For the financial year ended 31 December 2015

92

HAW PAR CORPORATION LIMITED

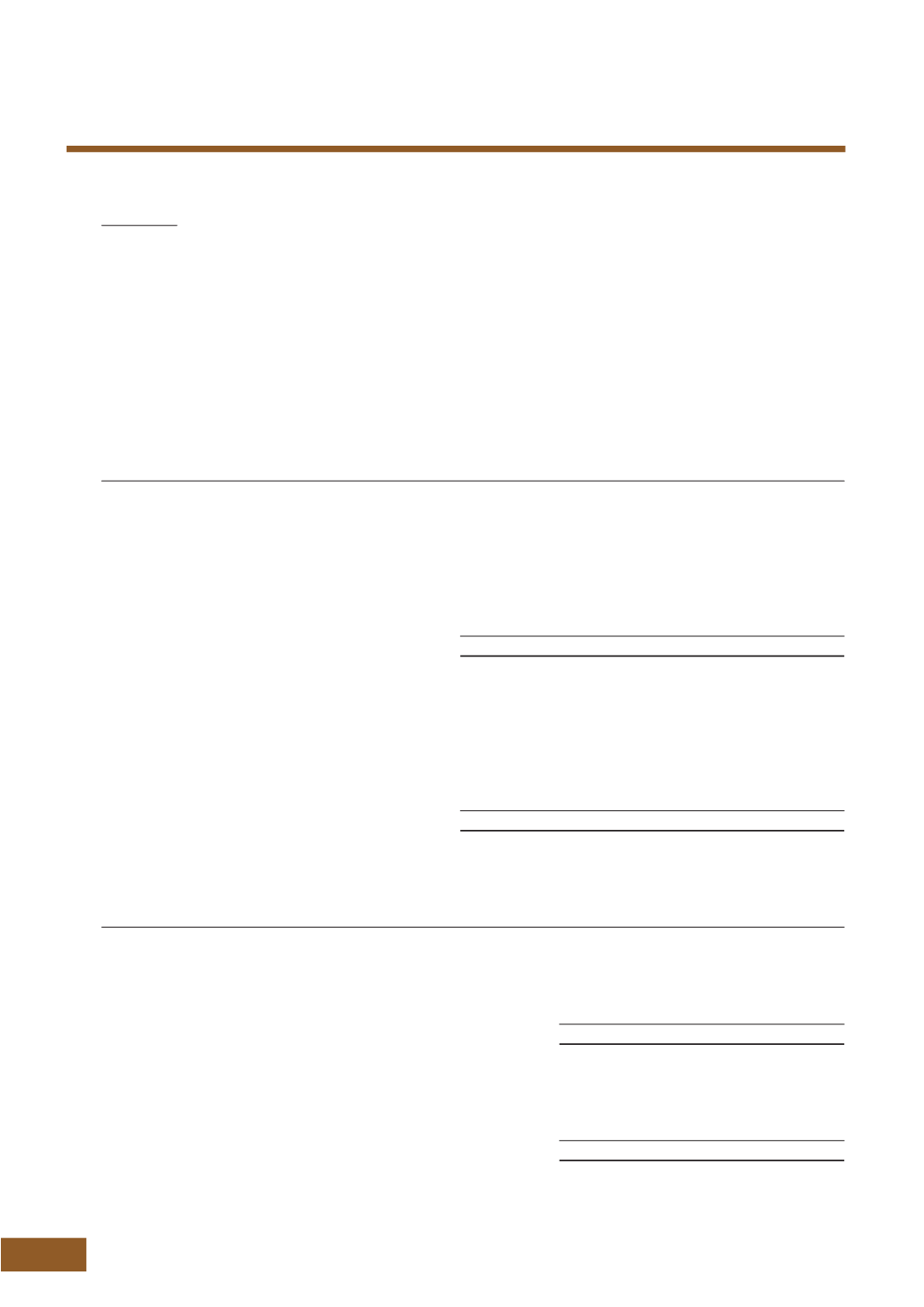

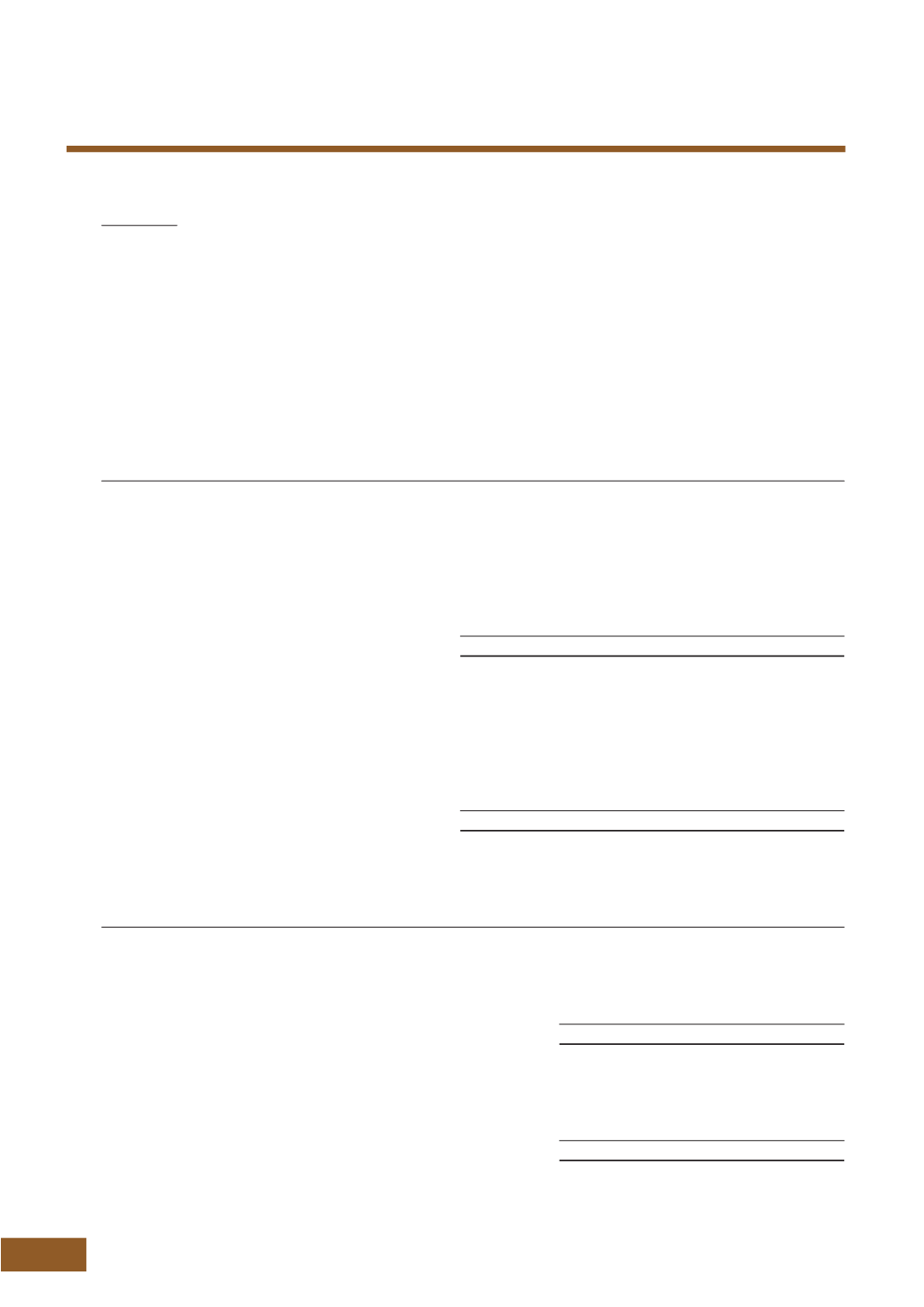

21. DEFERRED INCOME TAXATION

(CONTINUED)

The Group

The movements in the deferred income tax assets and liabilities (prior to offsetting of balances within the same tax

jurisdiction) during the financial year are as follows:

Deferred income tax liabilities

Fair value

changes

on current

available-for- Accelerated

sale financial

tax

assets depreciation

Others

Total

$’000

$’000

$’000

$’000

2015

Beginning of financial year

62,526

1,318

–

63,844

Credited to equity:

- changes in fair value

(15,512)

–

–

(15,512)

(Credited)/charged to profit or loss:

- others

–

(673)

463

(210)

Currency translation differences

–

2

(37)

(35)

End of financial year

47,014

647

426

48,087

2014

Beginning of financial year

52,124

1,450

–

53,574

Charged to equity:

- changes in fair value

10,402

–

–

10,402

Credited to profit or loss:

- others

–

(134)

–

(134)

Currency translation differences

–

2

–

2

End of financial year

62,526

1,318

–

63,844

Deferred income tax assets

Provisions Tax losses

Total

$’000

$’000

$’000

2015

Beginning of financial year

(201)

(62)

(263)

(Credited)/charged to profit or loss

(1,009)

51

(958)

Currency translation differences

53

(1)

52

End of financial year

(1,157)

(12)

(1,169)

2014

Beginning of financial year

(368)

(121)

(489)

Charged to profit or loss

167

60

227

Currency translation differences

–

(1)

(1)

End of financial year

(201)

(62)

(263)

NOT E S TO T H E F I NAN C I A L S TAT EME N T S

(CONTINUED)