HAW PAR CORPORATION LIMITED

38

Level and Mix of Remuneration and Disclosure on Remuneration

The RC takes into consideration current industry norms on compensation and adopts a remuneration policy in line with industry

practices. None of the Non-executive Directors have any service contract or consultancy agreement with the Company. Non-

executive Directors, including the Chairman of the Board, are paid directors’ fees which comprise a basic fee and additional

fees for serving on Board Committees. The RC recommends directors’ fees to the Board for endorsement prior to submission

to shareholders for approval at each annual general meeting. The Company’s share option scheme allows for grants of share

options to non-executive directors. To date, the Non-executive Directors have not been granted any share option.

The Group remunerates its employees at market competitive levels, commensurate with their performance and contribution

to the long-term interests and success of the Group. The remuneration package comprises fixed and variable compensation,

provident fund and share options (for eligible employees). A variable bonus scheme is in place. Key management in the

Group is rewarded by share options, taking into consideration working capital efficiency, productivity, current year earnings

and long-term sustainability and growth of the respective businesses and their contribution thereto.

In the annual review of the remuneration of the Executive Directors, the RC takes into consideration performance of the

individuals and comparative remuneration of similarly placed persons in the market. The performance criteria include

achievement of financial objectives using financial indicators such as overall profitability and return on assets over a period of

time. Their remuneration is reviewed annually by the RC and include a variable bonus component which is performance‑based.

Share options are granted to the Executive Directors and eligible key executives, based on their performance during the year.

These share options are granted at market price around the date of grant and can only be exercised after a vesting period

of usually one year to ensure that employees’ interest gel with the longer term performance of the Group. In the event of

misconduct on the part of a participant in the share option scheme, the RC may in its absolute discretion treat any outstanding

option as lapsed and null and void. More information on the Haw Par Corporation Group 2002 Share Option Scheme can be

found in the Directors’ Report and Note 25(b) to the financial statements.

