

2,444,721 2,253,217 1,788,970 1,959,648

Statistics

Return on equity (%)

4.2

4.4

5.3

4.5

5.9

Net assets per share ($)

12.82

11.18

10.34

8.21

8.97

Debt/Equity (%)

2.0

1.0

1.0

0.7

-

Number of shareholders

20,039

20,316

20,821

21,216

21,454

Employees

Number of employees

469

437

414

408

471

Group turnover per employee ($’000)

329

323

337

325

276

Pre-tax profit

#

per employee ($’000)

264

239

251

212

230

# Excludes fair value changes on investment properties.

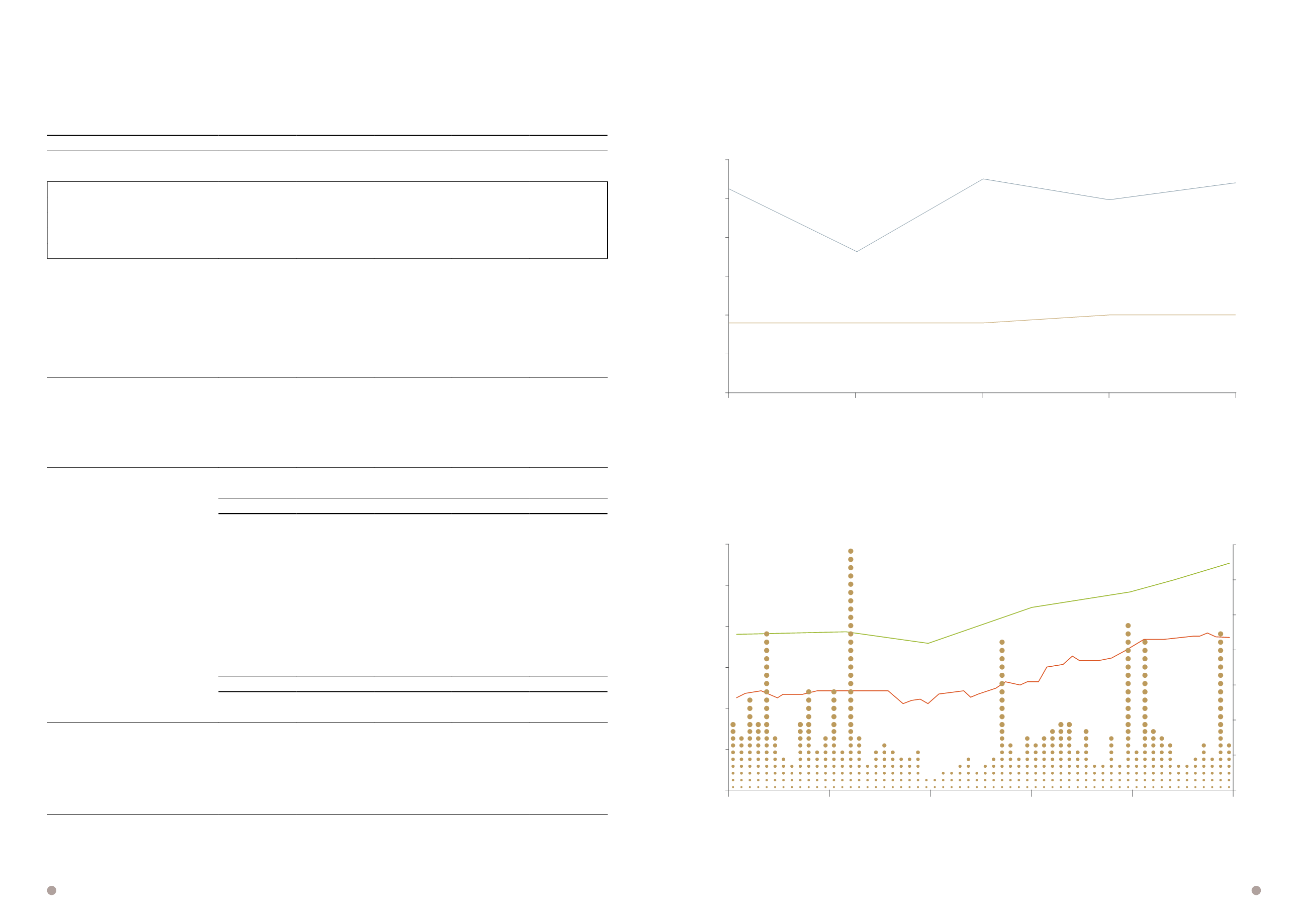

