ANNUAL REPORT 2014

39

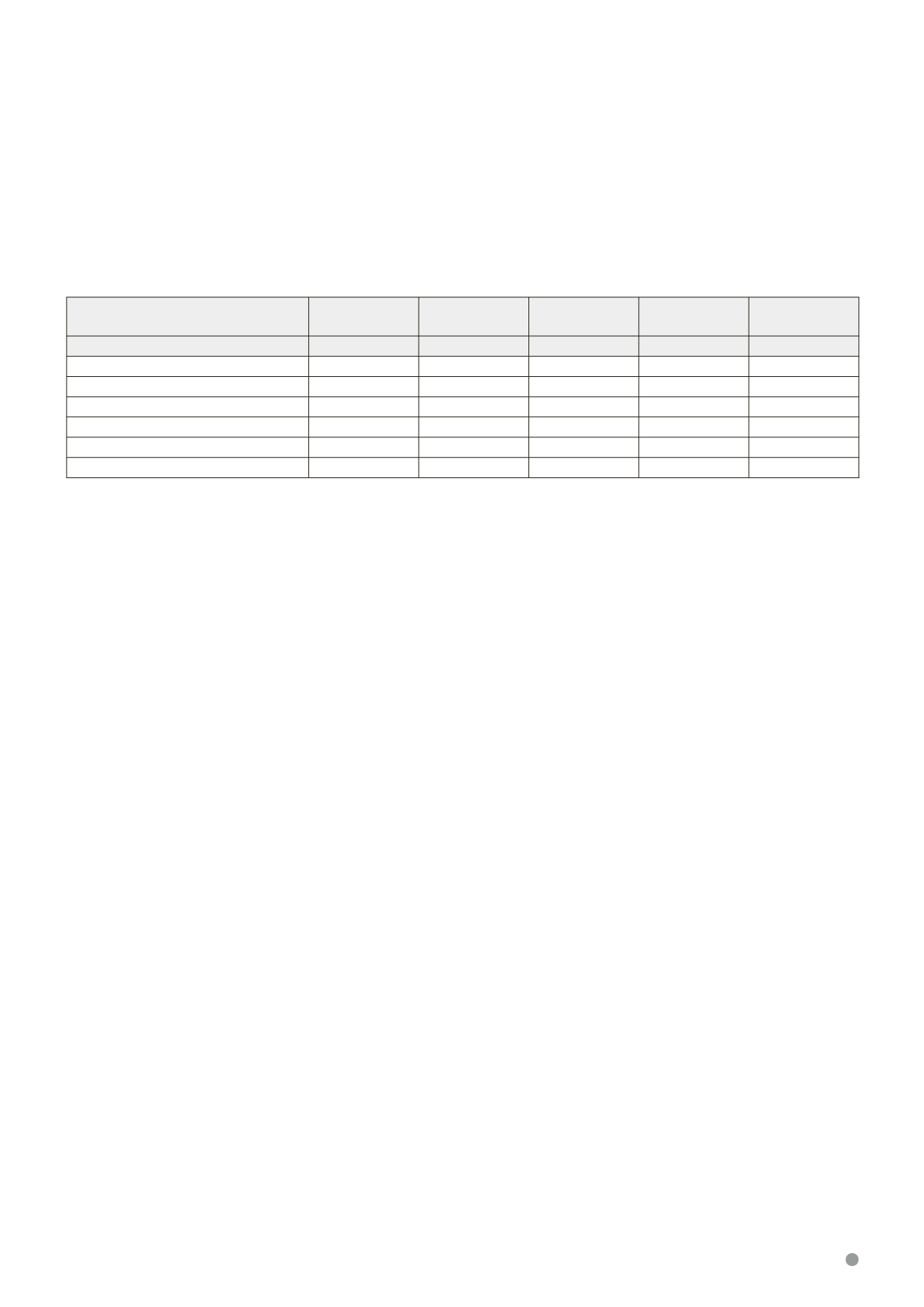

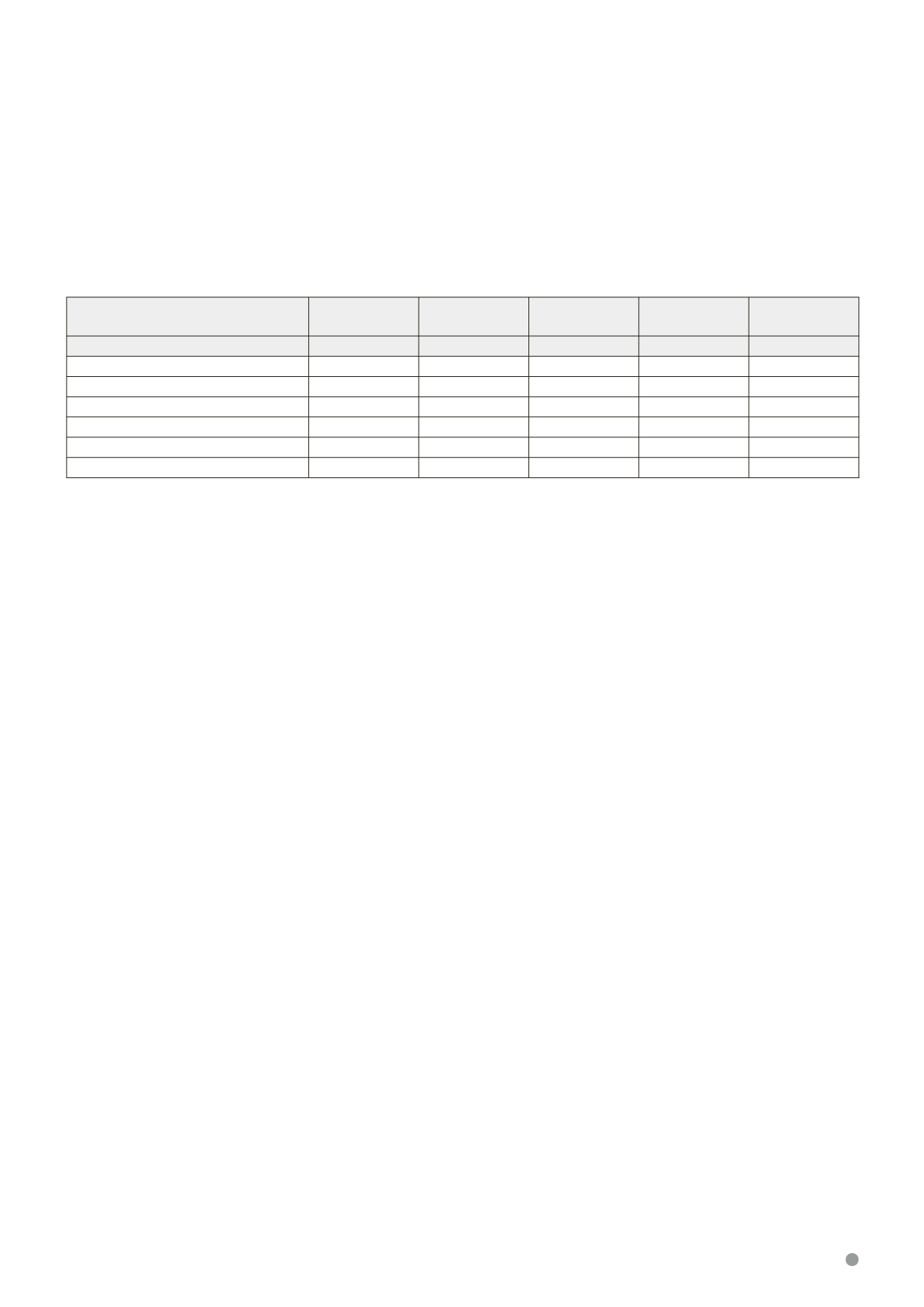

Remuneration of Key Executives

The remuneration of each of the top six senior executives of the Group (who are not Directors), in no order of quantum sum,

is as follows:

Table 3:

Name / Position

Base or fixed

salary

Variable bonus

Benefit-in-kind

and others

Total

Share options

granted

$250,000 - $500,000

%

%

%

% No. of shares

Goh Bee Leong, GM – Manufacturing

54

33

13

100

35,000

Jasmin Hong, GM – Marketing

57

31

12

100

33,000

Keeth Chua, DGM – Marketing

60

28

12

100

20,000

Kwek Meng Tiam, Regional GM

77

6

17

100

26,000

Tarn Sien Hao, Group GM

60

23

17

100

33,000

Zann Lim, CFO

58

27

15

100

33,000

The total remuneration paid/accrued to the top six senior executives is about $1,963,000.

The aggregate amount of termination, retirement and post‑employment benefits that may be granted to Directors, the CEO

and the top six key management personnel is around $500,000.

There is no employee (other than the CEO) who is an immediate family member of a Director or the CEO. A relative of the

CEO, Mr Kelvin Whang, who is the General Manager of Underwater World Pattaya, received annual remuneration of between

$150,000 to $200,000.

ACCOUNTABILITY AND AUDIT

Accountability

The Board provides shareholders with a balanced and clear assessment of the Group’s performance through announcements of

its quarterly and full-year results. Internal guidelines are in place to comply with legislative and requlatory requirements and

Management provides the Investment Committee with monthly management accounts of the Group, to enable the Investment

Committee to review, monitor and highlight to the Board any material information which may have a material impact on the

Group’s performance and prospects.

Risk Management and Internal Controls

The Group has established a formal risk management framework across the entire organisation to provide a structured approach

for managing risks. The framework enables management to have a formal structure in risk management assessment. The

framework is designed to ensure that risks are identified, assessed, monitored and effectively managed. It is in line with the

best practices as contained in the Risk Governance Guidance for Listed Boards, issued by the Corporate Governance Council

in May 2012.

The Risk Management Committee is chaired by the CEO and comprises an Executive Director, the Chief Financial Officer

(“CFO”), the Internal Audit Manager and Group General Manager. It performs the following roles:

• oversees the development of risk management policies;

• provides overall leadership, vision, framework and direction for risk management;

• promotes a risk management culture through human resources, use of technology and organisation structure;

• monitors the effectiveness of risk management and makes refinements as and when necessary;

• ensures that any risks are properly addressed; and

• reports to the AC and the Board twice a year on risk management activities and attestation undertaken (if any).

CORPORATE GOVERNANCE REPORT

(CONTINUED)