Disclosure of Remuneration

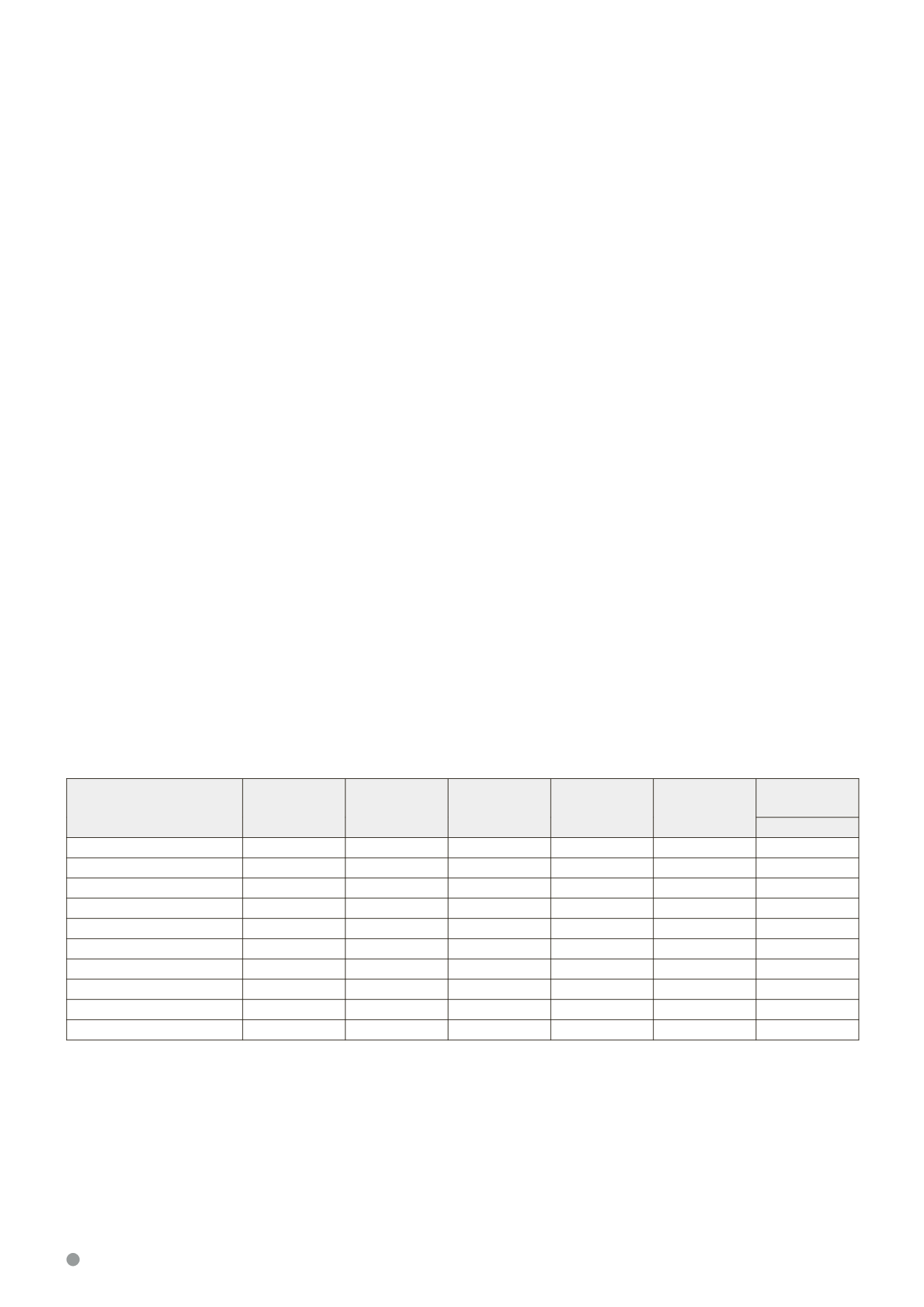

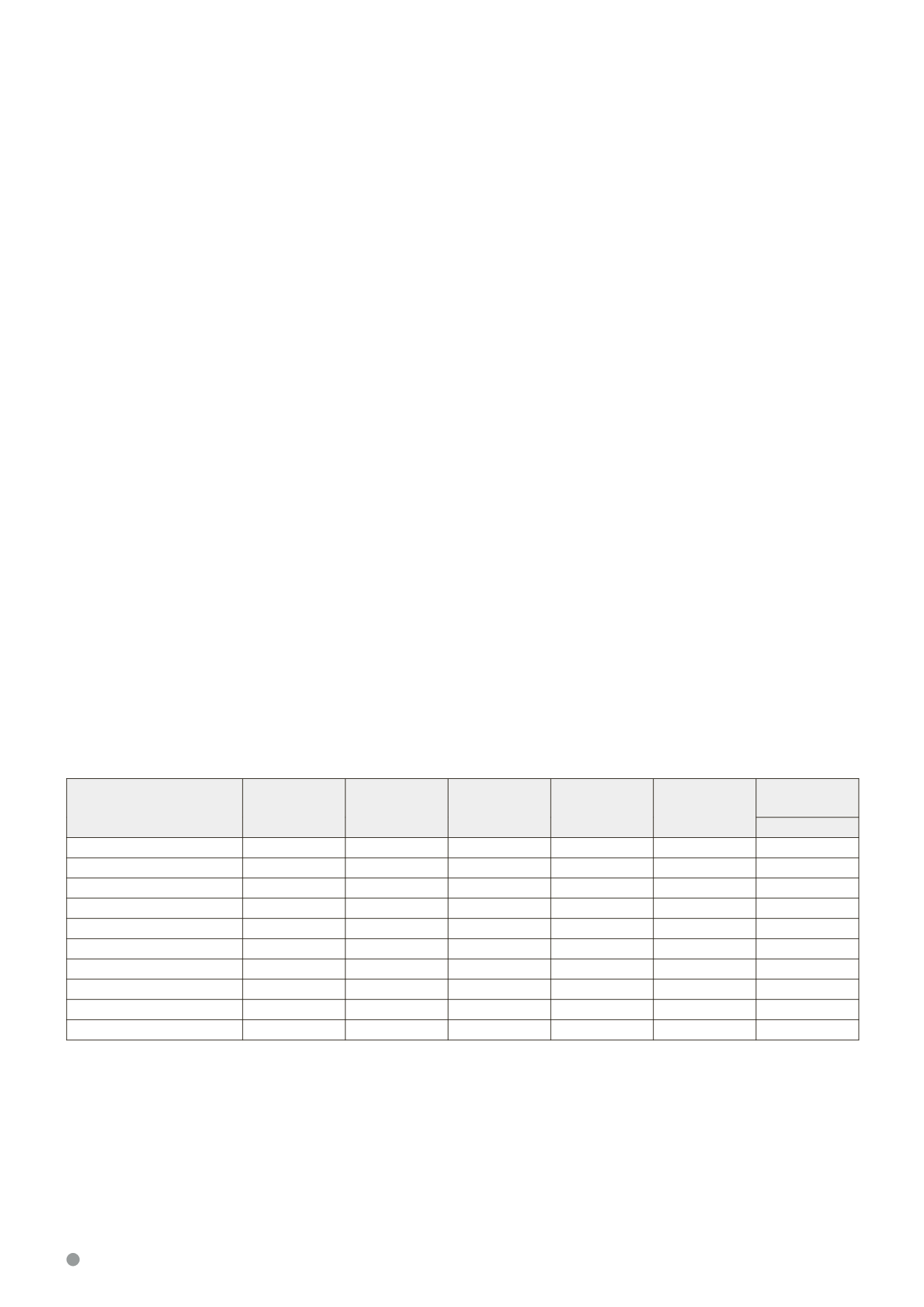

The details of the remuneration of each Director for FY 2014 are as follows:

Table 2:

Name

Directors’

Fees

(1)

Base or fixed

salary

Variable bonus

Benefit-in-kind

and others

Total

Share options

granted

$’000

$’000

$’000

$’000

$’000

No. of shares

Wee Ee Lim

–

667

550

85

1,302

–

Han Ah Kuan

–

291

214

115

620

66,000

Wee Cho Yaw

82

–

–

–

82

–

Sat Pal Khattar

56

–

–

–

56

–

Hwang Soo Jin

51

–

–

–

51

–

Lee Suan Yew

51

–

–

–

51

–

Chew Kia Ngee

56

–

–

–

56

–

Peter Sim Swee Yam

36

–

–

–

36

–

Gn Hiang Meng

14

–

–

–

14

–

Wee Ee-chao

36

–

–

–

36

–

(1) Directors’ fees are subject to shareholders’ approval at the forthcoming annual general meeting on 28 April 2015.

CORPORATE GOVERNANCE REPORT

(CONTINUED)