– Earnings per share

– Net Dividend per share

– share price

– Net assets per share

60.00

50.00

40.00

30.00

20.00

10.00

0

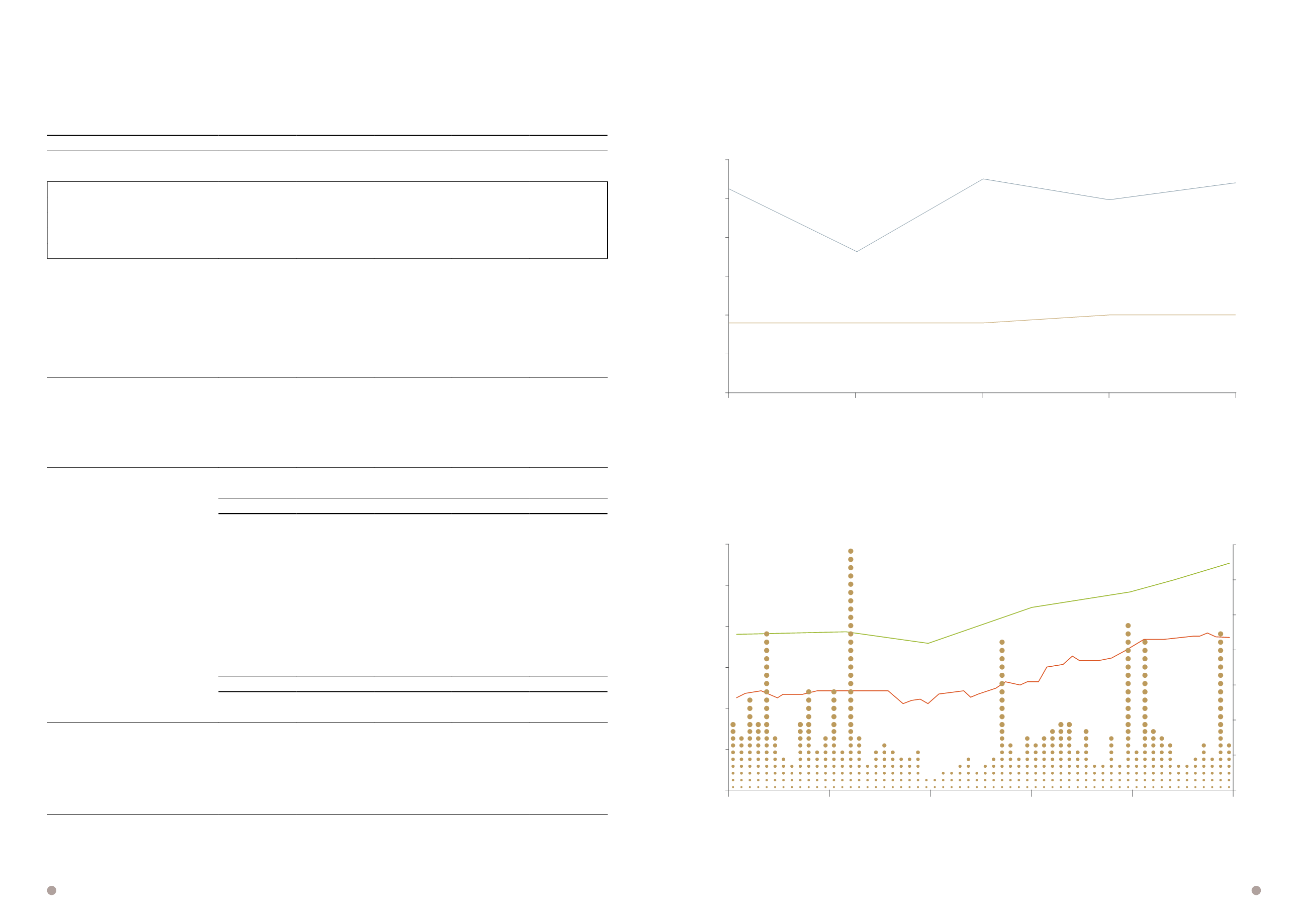

Trading Volume, Share Price & Net assets per share

earnings per share and net dividend per share

Share price /

Net assets per share

$

2010

2011

2012

2013

2014

2010

2011

2012

2013

2014

6,000

5,000

4,000

3,000

2,000

1,000

0

14.00

12.00

10.00

8.00

6.00

4.00

2.00

0

Trading Volume ’000

cents

Haw Par Corporation Limited

16

annual report 2014

17