For the financial year ended 31 December 2015

86

HAW PAR CORPORATION LIMITED

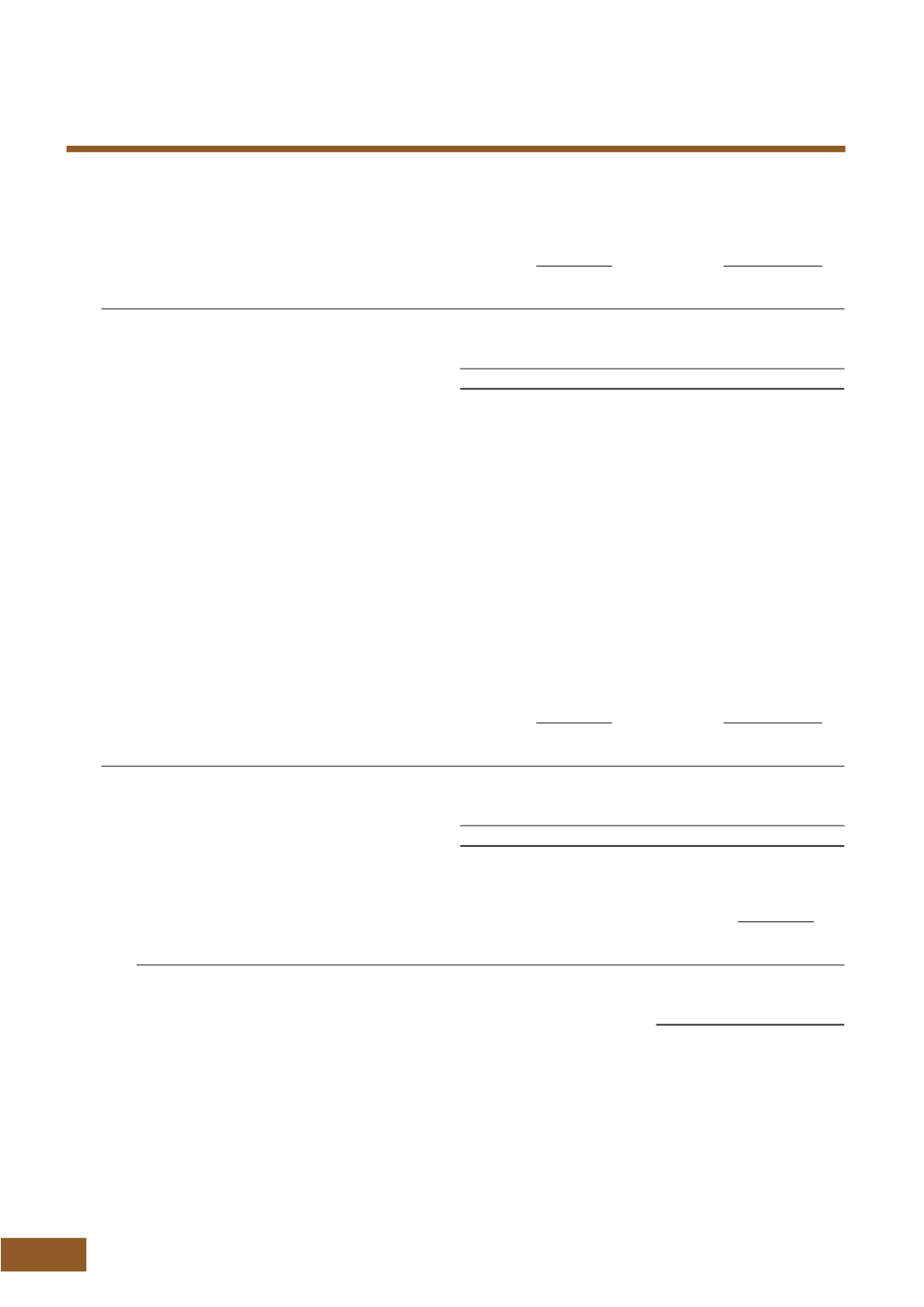

14. AVAILABLE-FOR-SALE FINANCIAL ASSETS

(CONTINUED)

Available-for-sale financial assets are analysed as follows:

The Group

The Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Quoted investments

2,080,179

2,311,062

–

–

Unquoted investments

376

430

281

330

2,080,555

2,311,492

281

330

The quoted investments are mainly listed in Singapore (Note 27(a)).

Note: The reclassified amount is based on the fair value of the retained interest in the associated company in

accordance with FRS and does not represent any additional cash outlay. As disclosed in Note 13, the Group

has recovered fully its cash capital cost invested in HHHI.

During the financial year, the Group elected to receive $22,398,000 (2014: $47,686,000) of dividend income as non-

cash available-for-sale financial assets in lieu of cash dividends.

Certain available-for-sale financial assets valued at $175,441,000 (2014: $205,499,000) are pledged as security for

bank credit facilities (Note 20).

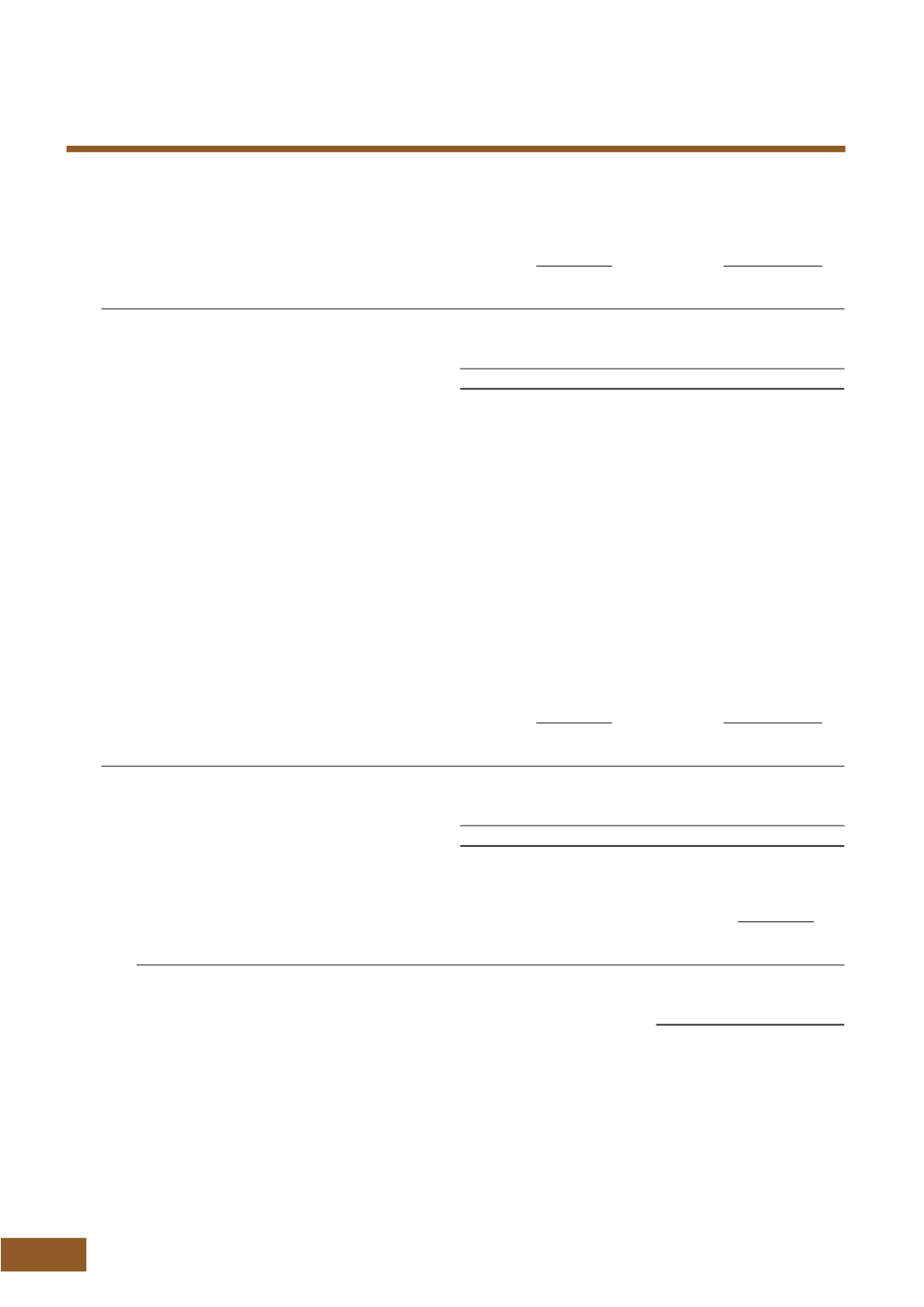

15. INTANGIBLE ASSETS

The Group

The Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Goodwill on consolidation

11,116

11,116

–

–

Trademarks and deferred expenditure

–

–

–

–

11,116

11,116

–

–

(a) Goodwill on consolidation

The Group

2015

2014

$’000

$’000

Cost

Balance at beginning and end of financial year

11,116

11,116

Impairment test for goodwill

The goodwill is allocated to the healthcare division of the Group, which is regarded as a cash-generating

unit (“CGU”).

During the financial year, the Group has determined that there is no impairment of its CGU containing the

goodwill. The recoverable amount (i.e. higher of value-in-use and fair value less costs to sell) of the CGU is

determined on the basis of value-in-use calculations. These calculations incorporate cash flow projections by

management covering a five-year period.

NOT E S TO T H E F I NAN C I A L S TAT EME N T S

(CONTINUED)